1. Front Cover

Good afternoon, everyone. I’m Yuichiro Wakatsuki, Co-President of Nippon Paint Holdings.

Thank you very much for taking the time today to participate in our conference call regarding financial results for the 1Q of FY2022, at this late hour for people attending this call in Japan.

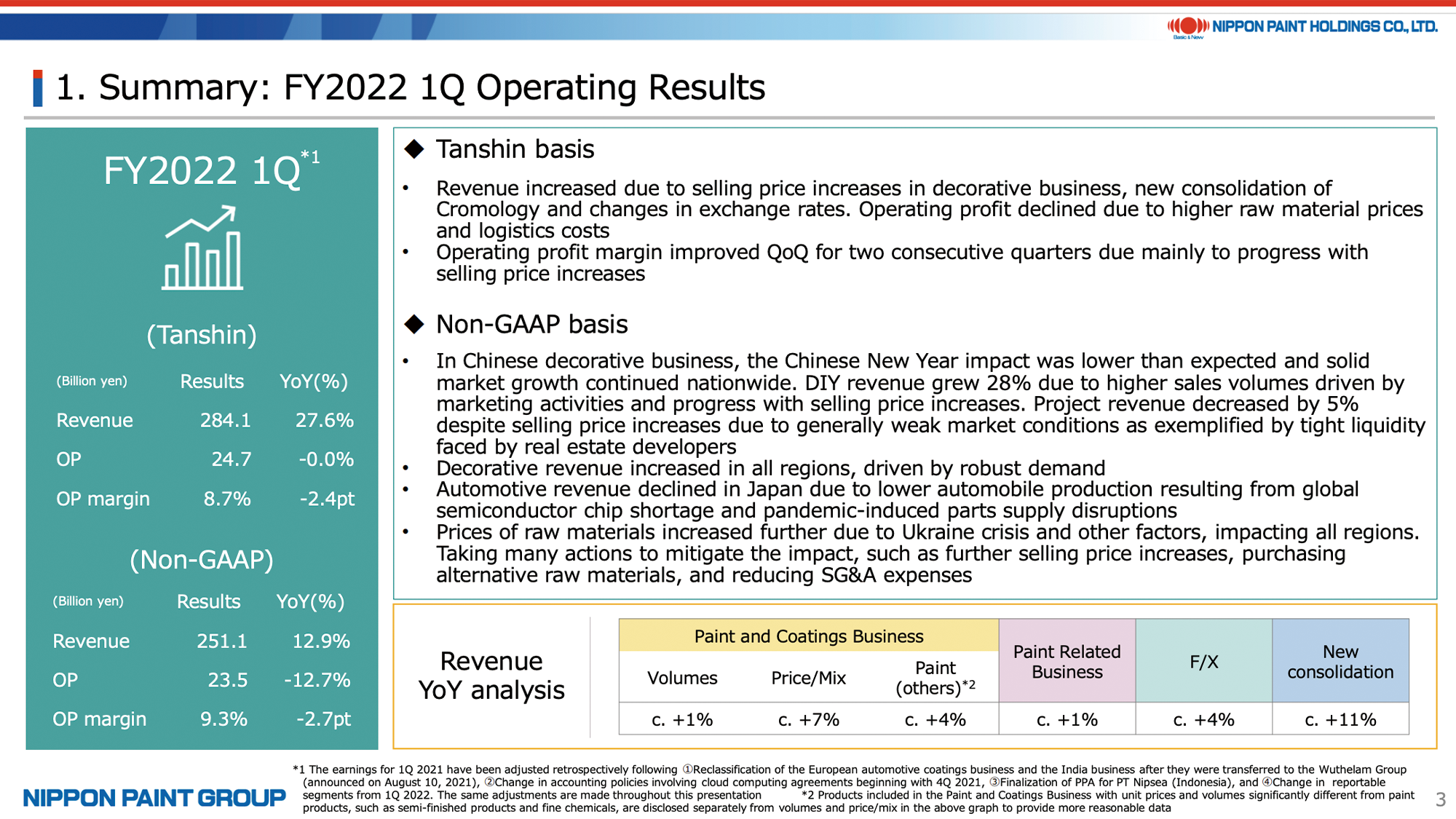

2. Summary: FY2022 1Q Operating Results

I would like to begin by summarizing the financial results for the 1Q of FY2022.

Revenue increased significantly and operating profit decreased slightly on a Tanshin basis. The positive factors were the new consolidation of Cromology and changes in exchange rates, while the negative factors continued to be increases in raw material prices and logistics costs.

Revenue increased by around 13% on a Non-GAAP basis, which excludes the effects of M&A and exchange rate changes. However, operating profit decreased by around 15%. In our Chinese decorative paints business, the DIY business delivered a strong performance and revenue declined in the Project business even after taking into consideration selling price increases.

The operating profit margin declined compared to the 1Q of FY2021, when raw material prices were not as high as they are now, but improved QoQ. This is in line with the quarterly earnings growth image we provided in the FY2022 forecast in February. On a monetary basis, we believe we have made more progress with passing on raw material price increases and achieving volume growth than we initially expected.

However, we believe that events worldwide remain unpredictable as described in this page. We are taking actions in every region to respond to this uncertainty.

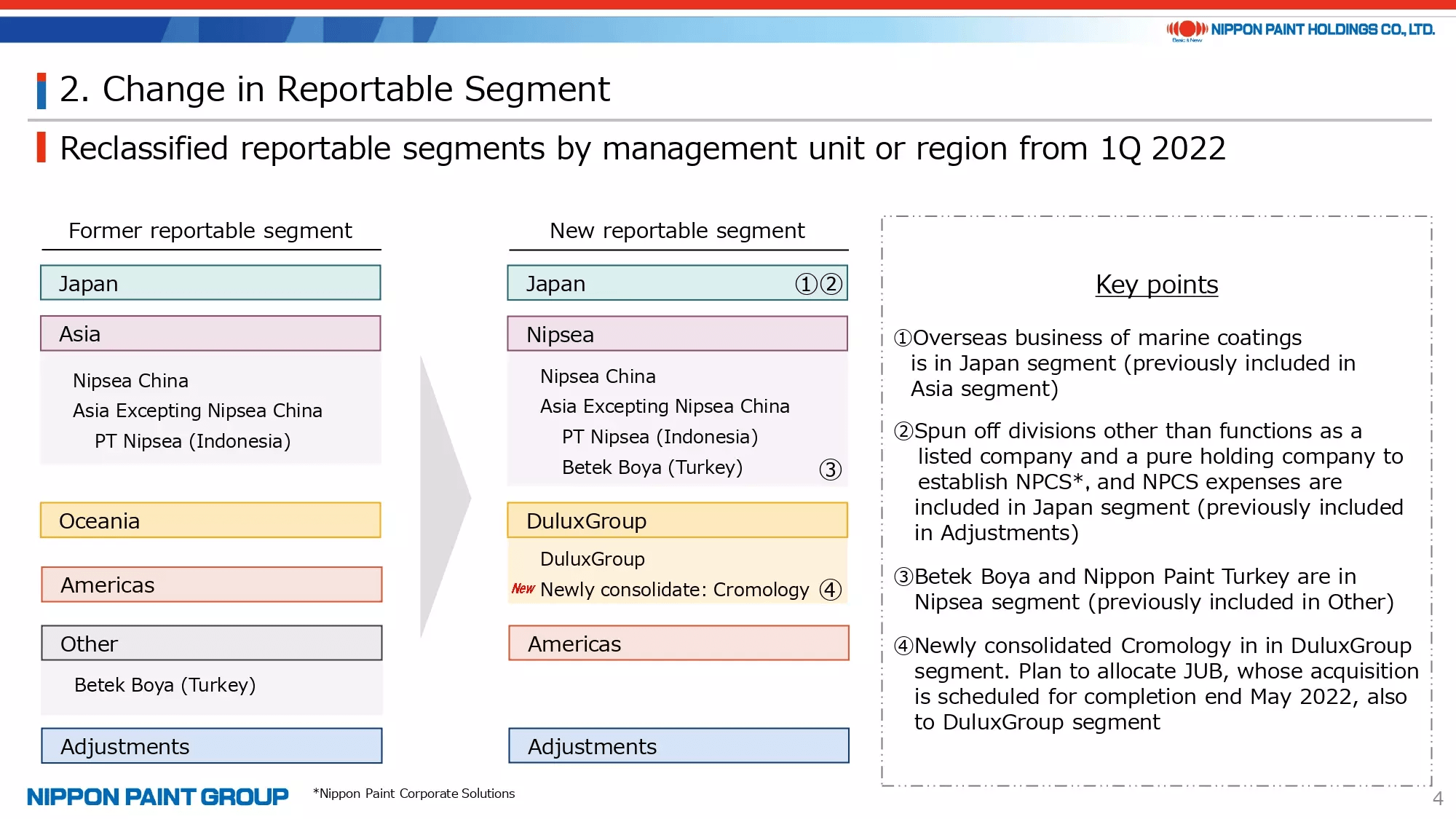

3. Change in Reportable Segment

This page explains the change in reportable segments, which I have mentioned previously.

We changed our reportable segments to segments divided by management unit or region from segments divided by region. There are four major changes.

Firstly, the marine coatings business is included in the Japan segment, along with the overseas business, which was previously included in the Asia segment, following a change in organizational structure with the goal of achieving a greater operational integration on a global level. This change will increase revenue in the Japan segment by around 10 billion yen on a full-year basis and will reduce revenue in the Nipsea segment by the same amount.

Secondly, the launch of Nippon Paint Corporate Solutions (NPCS) has resulted in an increase in expenses allocated to the Japan segment. Expenses of functions as a pure holding company are the main expense item included in Adjustments on a consolidated basis. I will mention it later, but the impact of the cost transfer in the 1Q was around 1.3 bn yen.

Thirdly, Betek Boya in Turkey and Nippon Paint Turkey Boya San (NPTR), our Turkish automotive coatings unit, are managed by Nipsea. Therefore, these companies are included in the Nipsea segment. We will disclose information about Betek Boya and PT Nipsea (Indonesia) separately as much as possible.

Fourthly, we newly established the DuluxGroup segment. This segment comprises DuluxGroup, which represented the Oceania segment previously, newly consolidated Cromology, and JUB, which is scheduled to join our Group. As you can see, the DuluxGroup segment is our Oceania business and European business combined.

This change in reportable segments may cause some inconvenience to analysts, and I would appreciate your understanding.

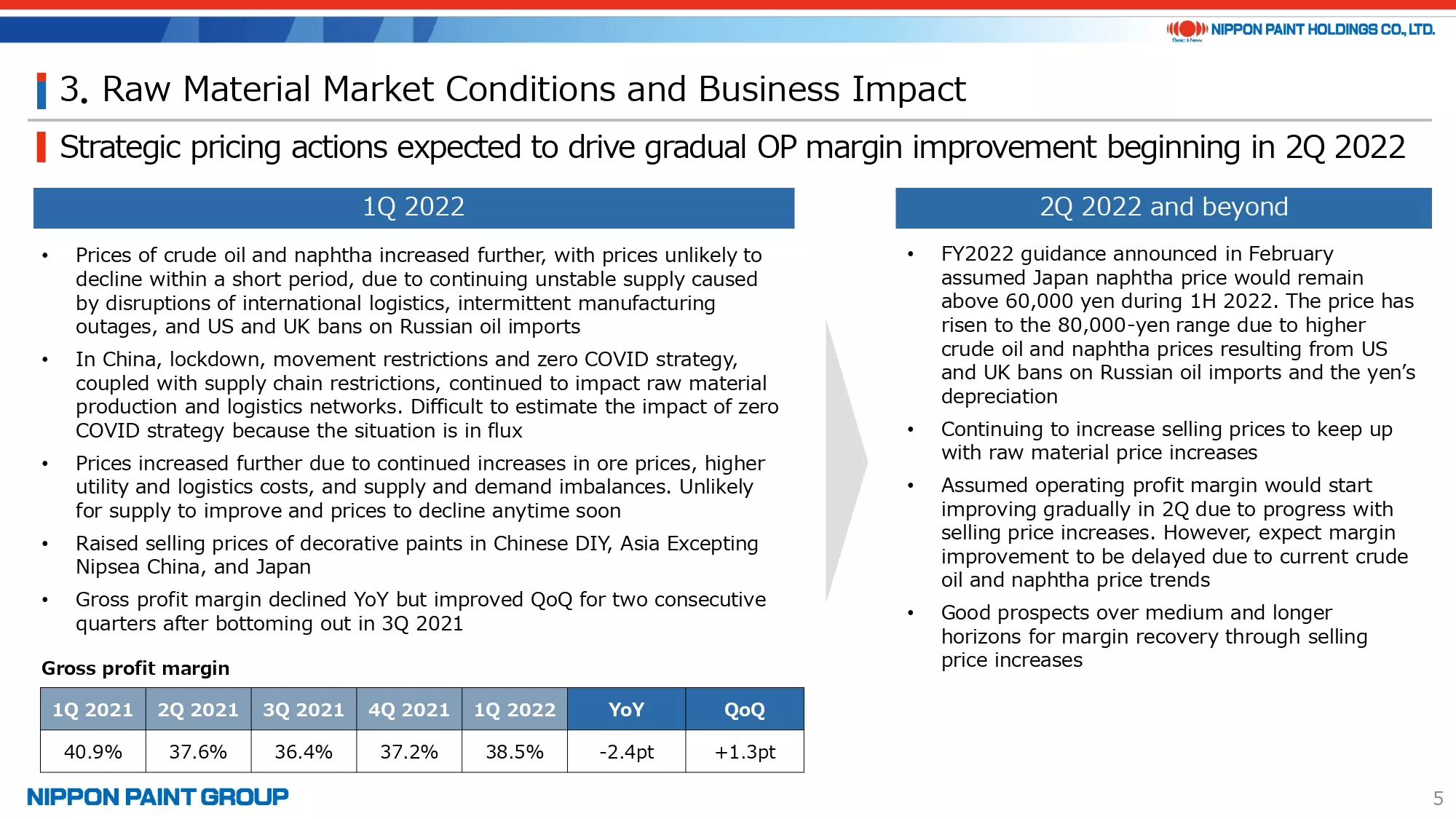

4. Raw Material Market Conditions and Business Impact

The raw material market conditions, explained on page 5, have not changed much from our previous explanation. We maintain our outlook that raw material prices are unlikely to decline anytime soon, and we will take actions to reduce costs and pass on raw material price increases wherever and whenever possible.

To supplement my comments, we assume a gradual margin improvement will continue in the 2Q but see a possibility that the pace of this margin improvement will be slower than we anticipated. Factors contributing to the slowing of margin improvement include raw material prices remaining elevated as a result of the crisis in Ukraine, cautious buyer sentiment, and lockdowns in China.

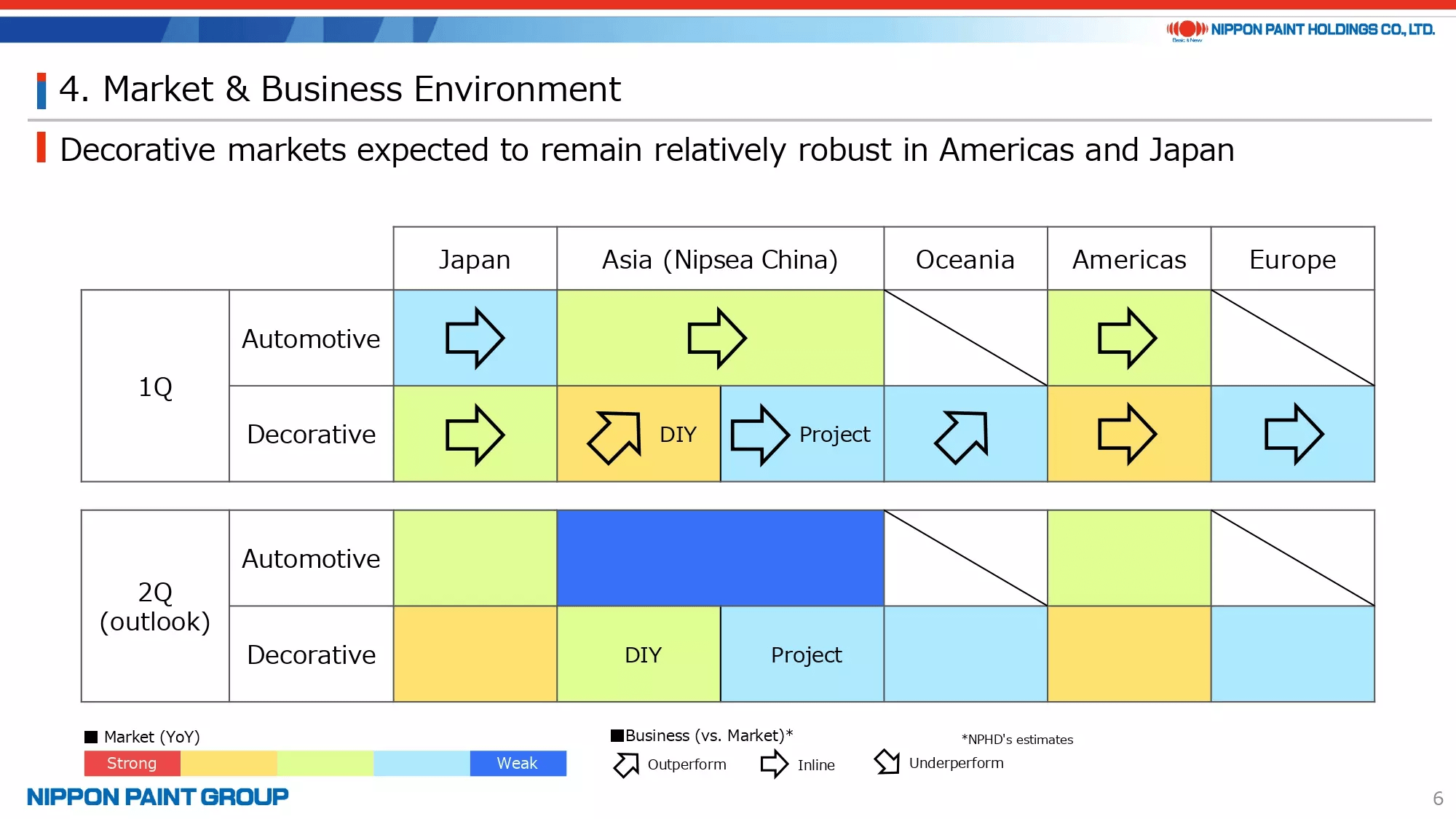

5. Market & Business Environment

Page 6 shows a heat map for the market and business climate.

We newly added a heat map for the decorative business in Europe for Cromology. Please note that Turkey is not included in Europe on this heat map.

While the overall market climate is rather weak, the Chinese DIY market achieved considerable growth in the 1Q. In addition, we believe our Chinese DIY business succeeded in increasing market share by leveraging its brand power and distribution networks.

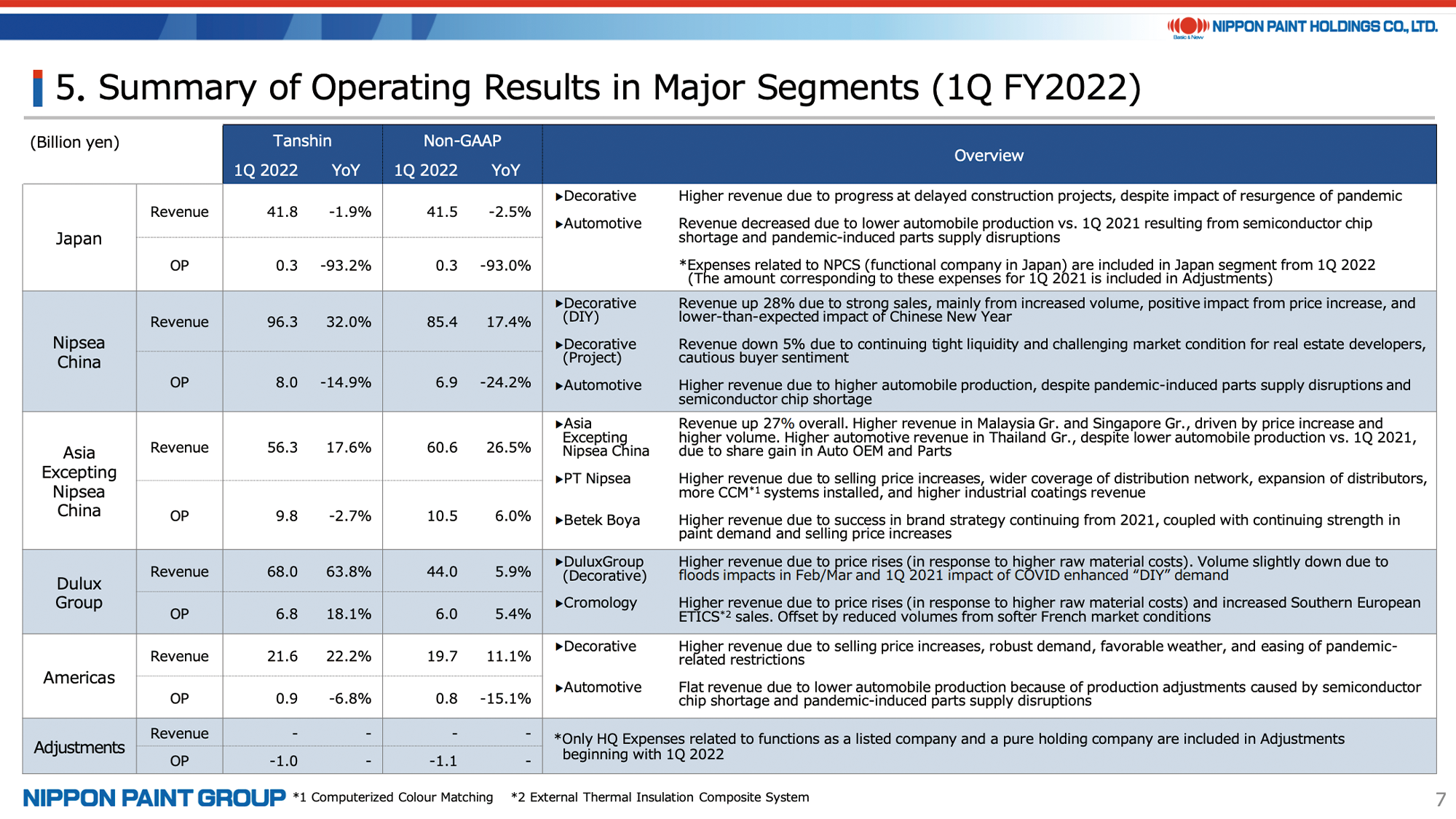

6. Summary of Operating Results in Major Segments (1Q FY2022)

This page briefly summarizes the operating results in our major segments. More information is provided in the Supplemental Material that starts on page 12.

The operating profit in the Japan segment declined significantly from 4.3 bn yen in the 1Q of FY2021 to 0.3 bn yen in the 1Q of FY2022. As I mentioned earlier, around one-third of the operating profit decrease of 4.0 bn yen is attributable to the cost transfer beginning with the 1Q of FY2022 and the remaining 2.7 bn yen resulted from lower earnings in business operations.

Although the automotive coatings business was impacted more than we expected by the decrease in automobile production, the decrease in the 1Q FY2022 operating profit in the overall Japan segment, compared to the 1Q FY2021 when raw material prices were not as high as they are now, was within our expectations. Based on a sequential comparison of the operating profit in the Japan segment that excludes NPCS expenses, the 1Q FY2022 operating profit margin improved slightly at 3.8% over the 4Q FY2021 operating profit margin at 2.9%. In the Japan segment, we have raised selling prices based on agreements with customers and are taking many actions to improve productivity. Needless to say, the Japan segment team is not satisfied with this margin level.

By the way, the DuluxGroup segment started to feel the impact of the raw material price increases, falling slightly behind other segments. We fully expect that this segment will achieve growth both in revenue and operating profit on a full-year basis by taking actions including selling price increases during the 1H of FY2022.

In the Americas segment, decorative paints revenue remained strong. On the other hand, automobile production, in particular at Japanese manufacturers, has been impacted by supply disruptions of parts. As a result, automotive coatings revenue in this segment was lower than expected.

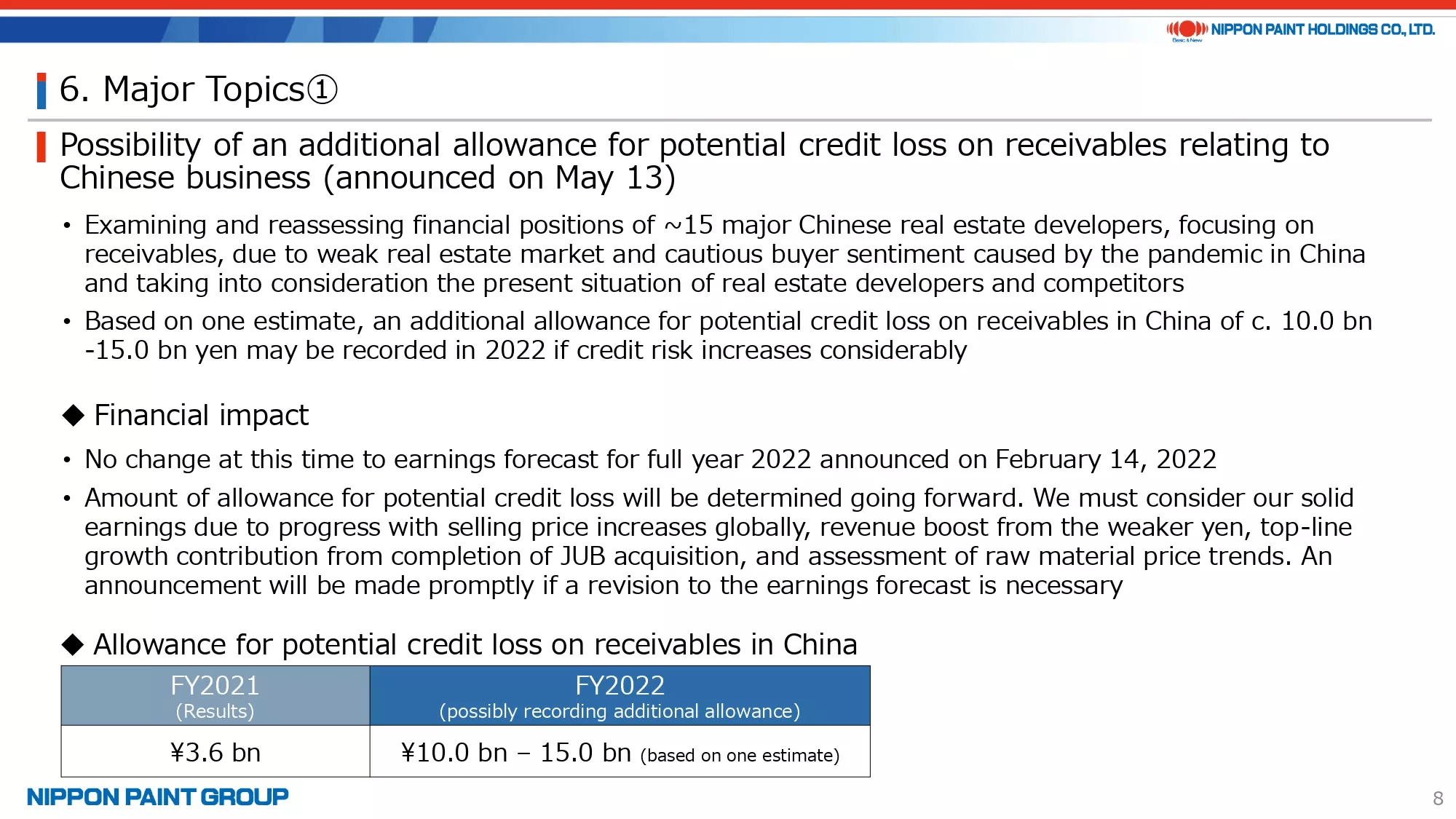

7. Major Topics①

As shown on page 8, we issued a press release on the possibility of recording an allowance for potential credit loss.

I want to clarify that this press release is strictly intended to announce a possibility to the capital markets and is not based on an event that has occurred.

The situation is changing day by day in China. In particular, the impact of lockdowns has been increasing since April. We are examining the necessity of recording an additional allowance for potential credit loss mainly on receivables from around 15 major Chinese real estate developers, along with the amount of this allowance if we decide to do so. Based on one estimate, there is a possibility that we will record an additional allowance of 10.0 billion-15.0 billion yen in FY2022. Our accounting auditor has not agreed with these figures and we will make an announcement as soon as the amount is finalized.

Regarding the impact of the situation in China on our full-year earnings, there are both positive and negative factors. As a result, we do not have sufficient reasons to revise our full-year guidance at this time. Exchange rates basically have moved towards a weaker yen compared to our assumptions at the beginning of the period, which is a positive factor. In addition, we are now confident about completing the acquisition of JUB at the end of May, which is not included in the initial guidance and is therefore a positive factor. On the other hand, the possibility of recording an additional allowance relating to the Chinese business is not a positive factor. Lockdowns in China and the Ukraine crisis will probably have a negative impact on our businesses. We are hoping to be able to release a clearer earnings guidance when we announce our 2Q FY2022 results, which is scheduled for August.

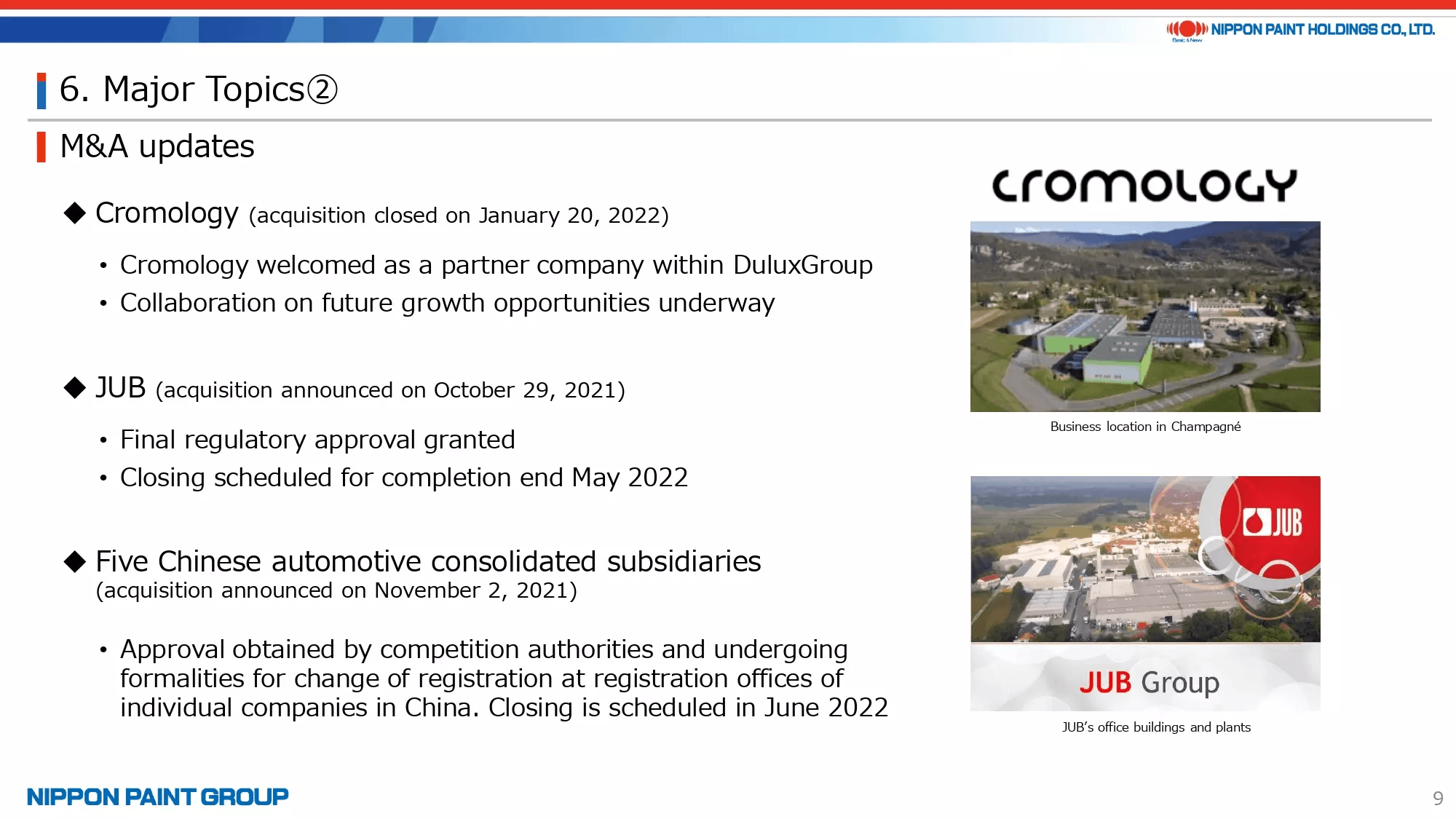

8. Major Topics②

This page provides our M&A update.

We completed the acquisition of Cromology in January and moved on to the next stage for collaboration with this company. As for JUB, we have already obtained all the approvals required from the antitrust authorities and expect the acquisition will close at the end of May. In addition, we have obtained the approval of the relevant authorities for the acquisition of our consolidated automotive coatings subsidiaries to make them wholly-owned subsidiaries. We expect that the acquisition can be completed during June.

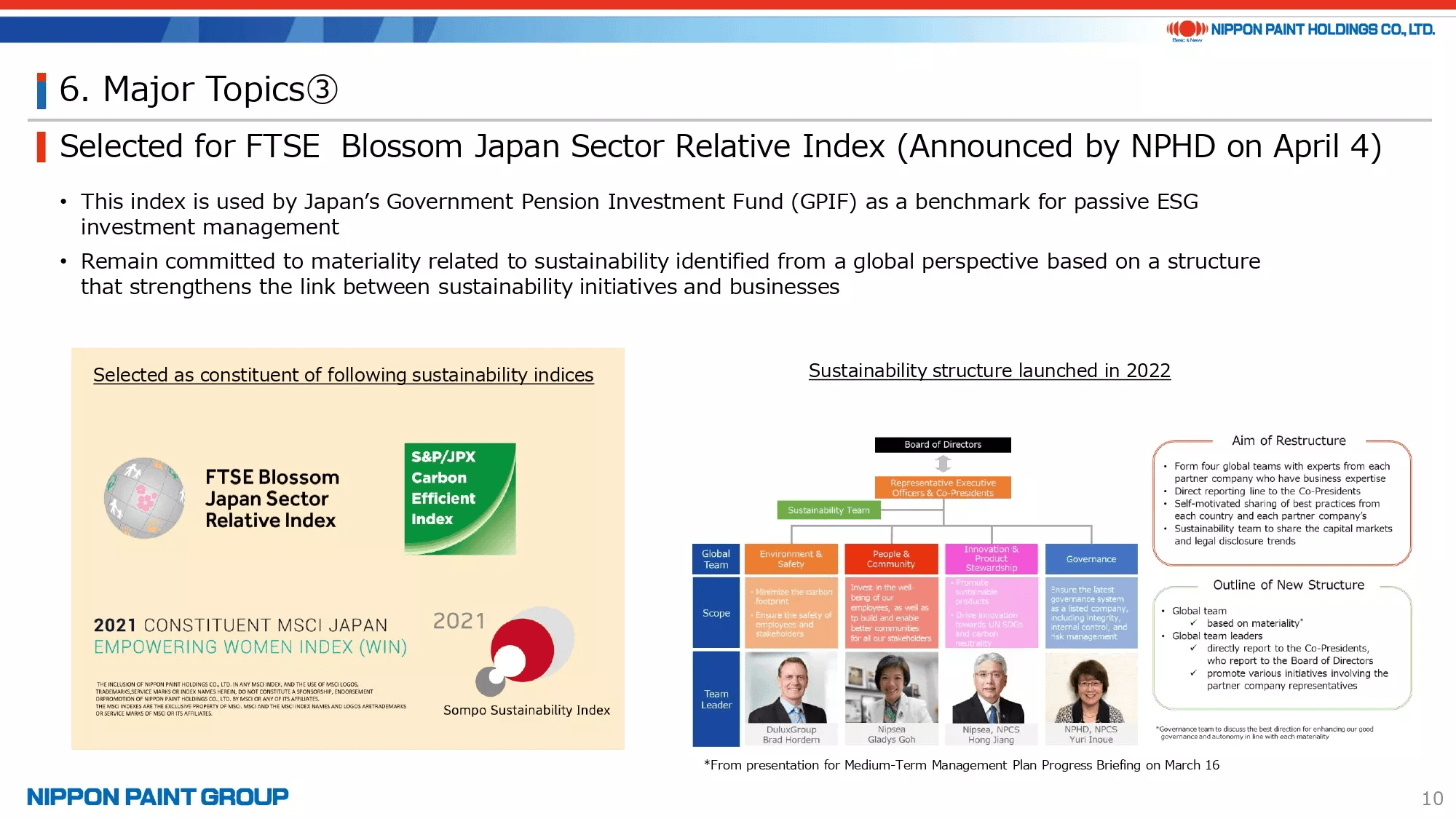

9. Major Topics③

This page explains our selection as a constituent of an FTSE index as we announced on April 4.

We will continue to disclose information in a timely and appropriate manner under the new sustainability structure, which we hope will attract new investors.

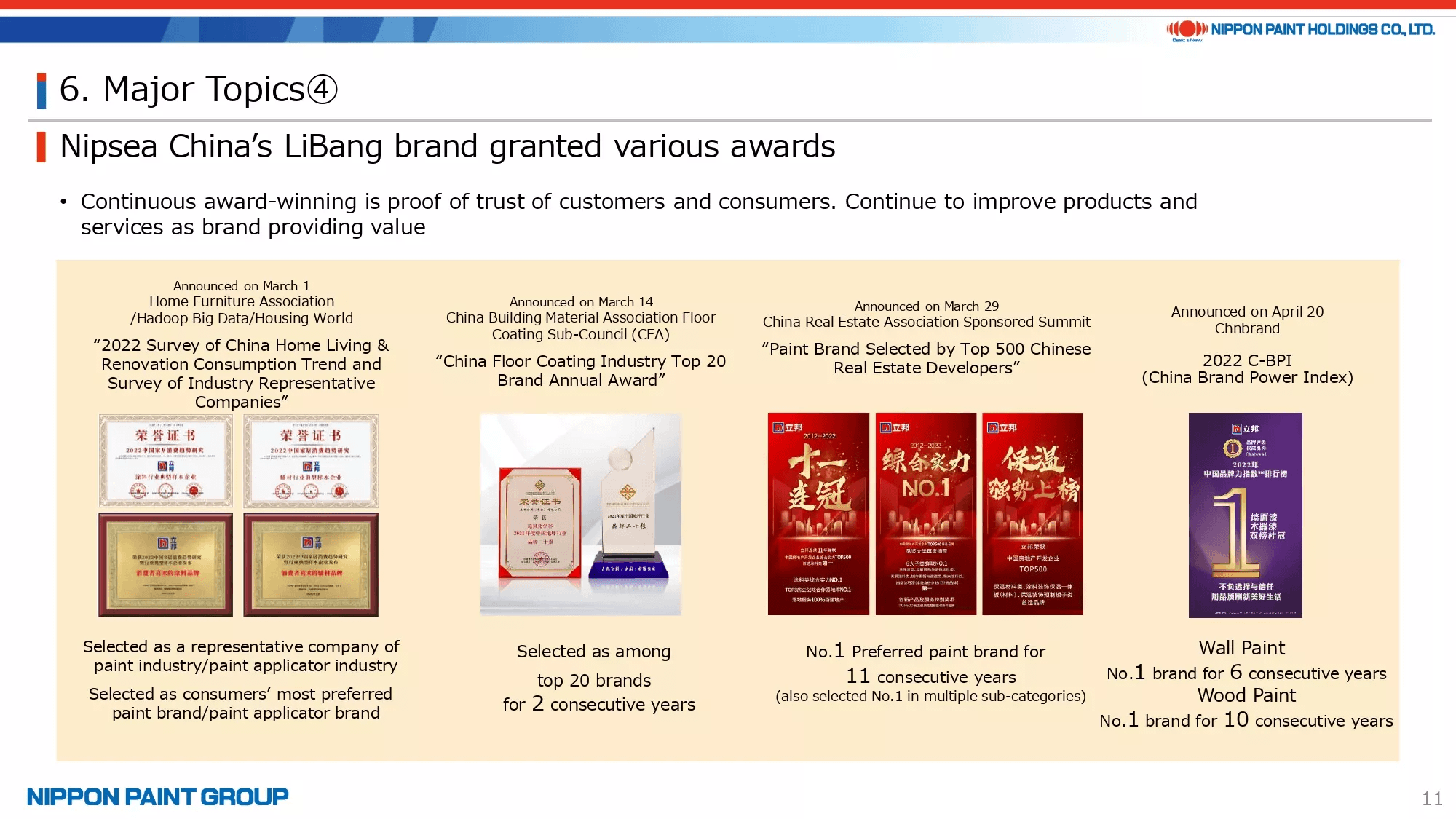

10. Major Topics④

Along with our efforts to further strengthen our DIY business in China, Nipsea China’s LiBang brand has received various awards. Since such a powerful brand cannot be built overnight, LiBang has become one of the strengths that differentiates us from competitors.

Thank you for your attention.