1. Front Cover

Good afternoon, everyone. I’m Yuichiro Wakatsuki, Co-President of Nippon Paint Holdings.

Thank you very much for taking the time to join us today as we review our financial results for the second quarter of 2024.

Since this is our quarterly earnings call, we also have members of the press with us today.

2. FY2024 2Q Operational Results –Revenue and Operating Profit Increase with Enhanced Margins (Non-GAAP)

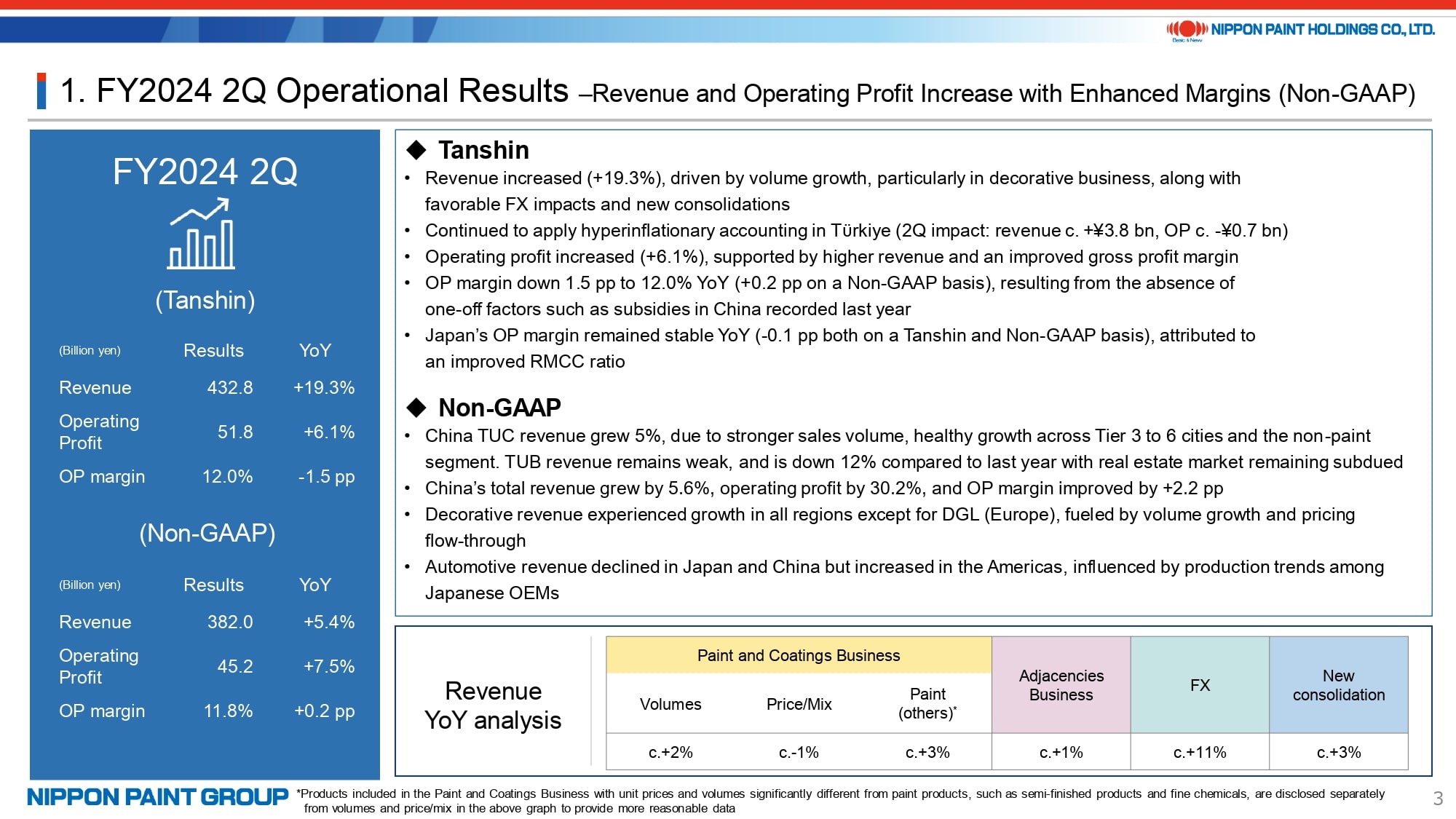

Let me start by providing an overview of our financial performance for the second quarter of 2024.

On a Tanshin basis, we experienced robust growth in both revenue and operating profit. Revenue saw a substantial year-on-year increase of 19.3%, reaching 432.8 billion yen. Operating profit also improved, rising by 6.1% year-on-year to 51.8 billion yen. As highlighted at the bottom of page 3 in our presentation, this positive momentum was largely driven by higher sales volumes in our paint and coatings business, contributions from our adjacencies business, favorable foreign exchange impacts, and the integration of newly consolidated entities. However, the price/mix factor had a slight negative effect on our revenue performance.

On a Non-GAAP basis, we saw a 5.4% increase in revenue and a 7.5% growth in operating profit. These figures exclude contributions from our recent acquisitions—NPT in Italy, acquired in 2023, and Alina in Kazakhstan, acquired in 2024. If we factor in these acquisitions, revenue would have grown by over 8%, excluding the impact of foreign exchange rates. In the decorative paints sector of NIPSEA China, revenue from the TUC segment rose by 5%, despite facing challenging market conditions. However, revenue in the TUB segment declined by 12%. On a positive note, our adjacencies segment also experienced revenue growth. Overall, on a Non-GAAP basis, total revenue for NIPSEA China increased by 5.6%, while operating profit saw a significant rise of 30.2%, accompanied by an improvement in the operating profit margin.

In our first quarter 2024 earnings presentation, I mentioned that our performance was largely in line with, or slightly above, our expectations. I’m pleased to report that this positive trajectory continued into the second quarter. Overall, our performance in the first half of the year has been very strong, further enhanced by favorable foreign exchange impacts.

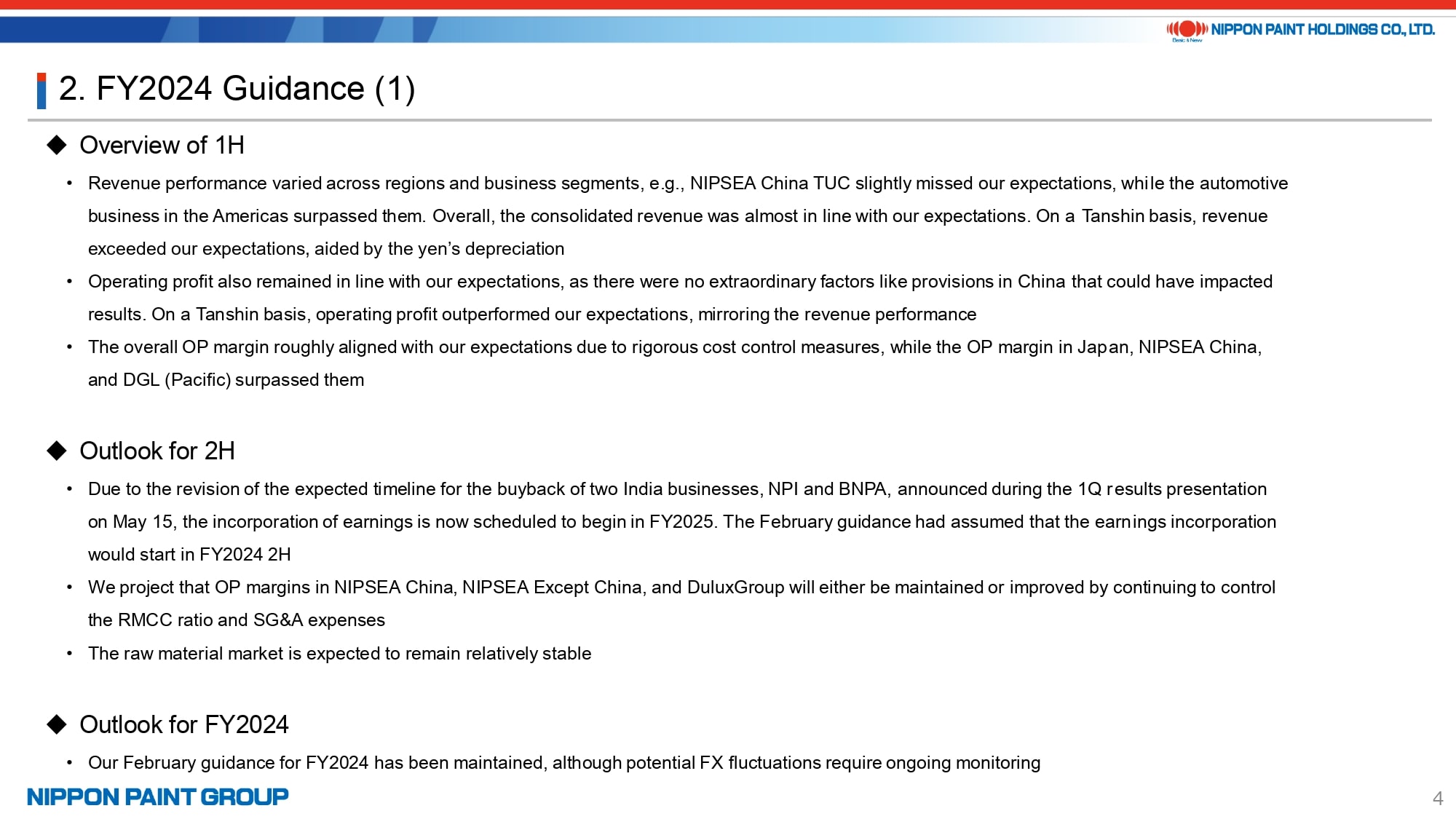

3. FY2024 Guidance (1)

Up until the last moment, we carefully considered whether to revise our full-year guidance for 2024. However, due to the significant recent fluctuations in foreign exchange rates, we have decided to maintain our initial guidance.

In the first half of the year, we experienced steady business growth and solid improvements in our profit margins, along with a more significant than expected depreciation of the yen. We have thus determined that it is currently challenging to forecast exchange rates for the second half of the year.

We initially expected the yen’s depreciation to provide a net positive impact, more than compensating for the negative effects of the delayed closure of our India businesses, as disclosed with our first-quarter financial results. However, the contribution has become somewhat uncertain. Considering all these factors, we have decided to keep our initial guidance unchanged. To clarify, this decision takes into account the expected absence of the India businesses’ contribution, which we had initially projected to be slightly under 30 billion yen in revenue and nearly 2 billion yen in operating profit at the start of the fiscal year.

As you may know, our Group operates with a focus on local production for local consumption, rather than being driven by export-oriented activities. This means that while exchange rate fluctuations can affect the cost of certain raw materials, the primary impact is seen in the conversion rates. As a result, analyzing trends in local currency offers a more accurate representation of our business performance.

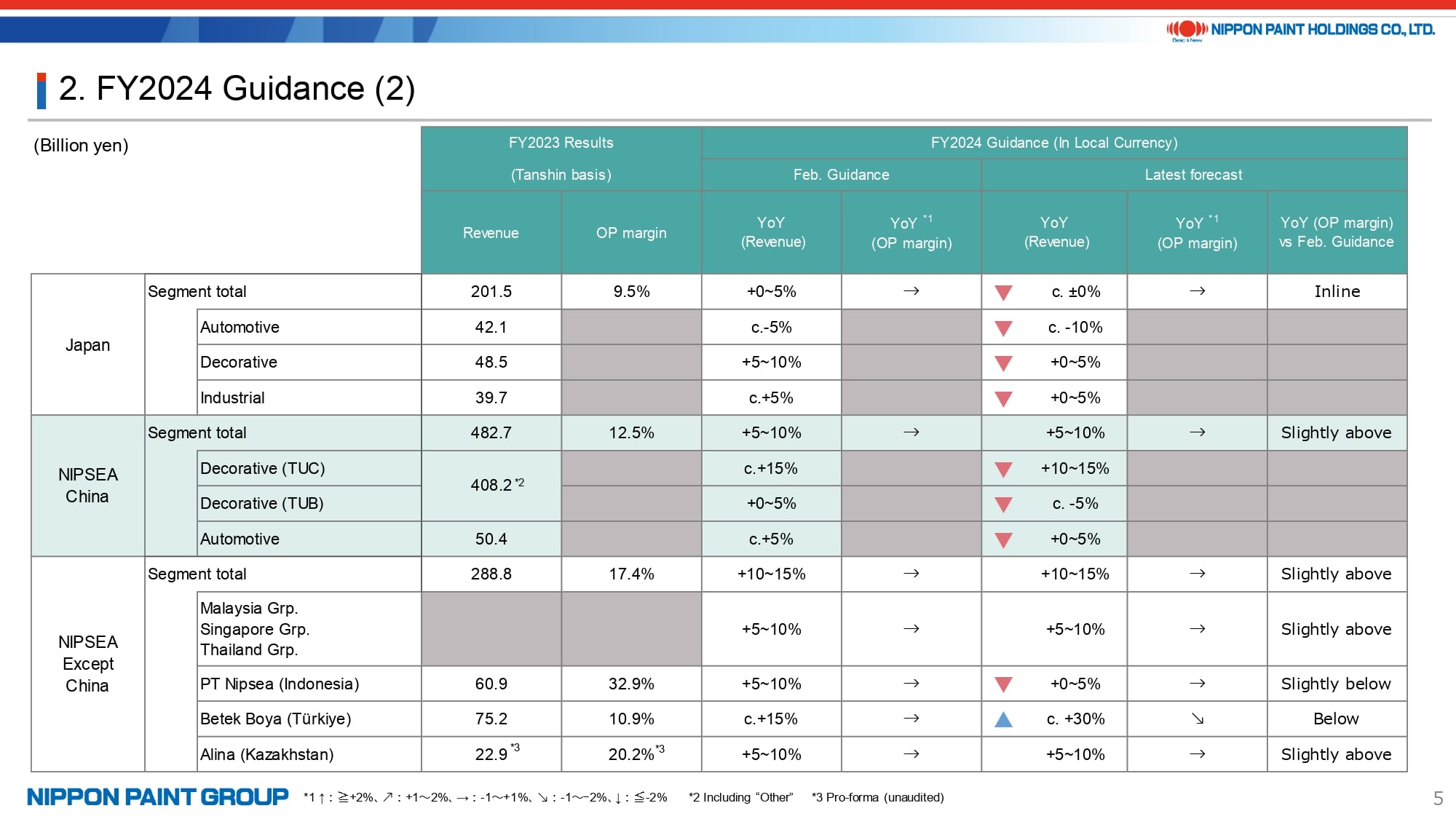

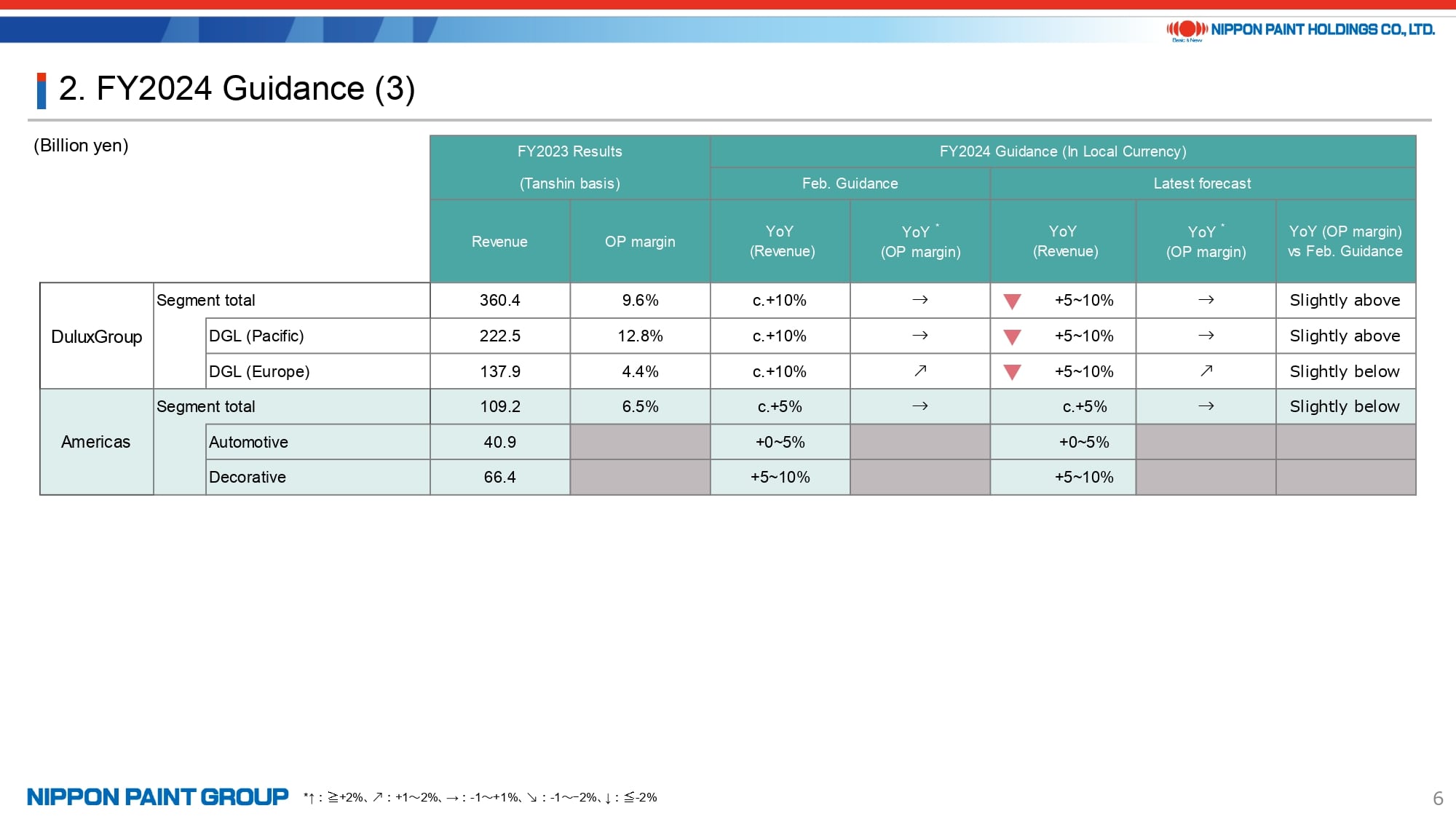

4. FY2024 Guidance (2)(3)

Moving forward, please refer to pages 5 and 6 of the presentation for the latest updates on full-year revenue growth and margin trends in local currency terms, as originally projected in February 2024. These updates are specific to our full-year outlook.

In the most recent forecast, you may notice slight downward revisions in the revenue growth projections for many of our business segments, with the exception of Türkiye. However, these adjustments mainly reflect modest changes in growth rates, with the exception of certain segments like NIPSEA China’s TUB segment. Despite these revisions, our overall outlook remains largely stable. For the TUC segment in NIPSEA China, we have adjusted the revenue growth forecast from approximately +15% to a range of +10% to +15%. Despite this revision, we still expect a slight improvement in the operating profit margin. As I have emphasized before, our strategy is centered on achieving a balanced approach to both revenue growth and profitability, rather than pursuing market share gains at the expense of profitability.

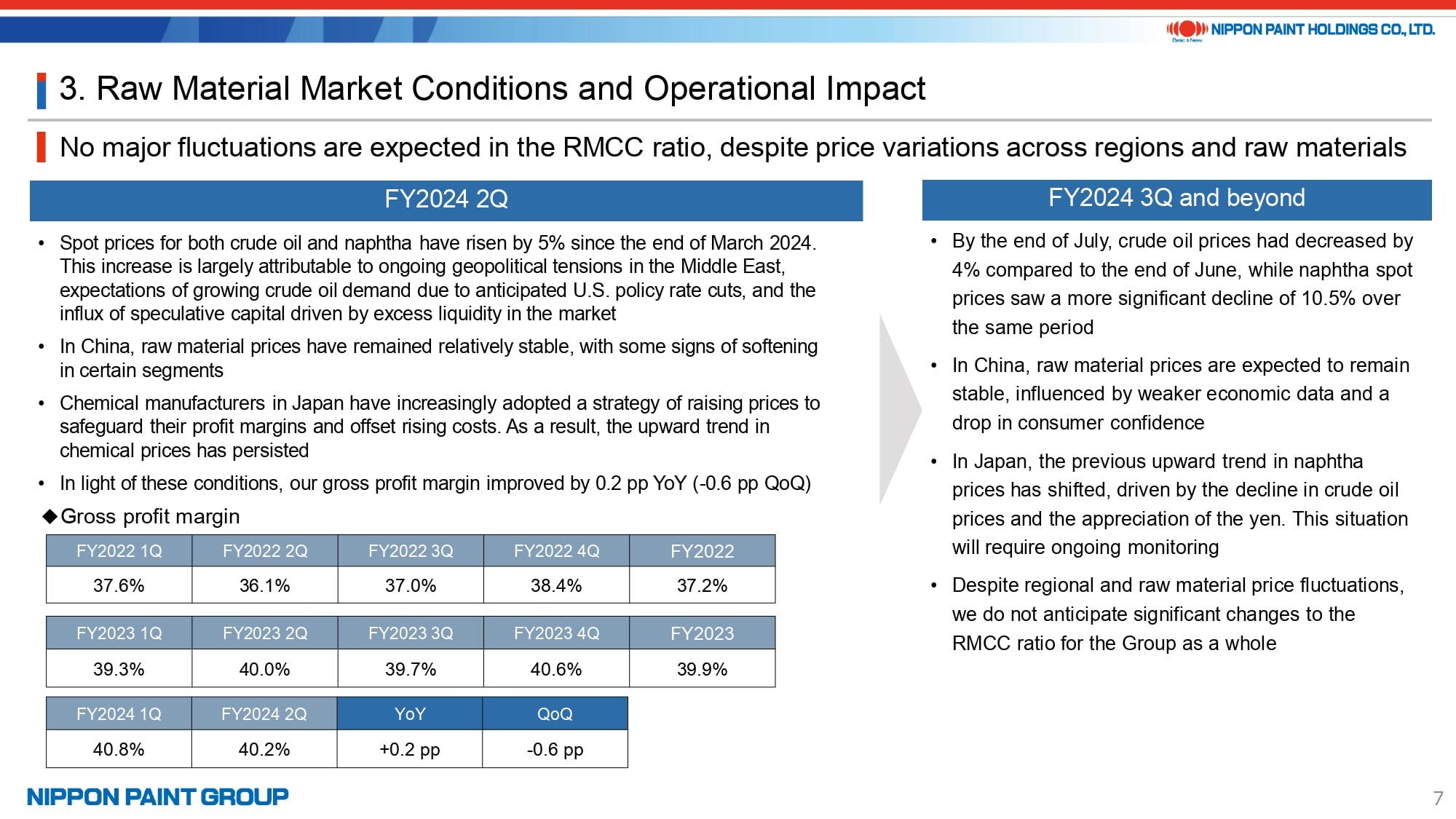

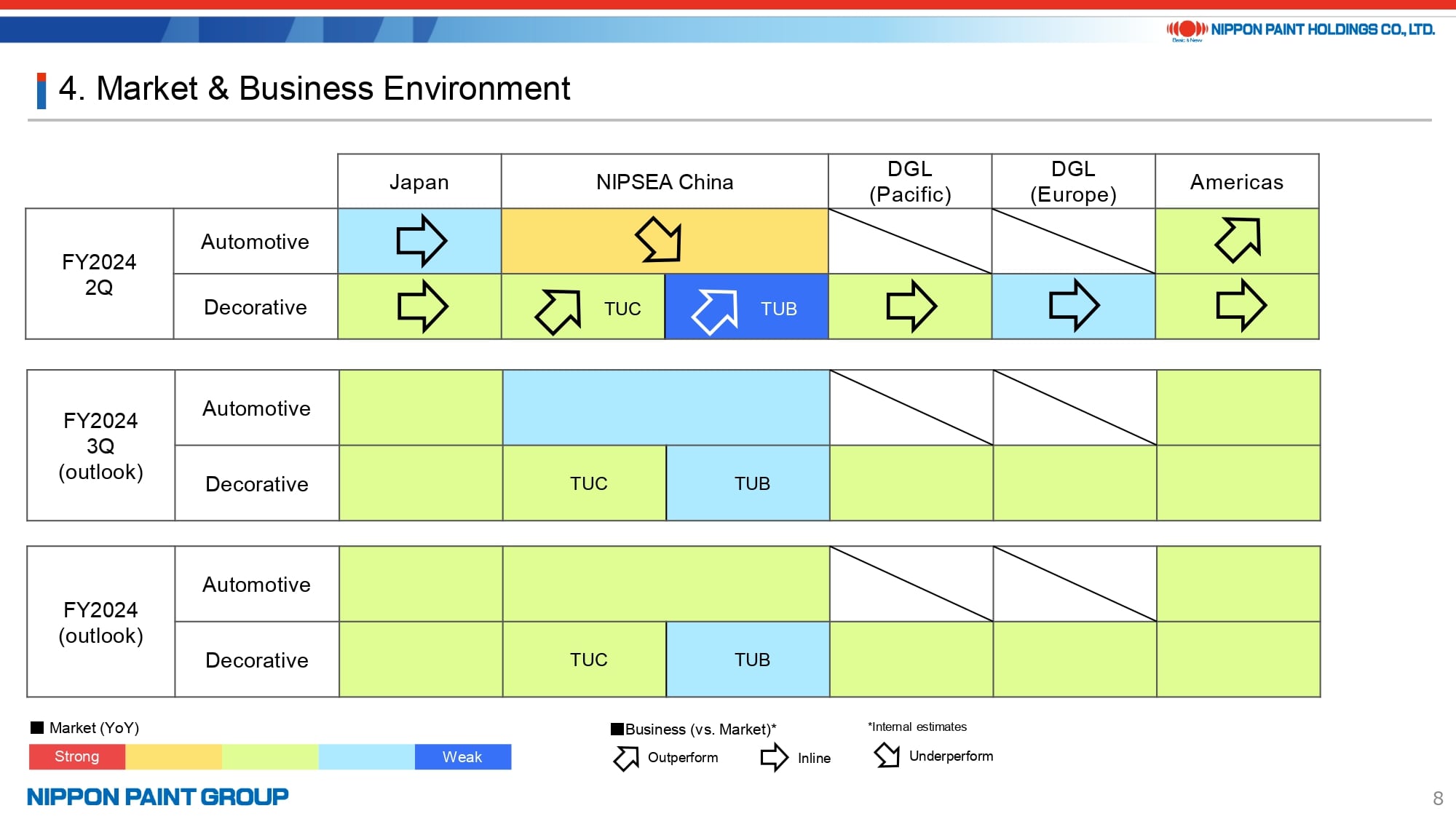

5. Raw Material Market Conditions and Operational Impact / Market & Business Environment

As highlighted on page 7 of the presentation, the raw material market conditions have remained generally stable. The market and business environments are depicted in the heat map on page 8 of the presentation.

In China, our automotive business continues to face challenges, particularly due to weak production trends among Japanese automakers. As a result, we have seen a slight decline in our market share relative to the overall market.

6. Summary of Operating Results in Major Segments

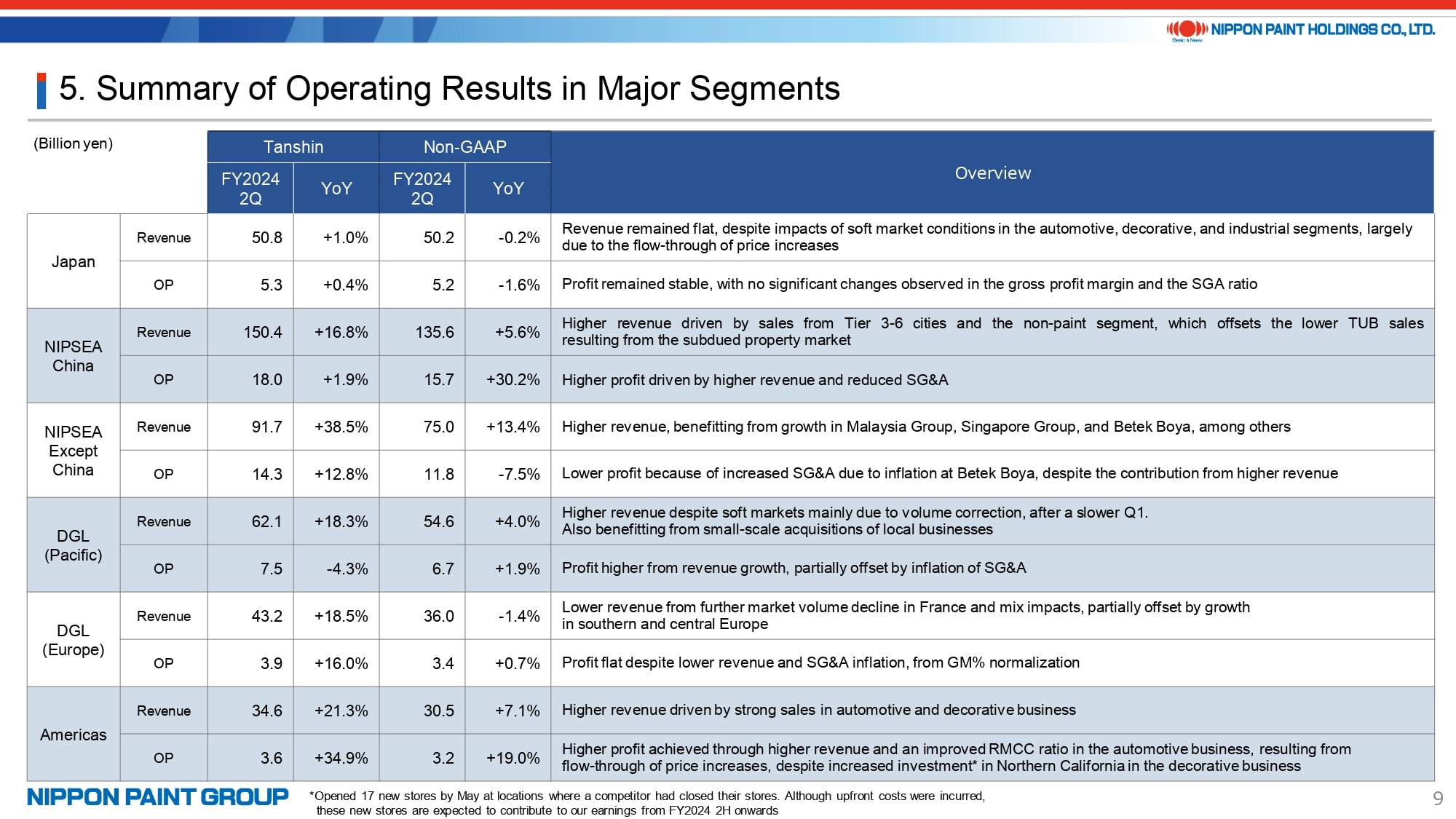

Now, I’d like to provide a brief overview of the performance of our major segments. I’ll address any related questions during the Q&A session that will follow.

- The trends in the Japan segment have remained largely consistent with what we observed in the first quarter. Our automotive business faced challenges due to a decline in automobile production, while both the decorative and industrial sectors continued to operate under difficult market conditions. As a result, the decrease in sales volumes was largely offset by price increases and other factors. On a positive note, our marine business continued to perform strongly. Overall, both revenue and operating profit for the Japan segment remained relatively stable compared to the same period last year.

- As mentioned earlier, NIPSEA China’s performance has been positive. The operating profit margin on a Non-GAAP basis improved, even after factoring in the additional provision recorded in 2023. This demonstrates that we have successfully achieved revenue growth while maintaining profitability.

- NIPSEA Except China continued to show strong revenue growth and maintained a high operating profit margin. However, the financial results were somewhat affected by inflation and hyperinflationary accounting in Türkiye, which contributed to a decline in the overall operating profit margins. When excluding Türkiye, the revenue growth rate for NIPSEA Except China was approximately 6%. Despite some geopolitical uncertainties in various regions, our performance generally aligned with expectations. In Indonesia, although we saw improvements compared to the first quarter, we remain cautious about the economic environment and plan to implement several recovery strategies in the second half of the year. Additionally, Alina in Kazakhstan made a significant contribution, achieving an operating profit margin of approximately 20%.

- DuluxGroup faced challenging market conditions in both the Pacific and Europe segments. Despite these headwinds, DGL (Pacific) achieved a 4% revenue growth and maintained a relatively stable operating profit margin, aided by contributions from small-scale acquisitions in the adjacencies area. Looking ahead to the second half of the year, we expect moderate growth, supported by a market recovery and the revitalization of our core brand. In contrast, DGL (Europe) experienced a decline in revenue due to continued market softness in France. However, we believe our market share has slightly increased, and there are early signs that the market may be beginning to bottom out.

- In the Americas, our automotive segment saw an 8.6% increase in revenue, driven by strong automobile production, particularly among Japanese automakers, even as overall market production remained stable. The decorative segment also experienced positive growth, although market conditions were somewhat challenging. A significant development in this region was the opening of 17 new Dunn-Edwards stores in Northern California by May, capitalizing on locations vacated by a competitor exiting the market. We expect these new stores to gradually contribute to our earnings. It’s important to clarify that these openings are not the result of business succession or acquisitions, but rather new Dunn-Edwards locations established in the sites previously occupied by the competitor.

7. Major Topic

Moving on to an important update, we are pleased to announce the release of our Integrated Report 2024.

This Report builds on the Medium-Term Strategy that we unveiled on April 4, providing a more in-depth exploration of our management strategy, including our approach to Return on Invested Capital (ROIC). Additionally, the report features a governance discussion between Chairman Goh and Lead Independent Director Nakamura. We are proud to have published this report two months earlier than last year’s edition, and we believe it offers valuable insights that are well worth your time. We encourage you to take a moment to review its contents.

In addition, we will be hosting an online briefing on the Integrated Report 2024 on Thursday, September 5, and we warmly invite you to join us for this event.

While our financial results for the second quarter largely met expectations, we are beginning to see positive outcomes from our strategies focused on healthy growth and margin preservation across each region. Although the economic environment remains challenging, there are encouraging signs of improvement in certain areas. We remain committed to achieving our initial guidance and are working diligently to surpass it. We will continue to keep you informed with updates in our third-quarter results.

Thank you for your attention.