1. Front Cover

Thank you for taking the time to join today’s briefing on the Integrated Report 2024 amidst your busy schedule. I’m Ryosuke Tanaka, General Manager of Investor Relations.

During this session, I’ll be covering the key highlights of the Integrated Report 2024, which was published at the end of July.

Thanks to the valuable suggestions and feedback from our investors, we were able to release the 2024 edition two months earlier than last year. Your expert insights helped us swiftly identify areas for improvement and streamline the production process. We sincerely appreciate your ongoing support and collaboration.

As we turn our attention to the 2025 edition, we look forward to incorporating the insights shared in today’s discussion. Your continued feedback will be instrumental in shaping the next report.

2. The Aim of Today’s Briefing

Let me begin by outlining the purpose of today’s briefing.

We have three key objectives:

- This year’s Report has been condensed to 100 pages, making it more concise and accessible. In this briefing, I will highlight the key sections that deserve your attention to ensure efficient reading and a clearer understanding of our strategic initiatives focused on Maximization of Shareholder Value (MSV).

- The insights we’ve gathered through our engagement with investors—covering our unique business model, management strategies, and sustainability initiatives—will be used to enhance our future corporate management and Investor Relations activities.

- These initiatives will support the maximization of PER and provide valuable guidance for the planning of the 2025 edition of the Report.

3. Production Process and Editorial Policy

The editorial policy for the 2024 edition was shaped by three primary objectives:

- To clearly articulate the strengths of our Asset Assembler model and present a rational and logical narrative that demonstrates our ongoing efforts to maximize EPS

- To showcase the exceptional value of our human capital from various angles, emphasizing both corporate management and business operations

- To provide a deeper analysis of key topics that are highly relevant to capital markets, such as “Management with a Focus on Stock Price,” “Our Strategy for Maximizing PER,” “Our Approach to ROIC,” and “Our Relationship with the Majority Shareholder and the Protection of Minority Interests”

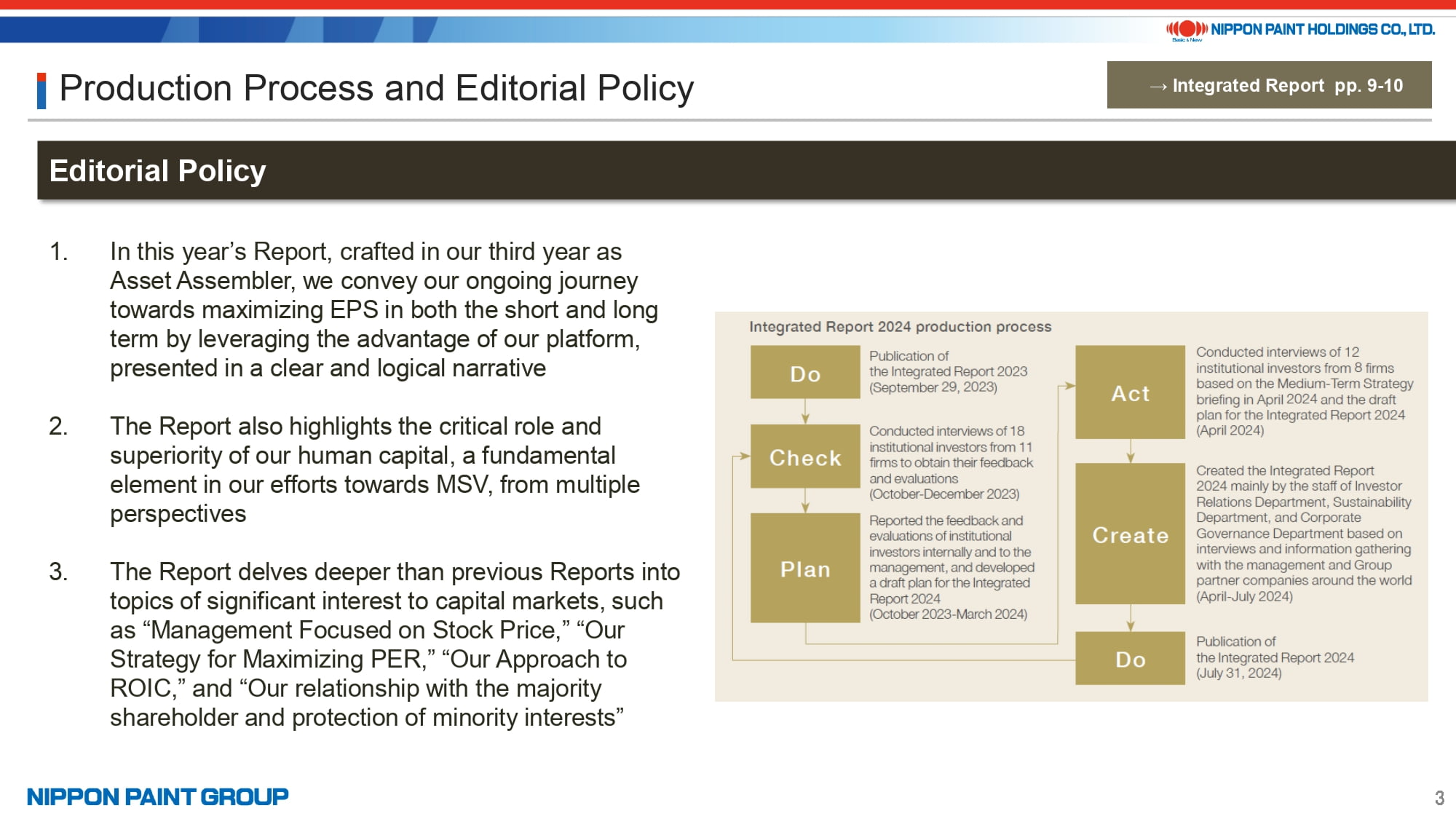

The Report was developed following the structured process outlined on the right of the presentation.

Each year, management’s involvement in the production of the Integrated Report has grown. For this edition, we received substantial support and collaboration not only from Co-Presidents Wakatsuki and Wee but also from Lead Independent Director Nakamura, Chairman Goh, and our Group partner companies across the globe. This collective effort from leadership and partners was key to the Report’s development.

The quality of the Report has steadily improved over time, driven by the invaluable feedback we’ve received from investors. We are committed to using the Integrated Report as a tool to further strengthen our engagement with investors.

4. Key Improvements

This page highlights the key enhancements we intentionally implemented in this year’s edition.

One of the standout features is the inclusion of more detailed explanations and numerous case studies, offering greater depth and practical examples compared to previous editions. These additions provide clearer insights into our strategies and operations.

Specifically, items 1, 2, 3, 4, 6, 7, 8, and 9 exemplify the deeper explanations featured in this edition. Items 1 and 2 focus on the “prudent management stance and risk-averse approach” that form the foundation of our Asset Assembler model, along with our strength in driving organic growth, as outlined in our Medium-Term Strategy. Items 3, 4, and 9 address measures and approaches that align with topics frequently discussed with investors during our regular IR activities.

Items 1, 2, 5, 6, and 11 feature specific case studies that illustrate key aspects of our business strategy. In items 1 and 2, we showcased examples such as DuluxGroup, Betek Boya, and Alina in Kazakhstan to demonstrate how our group collaboration leverages our platform through autonomous and decentralized management. Items 5, 6, and 11 address investor feedback requesting clearer explanations of the connections between financial and non-financial factors, supported by additional case studies to enhance the understanding of our management strategy. While not all case studies could be included in the Integrated Report, we have streamlined our information disclosure system. As detailed in item 11, many of these case studies are available on our website for further exploration.

5. Key Strategies for Condensing the Report

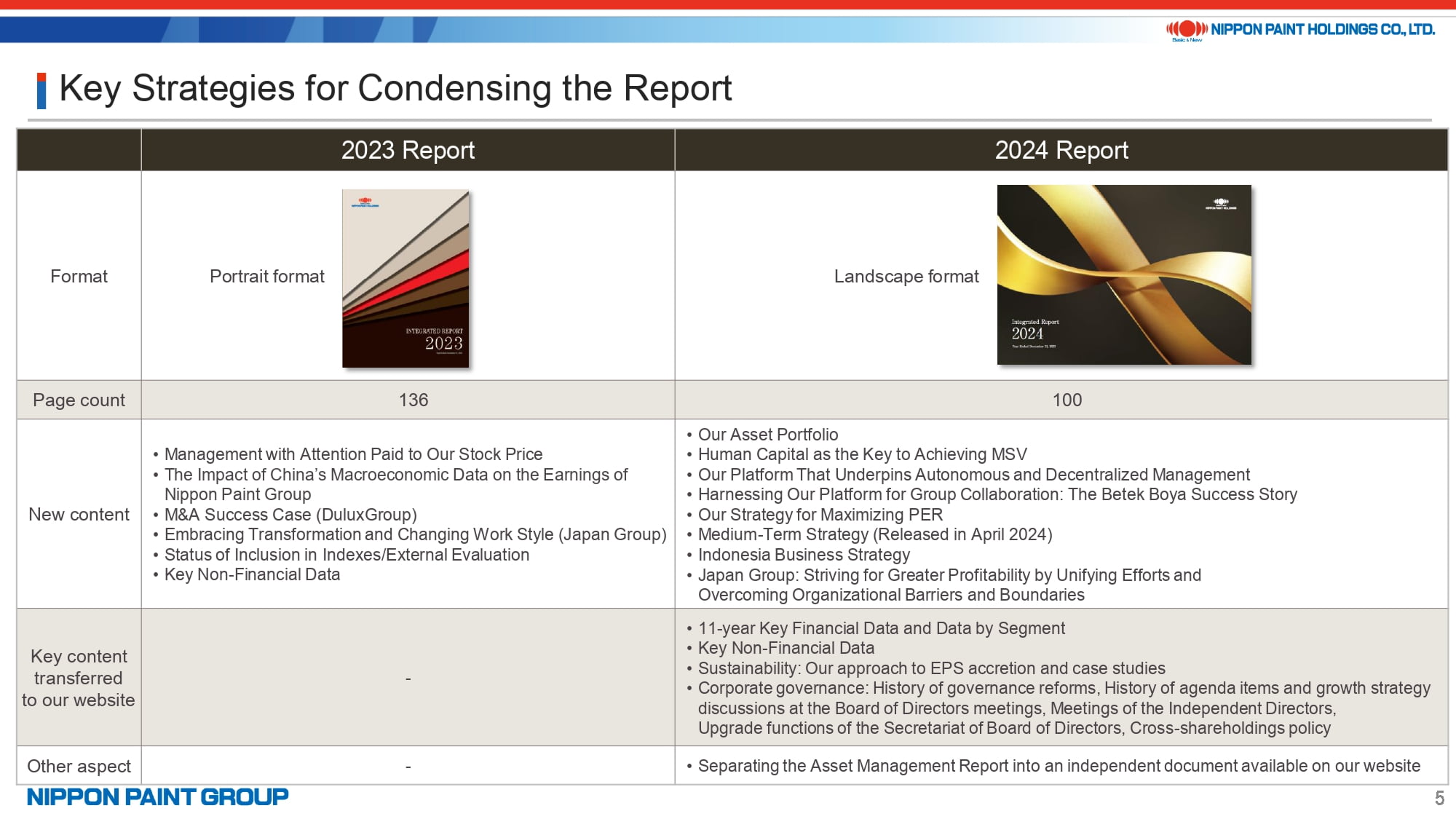

Let me begin by expanding on the first key point: “conciseness.”

In response to investor feedback, particularly the suggestion to streamline the Report for a more focused presentation of key points—especially to engage a broader audience, including fund managers—we made a concerted effort to reduce the Report’s length. As a result, we successfully condensed this year’s edition by nearly 30%, bringing it down to 100 pages while maintaining the depth and clarity of our core content.

Although we introduced more new content compared to the previous edition, regular sections with minimal updates, supplementary case studies, and essential data have been relocated to our website.

Moreover, the “Asset Management Report,” which had been a regular feature in past editions, has been published as a standalone document, now accessible online.

This reallocation allowed us to dedicate more space in the Integrated Report to the topics that matter most to our investors and that we are eager to highlight, making it a more focused and valuable resource for discussions.

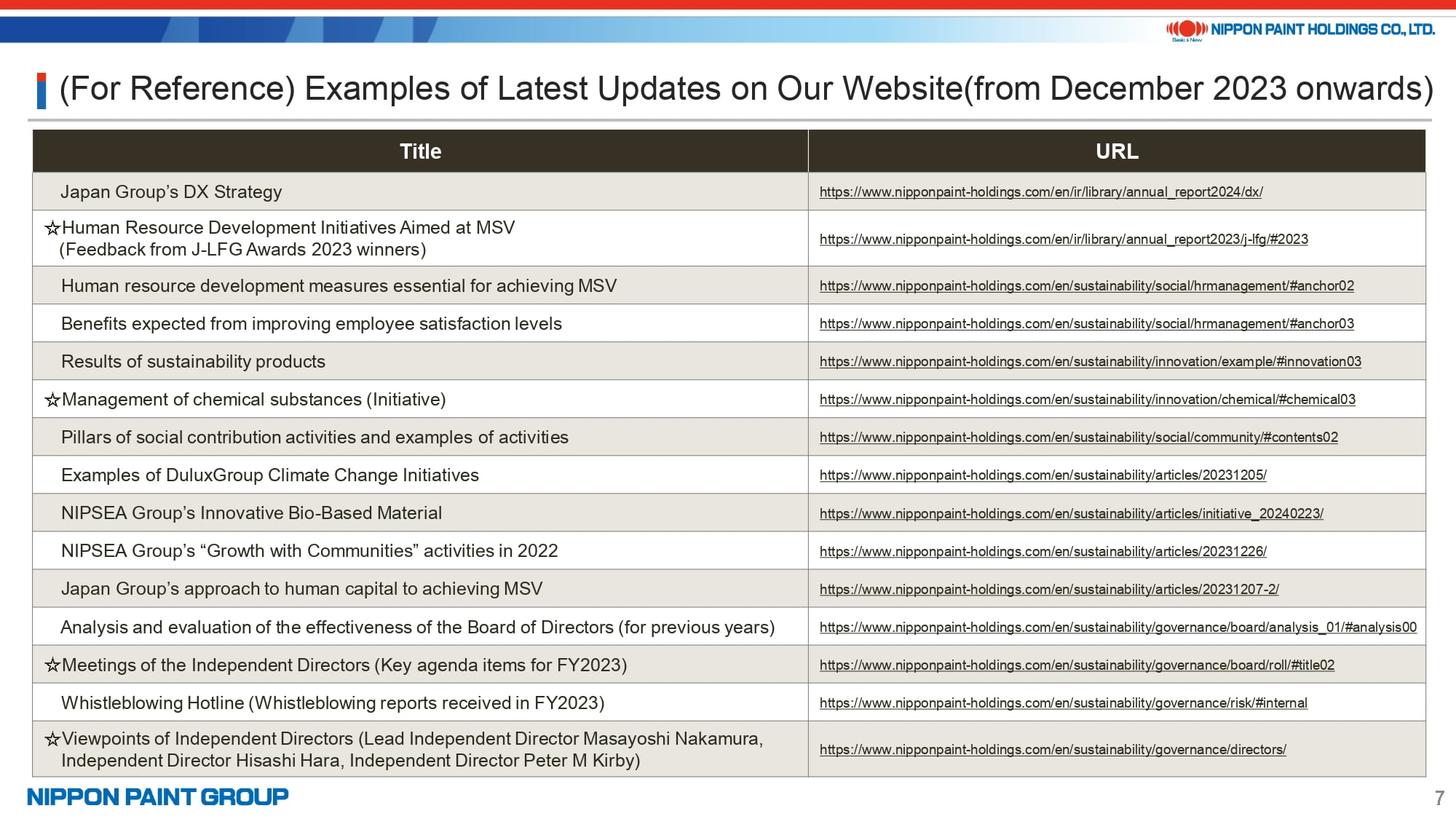

6. (For Reference) Examples of Latest Updates on Our Website (from December 2023 onwards)

This page provides examples of the more detailed explanations and specific case studies that have been made available on our website since last December, offering greater depth than previous Reports.

Items marked with a star particularly highlight examples that demonstrate the effectiveness of the Board and management execution, as well as their direct connection to EPS maximization. We encourage investors to use the Integrated Report for overarching policies and strategies, visit our website for detailed data and case studies to gain a deeper understanding, and consult the Investor Book for fundamental information and data tailored to entry-level investors.

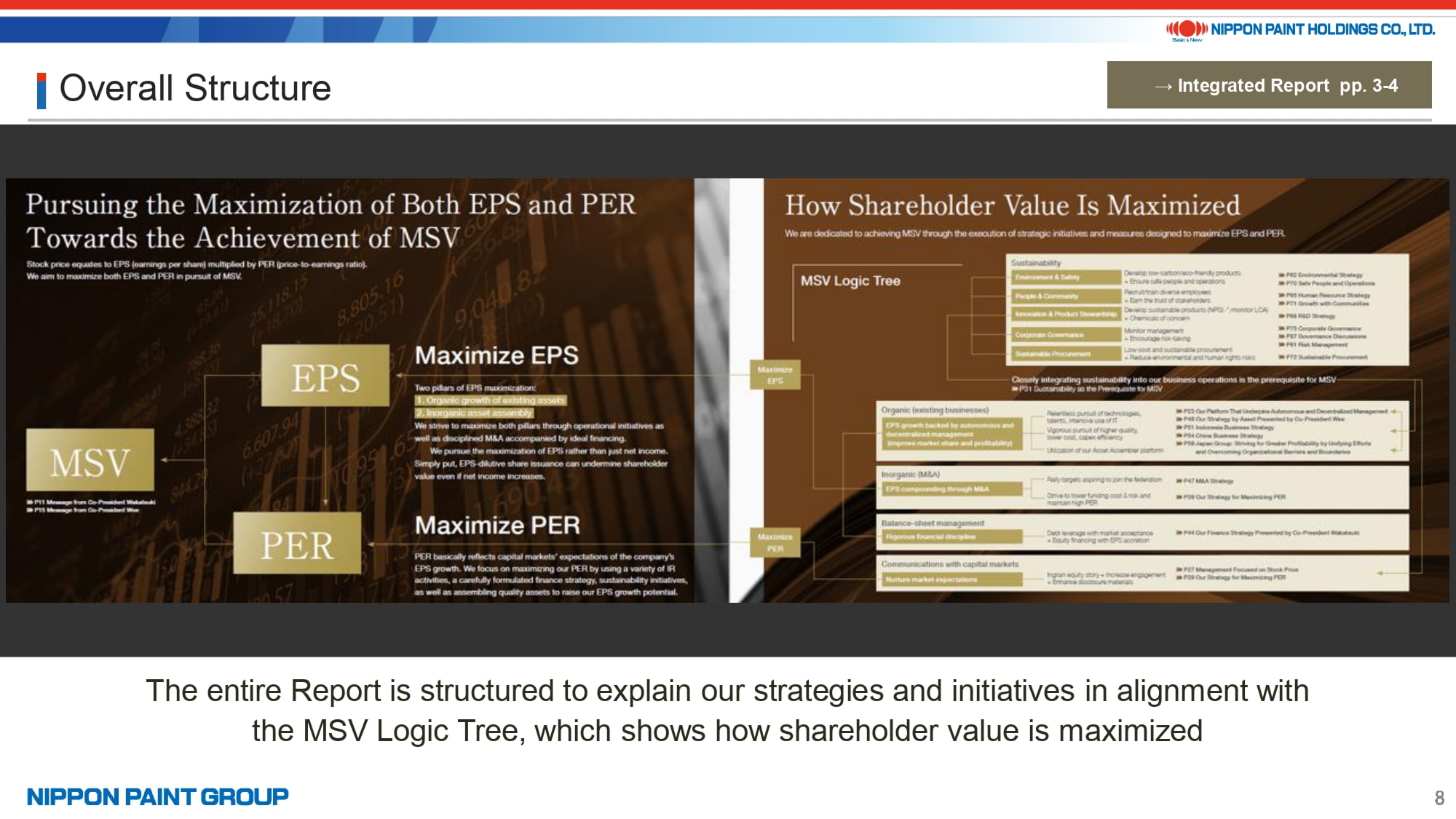

7. Overall Structure

Let me walk you through the structure of the 2024 edition.

On pages 3-4, we introduce our Logic Tree, we present our Logic Tree that outlines how shareholder value is maximized, which is our sole mission. A key highlight of this year’s Report is the clear and logical presentation of the specific strategies and initiatives that drive the maximization of both EPS and PER, which is consistently emphasized throughout the document.

Our sustainability initiatives, efforts in existing businesses, M&A activities, balance sheet management, and communication with capital markets are all strategically aligned to maximize EPS and PER, with the ultimate objective of achieving MSV.

Each element in the Logic Tree clearly outlines our actions and demonstrates how we intend to accomplish MSV.

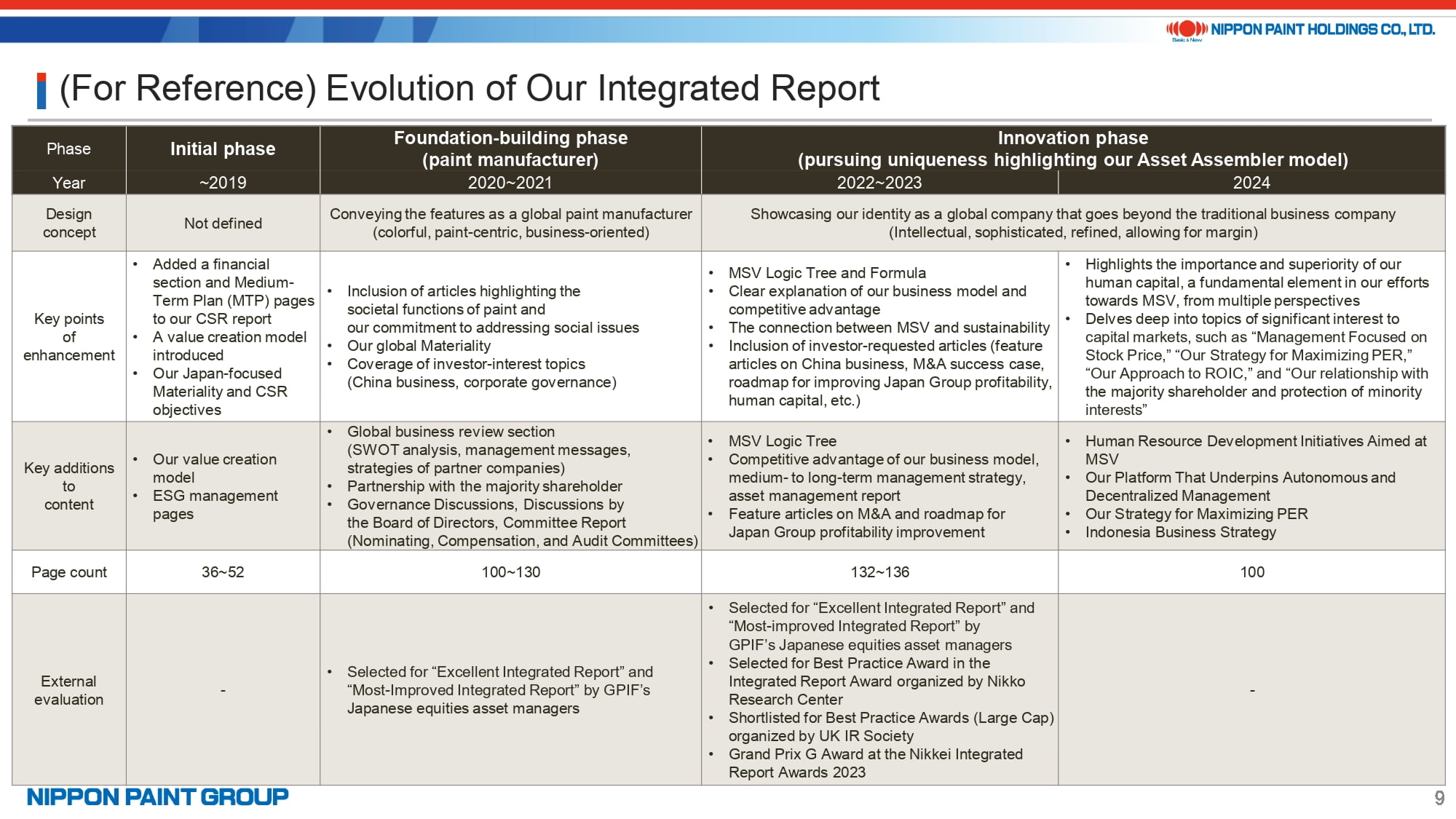

8. (For Reference) Evolution of Our Integrated Report

For your reference, we have outlined the evolution of our Integrated Report.

Since enhancing our IR framework in 2019, we have steadily improved the Report, which has become a vital communication tool with our investors.

We are now in a phase where we focus on conveying our unique approach as Asset Assembler, moving beyond the conventional boundaries of a paint company. Through ongoing engagement with our investors, we aim to further refine and advance the Report to better reflect our strategy and vision.

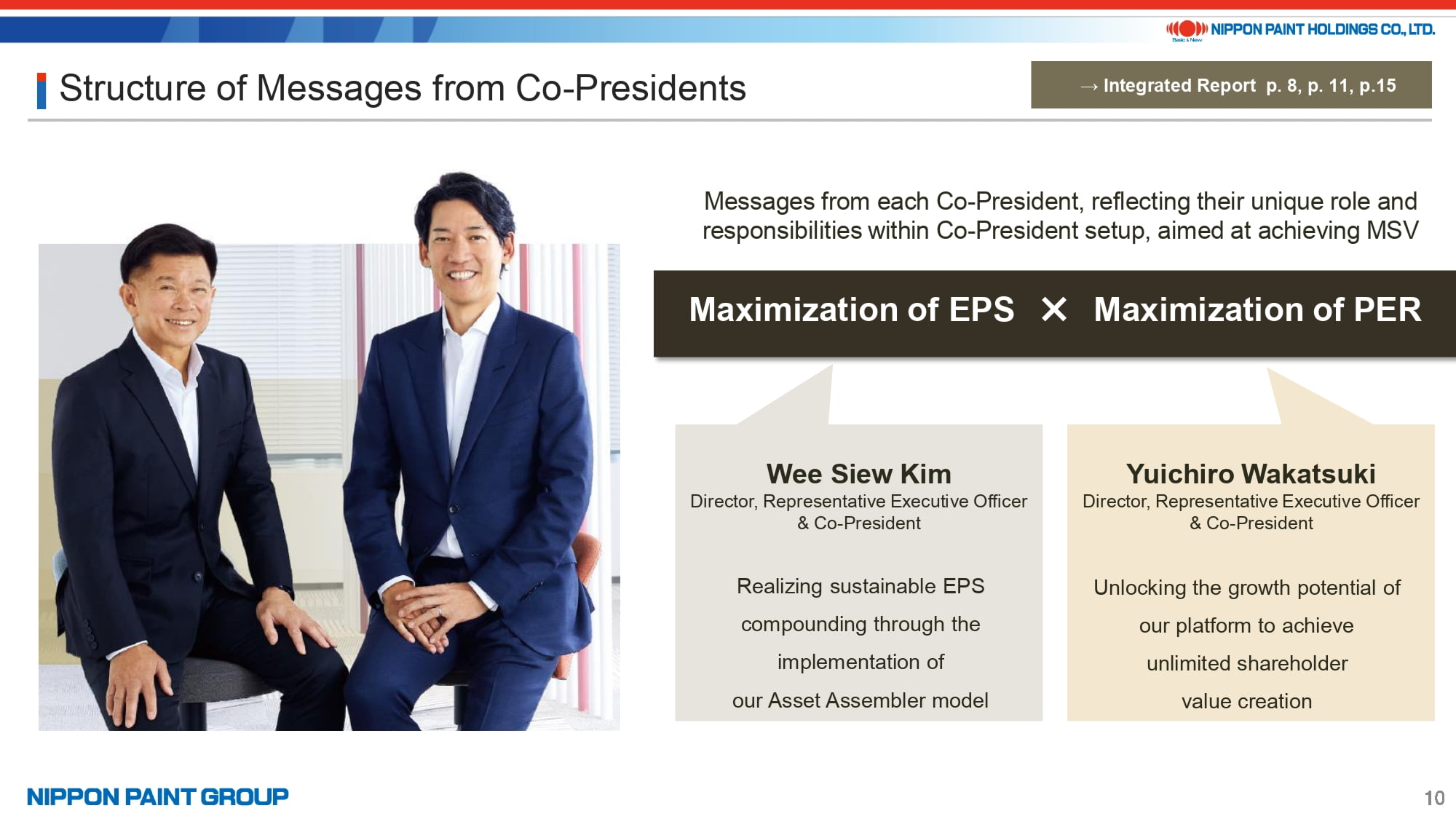

9. Structure of Messages from Co-Presidents

Let me walk you through the key points of each section.

Starting with the Messages from the Co-Presidents, our company operates under a distinctive Co-President structure. Co-President Wee is primarily focused on maximizing EPS, while Co-President Wakatsuki is dedicated to maximizing PER. Together, their leadership drives our Group’s unified pursuit of MSV.

In this section, both Co-President Wee and Co-President Wakatsuki share their insights and vision, with each message reflecting their respective roles and responsibilities.

10. Message from Co-President Wakatsuki

In Co-President Wakatsuki’s message, titled “Unlocking the Growth Potential of Our Platform to Achieve Unlimited Shareholder Value Creation,” he shares his personal beliefs and philosophy, emphasizing his approach to maximizing PER.

For example, in items 1, 2, and 3, Co-President Wakatsuki articulates the core of our Asset Assembler model, which focuses on sustainable EPS compounding with minimal risk through both organic and inorganic growth strategies.

Additionally, in items 4, 5, 6, and 7, he reinforces our commitment to being recognized by the capital markets as an EPS Compounder, one that consistently and securely drives EPS growth. This, in turn, aims to raise market expectations for our sustainable EPS growth, ultimately maximizing PER. He also discusses the benefits of autonomous and decentralized management, considering both financial aspects and non-financial factors such as human capital and sustainability.

In essence, our company has the capability to unlock the growth potential of its platform, which encompasses key assets such as brand, talent, technology, and expertise. By leveraging these strengths, we are able to maximize shareholder value effectively.

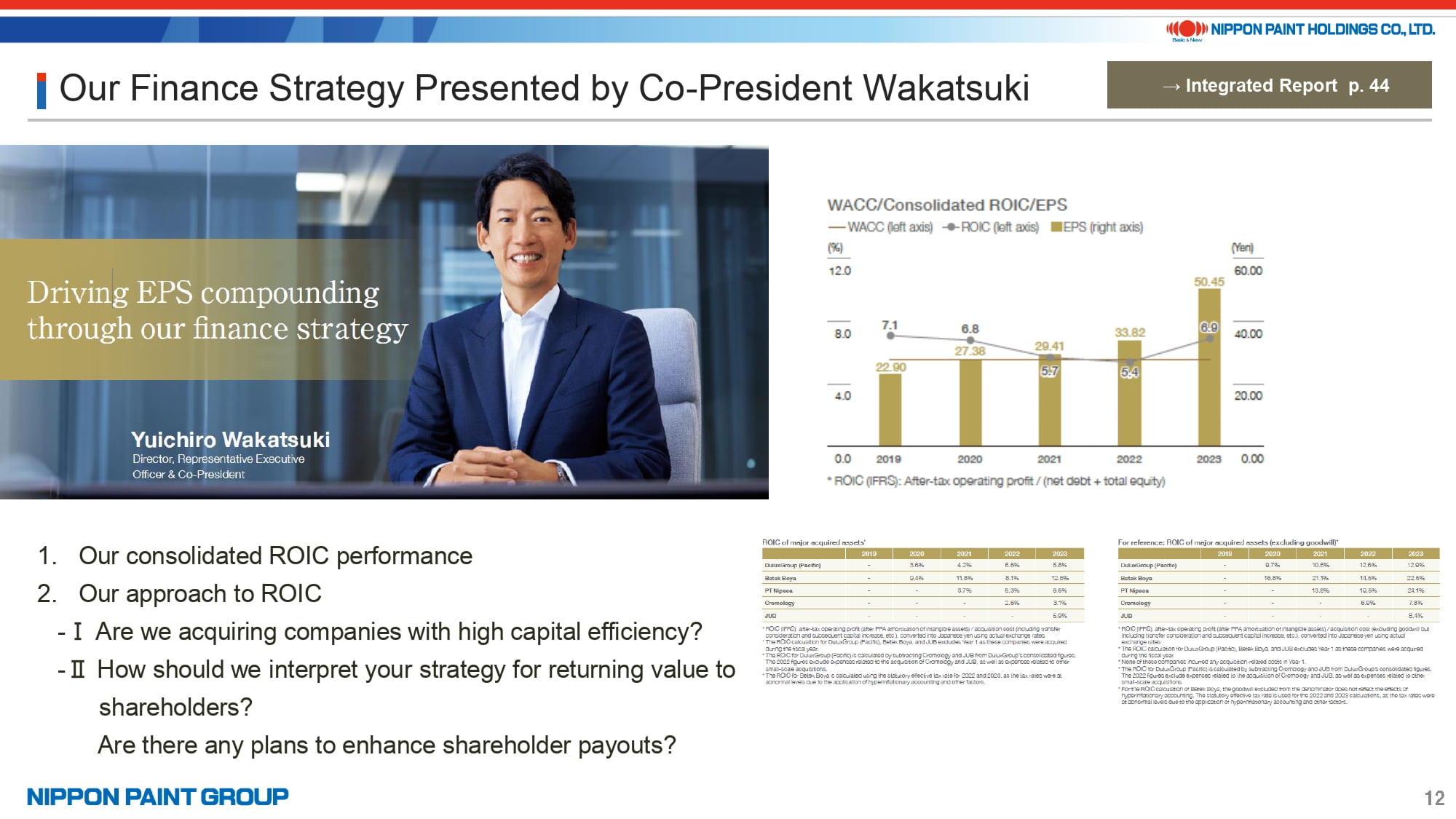

11. Our Finance Strategy Presented by Co-President Wakatsuki

Next, turning to our financial strategy:

In response to the growing number of investor inquiries about ROIC, we have provided a more comprehensive explanation of our approach this year, addressing two specific questions related to our consolidated ROIC performance.

While some investors view ROIC as a key metric, our emphasis on low-risk, good-return M&A, which targets secure opportunities that drive EPS growth, indicates that assessing our potential based solely on consolidated ROIC may not fully capture our strategic value.

We aim to incorporate this perspective into future discussions with investors.

12. Message from Co-President Wee

In Co-President Wee’s message, titled “Realizing Sustainable EPS Compounding Through the Implementation of Our Asset Assembler Model,” he delivers a powerful message, supported by specific examples that highlight our strategy in action.

For example:

- He highlights DuluxGroup, which became part of our Group in 2019, as a prime demonstration of our Asset Assembler model in action. DuluxGroup has maintained its autonomy while leveraging our Group’s financial strength and management resources to drive further growth.

- He also introduces the Selleys brand and Dunn-Edwards as examples of fostering organic growth through collaboration among partner companies, supported by our autonomous and decentralized management approach.

Additionally:

- Co-President Wee emphasizes the importance of “people,” “talent,” and “organizational agility” as core pillars of sustainability. He shares his unique insights on the qualities he looks for when identifying exceptional management teams and offers his perspective on fostering effective organizational dynamics.

Moreover:

- Co-President Wee discusses our goal of achieving “value creation through a focus on technological innovation,” providing updates on current progress and outlining risk mitigation strategies from his distinct vantage point.

13. Our Strategy by Asset Presented by Co-President Wee

Next, Co-President Wee addresses practical strategies for overcoming challenges to sustain EPS compounding.

- Focusing on NIPSEA Group, he highlights their ability to balance growth and profitability through adept execution of strategic adjustments, even in the face of numerous unforeseen challenges.

- For Japan Group, Co-President Wee highlights initiatives designed to build a stronger profit-generating platform through organizational reforms and functional integration. This includes leaders taking on multiple roles to strengthen group cohesion, revitalizing the marine business, enhancing collaboration within the technology division, and launching task forces aimed at exploring new markets.

- In the automotive business, he outlines efforts to create a customer-focused global cooperation framework.

Co-President Wee presents these practical initiatives with his distinctive narrative style, reflecting his leadership in overseeing operations.

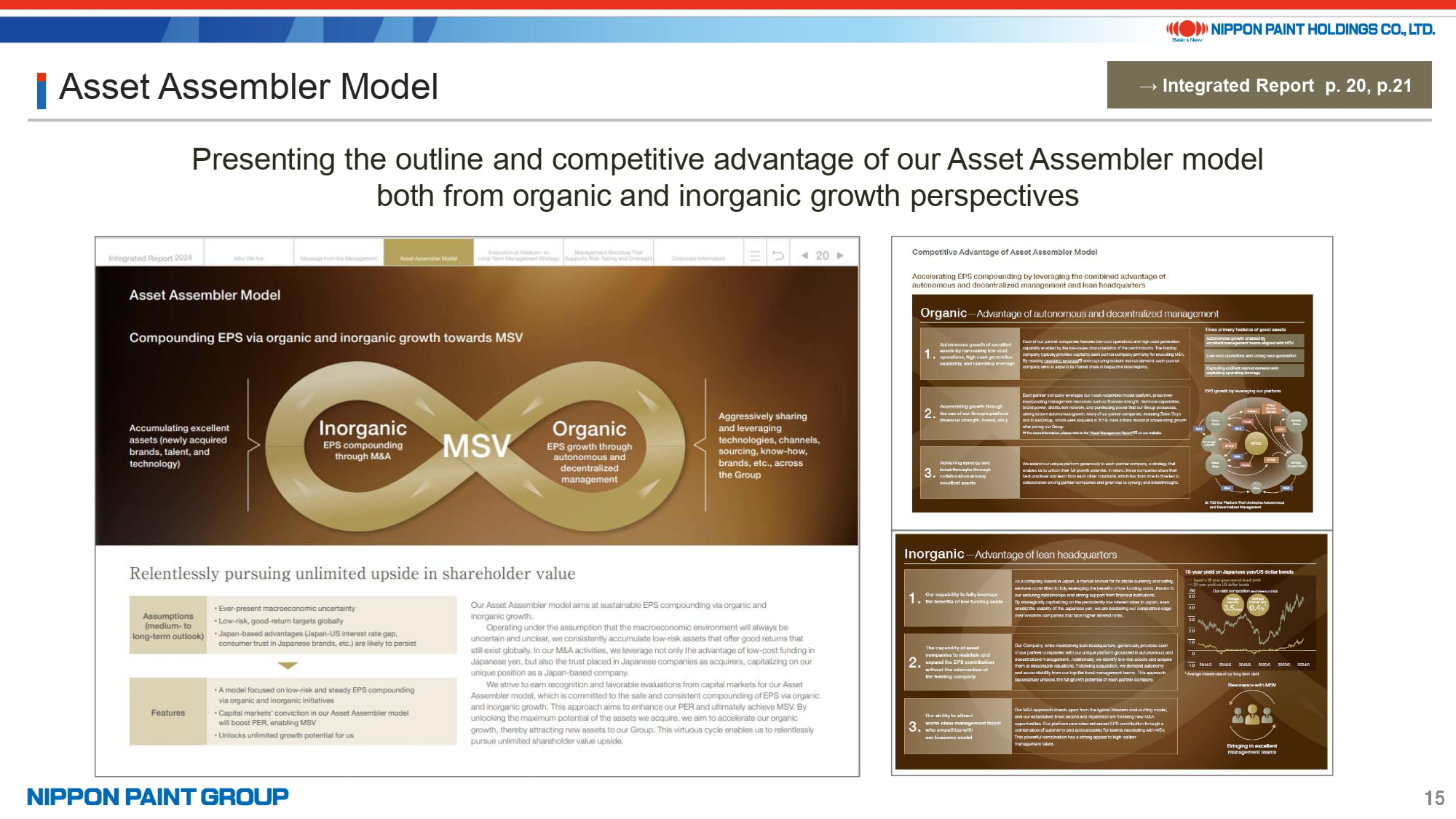

14. Asset Assembler Model

Now, let me provide an overview of our Asset Assembler model and its competitive advantages in driving MSV.

Aligned with our Medium-Term Strategy, we emphasize the strengths of our Asset Assembler model in achieving sustainable EPS compounding through both organic and inorganic growth strategies.

In response to investor feedback requesting further details on the benefits of our autonomous and decentralized management approach, we have outlined three key advantages that maximize the potential of our assets to drive organic growth.

For inorganic growth, we have also explained three advantages that allow us to pursue low-risk, sustainable EPS compounding by acquiring excellent assets that consistently generate stable cash flow.

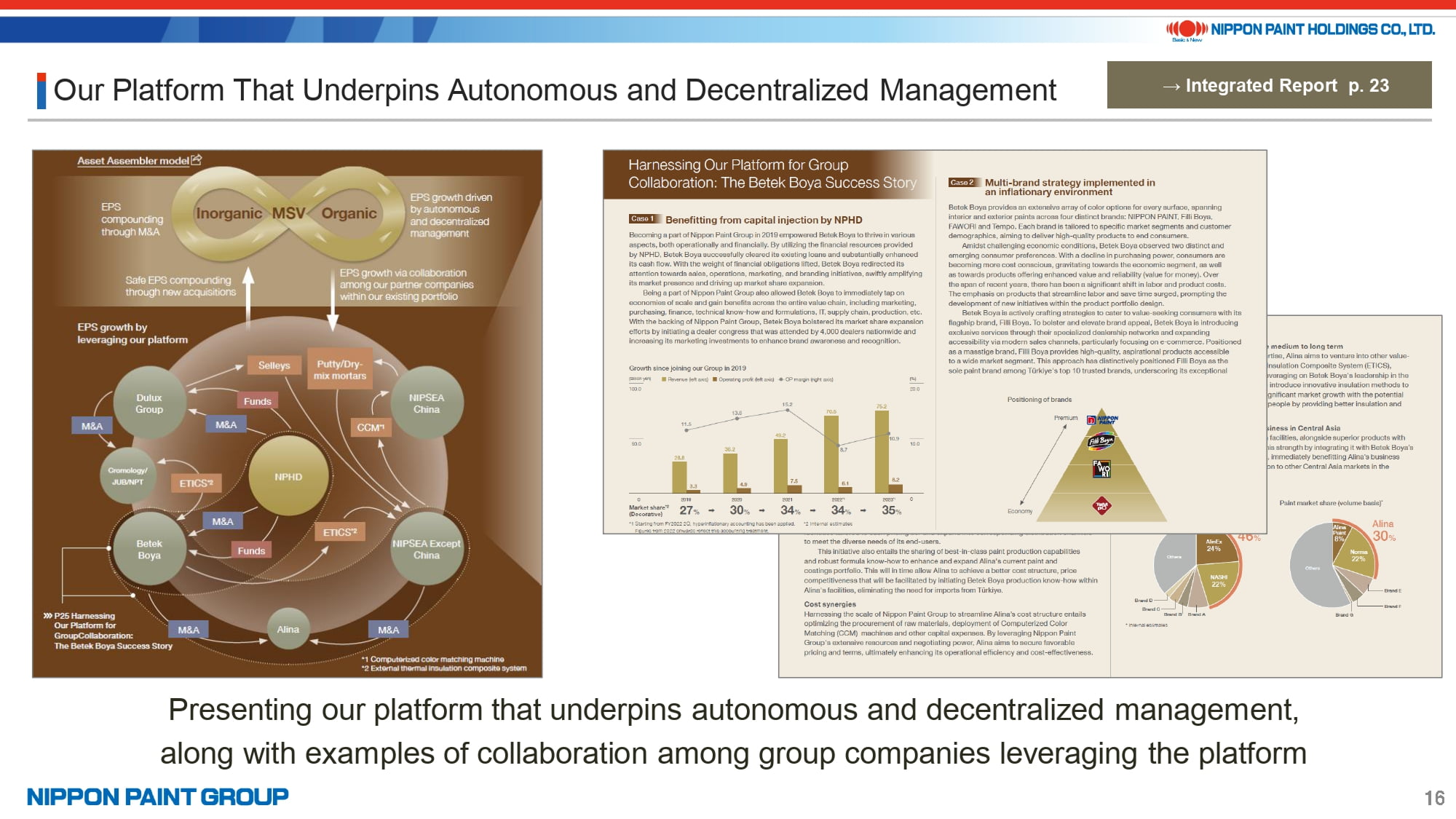

15. Our Platform That Underpins Autonomous and Decentralized Management

Next, let me explain “Our Platform That Underpins Autonomous and Decentralized Management.”

The stable, ongoing growth of our existing businesses is driven not only by the exceptional management teams in various regions but also by the effective operation of our platform. This platform provides key management resources, such as financial strength, technological capabilities, and brand power, which each partner company leverages to fuel their growth.

In this section, we highlight Betek Boya, which joined our Group in 2019, as a prime example of group collaboration. We emphasize the impact of our capital investment, the implementation of a multi-brand strategy incorporating the “Nippon Paint” brand, and the successful expansion into the Kazakhstan market.

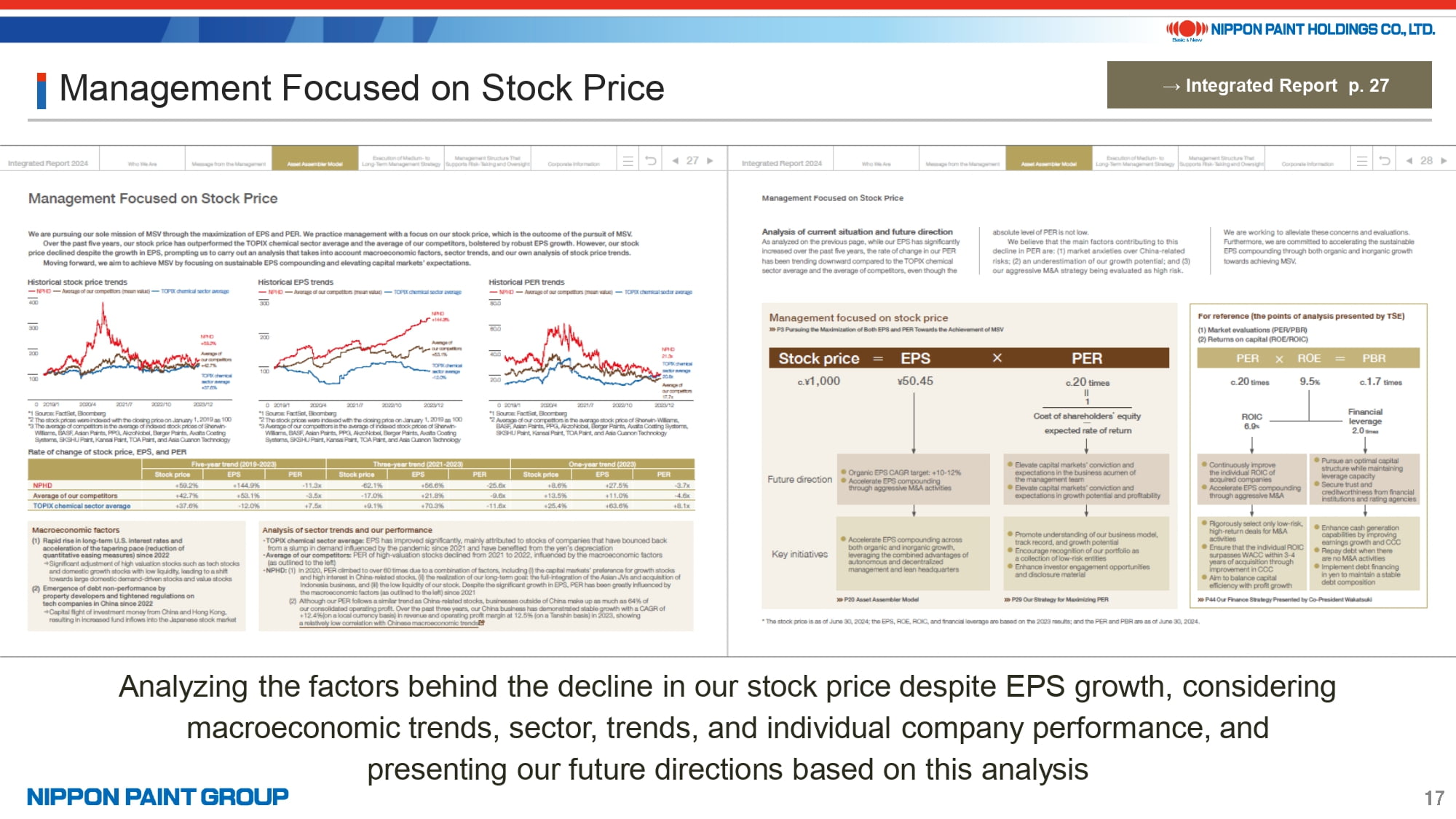

16. Management Focused on Stock Price

Next, let me explain our approach to “Management Focused on Stock Price.”

The recent decline in our stock price, despite EPS growth, has been a recurring topic in investor discussions. In response, we have analyzed the contributing factors, considering macroeconomic conditions, sector trends, and our internal stock price analysis. Based on these insights, we have outlined our strategic direction moving forward.

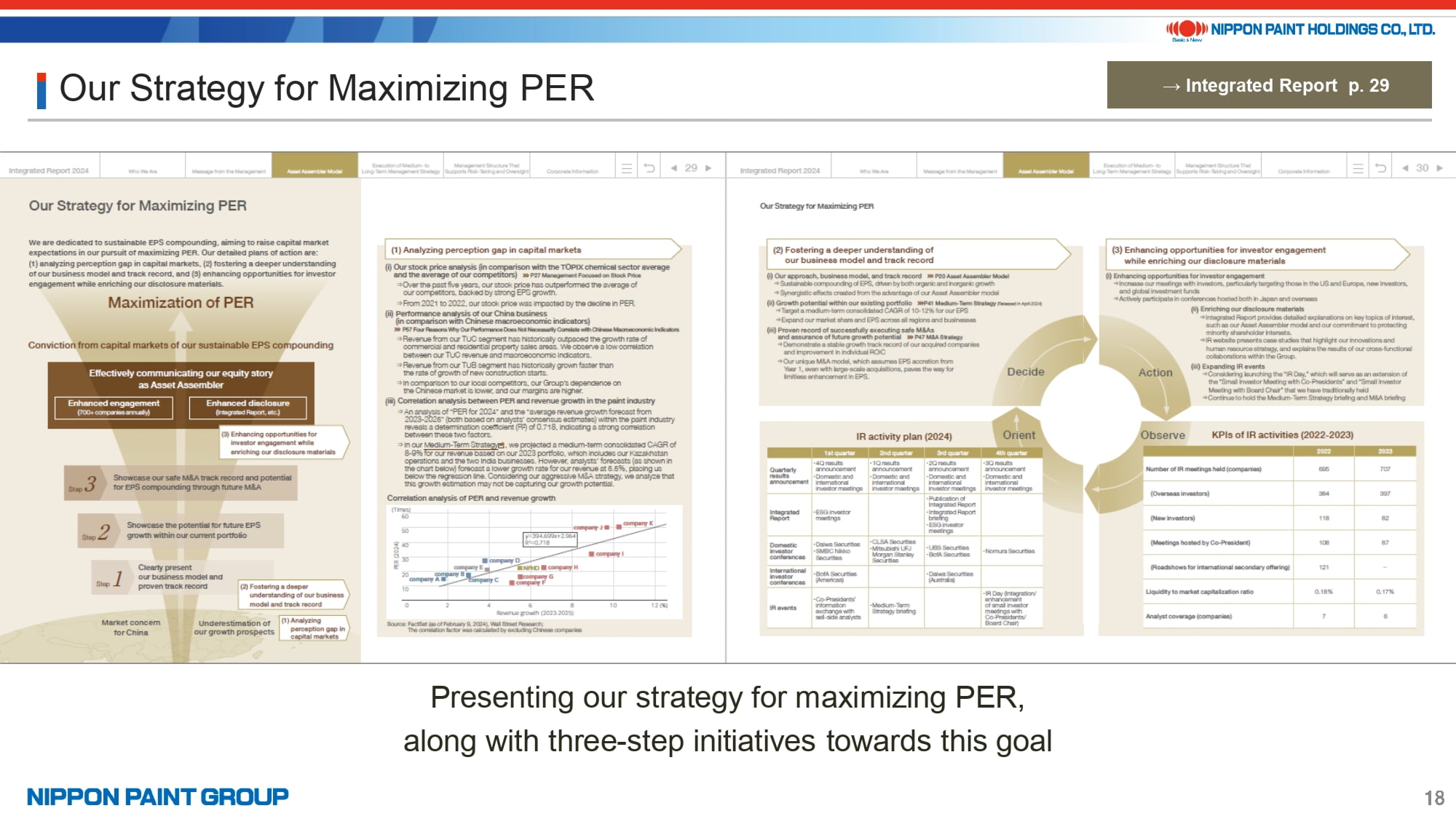

17. Our Strategy for Maximizing PER

In the section titled “Our Strategy for Maximizing PER,” we outline specific initiatives along with a detailed explanation from our Medium-Term Strategy. This is divided into three key steps: “gap analysis,” “key areas requiring deeper understanding,” and “methods for enhancing comprehension.”

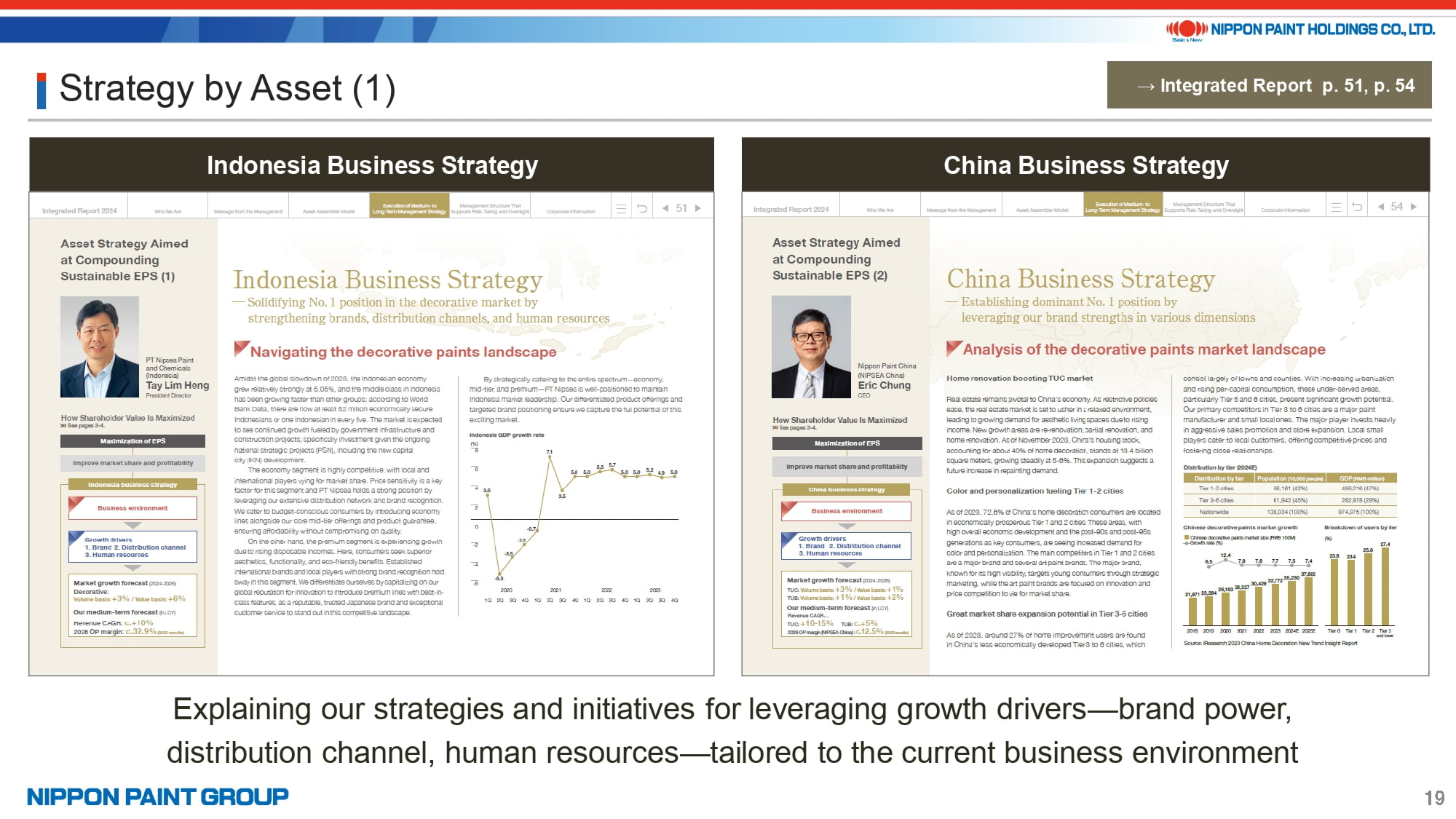

18. Strategy by Asset (1)

Next, I will explain the “Strategy by Asset” section.

This year, in addition to outlining our China business strategy, we have expanded our focus to provide a deeper analysis of our Indonesia business strategy.

Using a fresh perspective, we present specific strategies and initiatives based on an analysis of the current business environment. We highlight how we are leveraging key growth drivers, including brand strength, distribution channels, and human resources, to achieve our objectives.

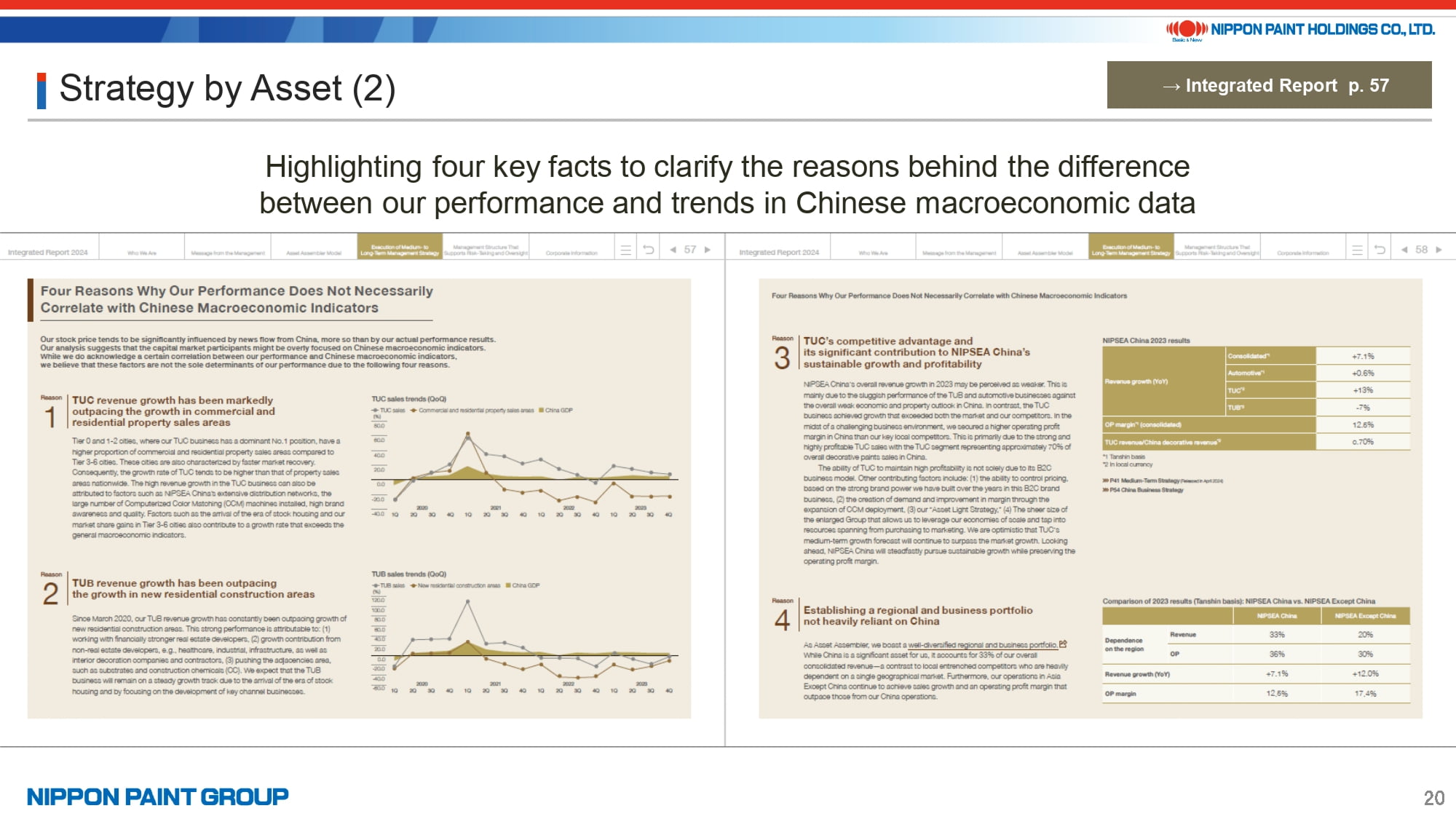

19. Strategy by Asset (2)

Next, we present a column titled “Why Our Performance Does Not Necessarily Correlate with Chinese Macroeconomic Indicators.”

Building on the positive feedback from last year, we have expanded this section. Our stock price is often more influenced by news flow from China than by our actual performance results. In response to investor feedback, we included this data analysis to offer a clearer understanding of this disconnect and provide more context.

I frequently reference this page during meetings with overseas investors, highlighting three key points: (1) the low correlation between our performance and Chinese macroeconomic data, (2) the stability of our business performance in China, and (3) our growth in regions outside of China. We’ve noticed that investors are gaining a deeper understanding and confidence in these factors.

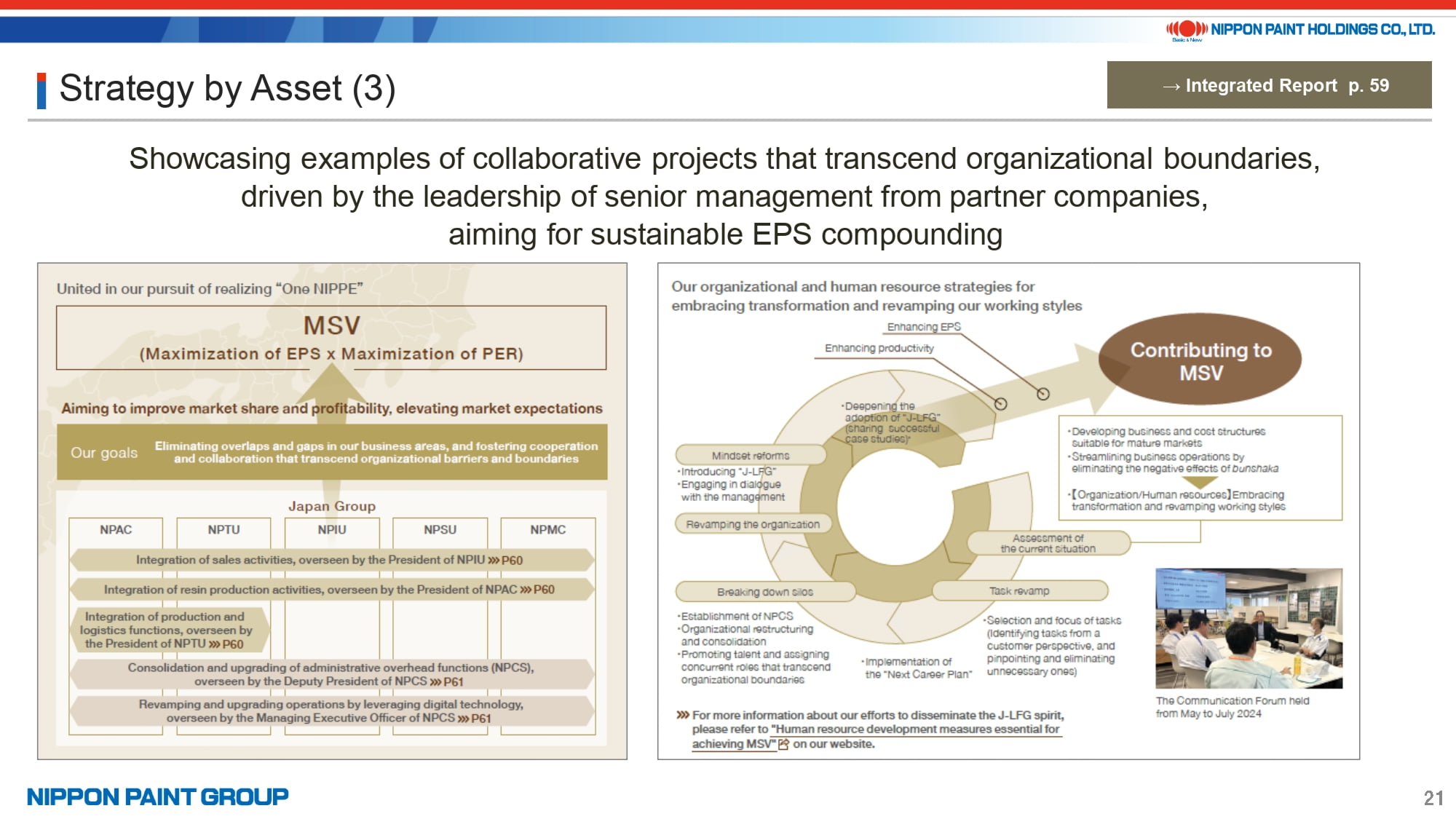

20. Strategy by Asset (3)

Next, I will provide an update on the structural reforms within the Japan Group.

To restore the profitability levels seen in 2017-2018, we are intensifying collaboration efforts across organizational boundaries, led by senior management from each partner company.

This section introduces various projects and initiatives spanning sales, production logistics, administrative functions, and IT/DX, outlining the strategies we are implementing to further enhance profitability.

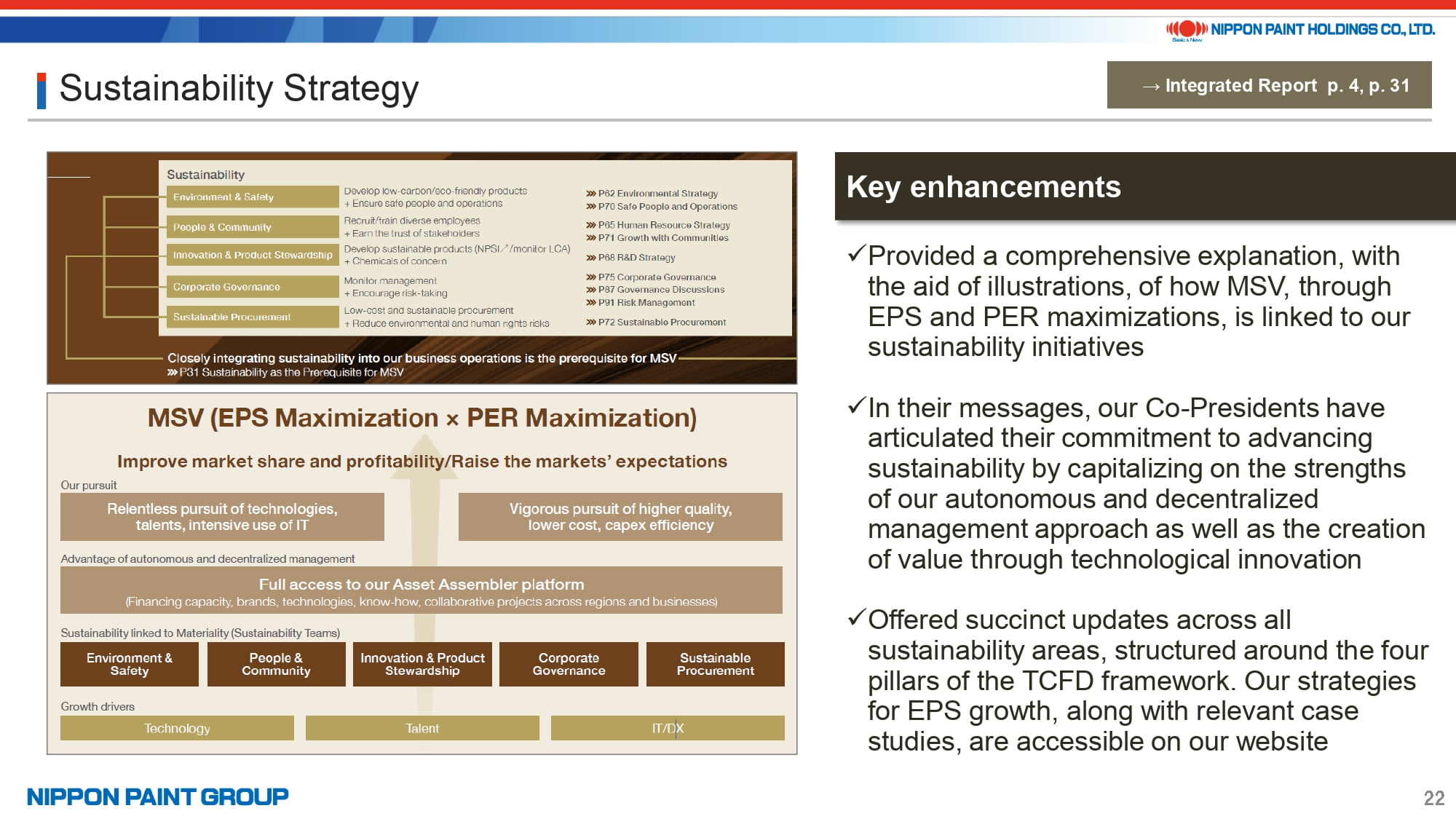

21. Sustainability Strategy

Next, in the “Sustainability” section, we have enriched the content with a special emphasis on demonstrating the link between MSV and sustainability, supported by specific examples.

The key enhancements include:

- A detailed explanation and visual representation of the connection between MSV (maximizing EPS and PER) and sustainability, based on valuable feedback from investors.

- Both Co-Presidents have emphasized their commitment to sustainability in their messages, highlighting the benefits of autonomous and decentralized management, as well as value creation through technological innovation, among other key aspects.

- We have provided concise updates on various sustainability initiatives, aligned with the four pillars of the TCFD recommendations, while offering detailed strategies for EPS growth and additional case studies on our website.

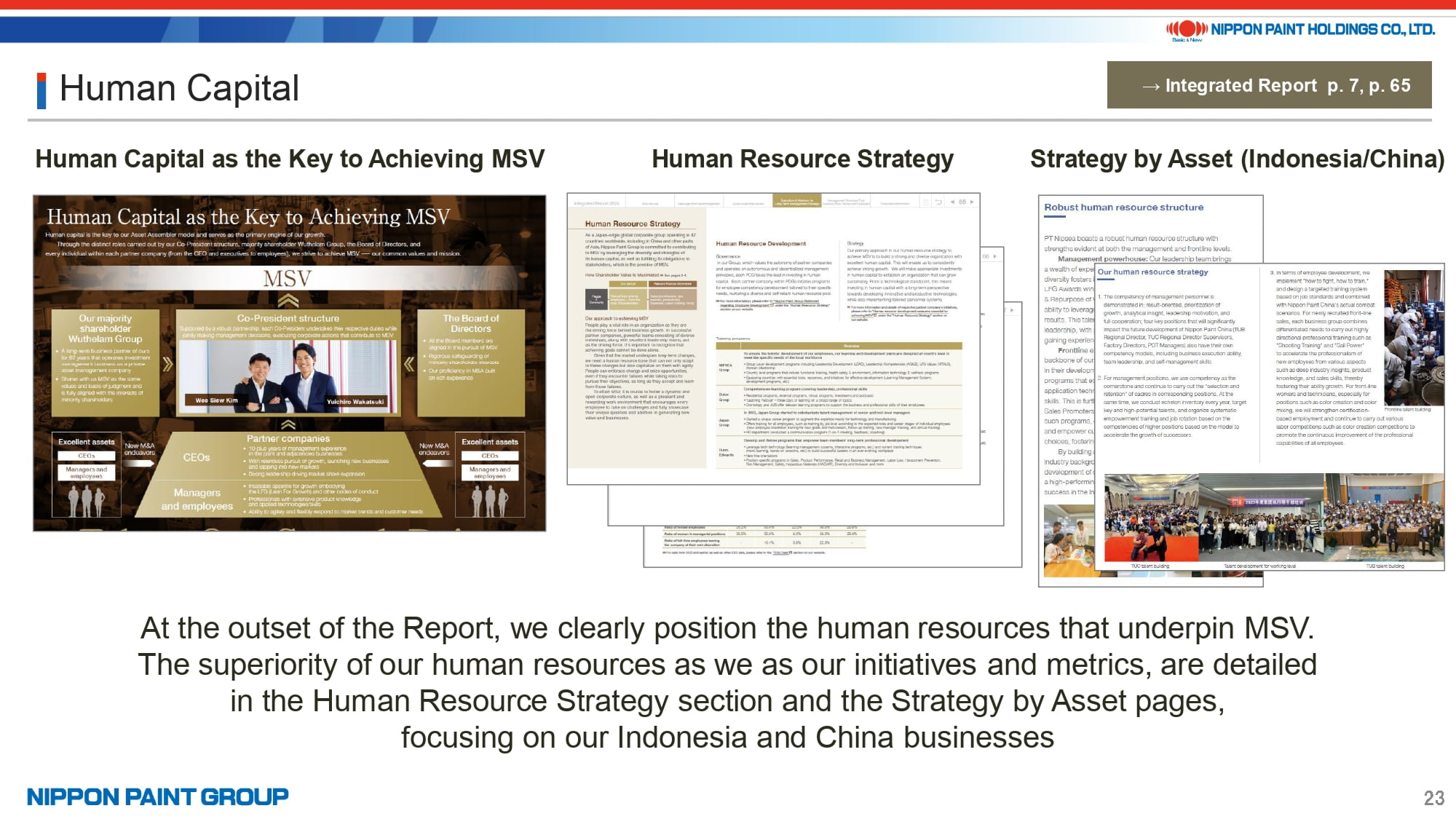

22. Human Capital

We have placed particular emphasis on explaining the significance and advantages of human capital, which serves as the foundation for achieving MSV, from both management and operational perspectives.

While investor focus often centers on our financial metrics, given that our Asset Assembler model drives EPS growth through both existing businesses and new M&A, human capital plays a crucial role at every level—from the Board of Directors and Co-Presidents to the CEOs of local partner companies, managers, and employees. Numerous initiatives are being implemented to leverage human capital to outperform competitors. In this year’s edition, we have showcased the strengths, metrics, and examples of our human capital across multiple sections.

23. Environment Strategy/R&D Strategy

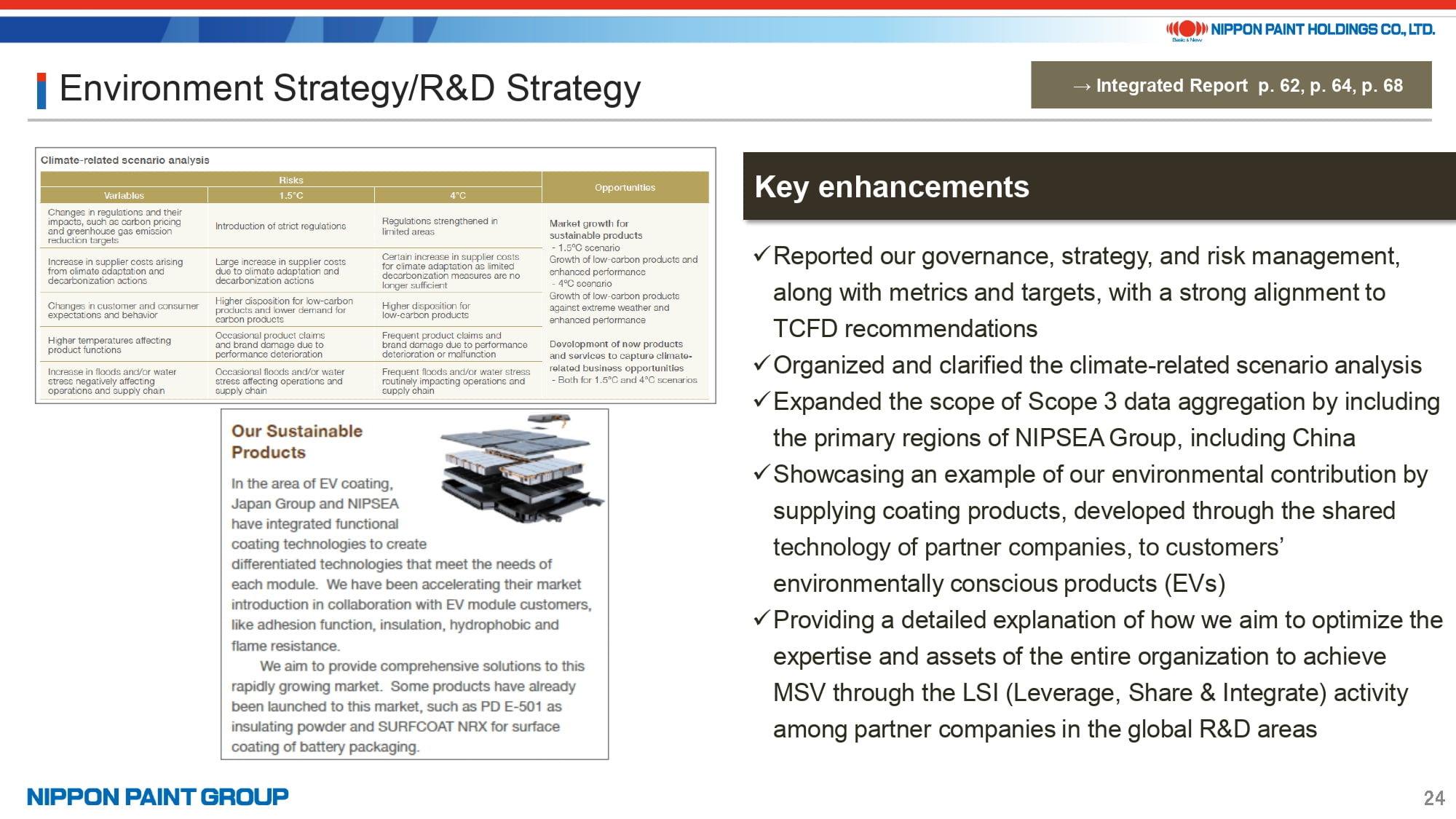

The key enhancements in the “Environmental Strategy” and “R&D Strategy” sections are as follows:

This year, we aligned the entire sustainability section closely with the TCFD recommendations, covering all four pillars, including governance and strategy. Notable improvements include refining and organizing our climate change scenario analysis and expanding Scope 3 data aggregation to encompass major regions within the NIPSEA Group, including China.

Additionally, we have expanded the examples of our environmental contributions and technological collaborations, both in the Integrated Report and on our website. We also discuss the optimization of expertise and resources across all partner companies, particularly in global research and development efforts.

24. Corporate Governance

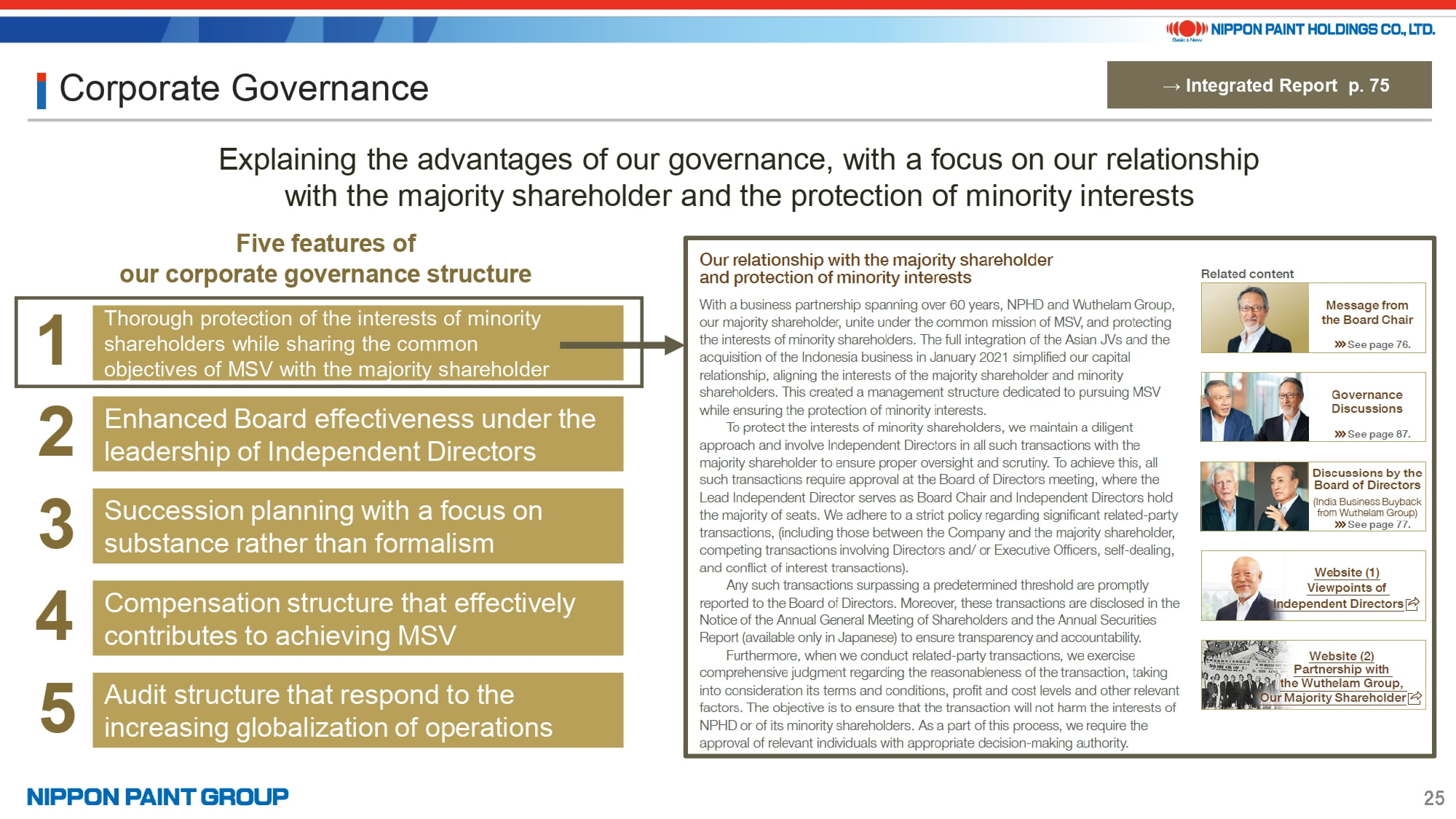

Next, I will outline the key points of the Corporate Governance section.

Our corporate governance framework has five distinctive features, which we view as a competitive advantage.

This year, we have placed special emphasis on the first feature: “Thorough protection of the interests of minority shareholders while sharing the common objective of MSV with the majority shareholder.” In this context, alongside the fundamental aspects, we have included a message from Board Chair Nakamura, as well as unique content such as “Board of Directors Discussions” and “Governance Discussions,” which I will elaborate on later. These sections offer concrete insights into our governance practices, helping to deepen investors’ understanding.

Additionally, our website features perspectives from each Independent Director. By exploring these viewpoints, along with the skills matrix of our Independent Directors, we believe investors can gain a more comprehensive understanding of our governance framework.

25. Discussions by the Board of Directors

Next, we highlight the “Discussions by the Board of Directors,” a section that consistently receives positive feedback from investors each year.

This year, we focused on each Director’s comments regarding the buyback of our India businesses, which were transferred to Wuthelam Group, our majority shareholder, in August 2021.

In preparation for the Board’s resolution in August 2023, we conducted an independent third-party evaluation and formed a special committee to ensure thorough discussions, with particular attention to protecting minority shareholders’ interests. This process mirrored the approach taken during the initial transfer transaction. The content showcases the extensive questioning and debate around the soundness of past management decisions and the future outlook for these businesses, offering investors valuable insights.

26. Committee Report

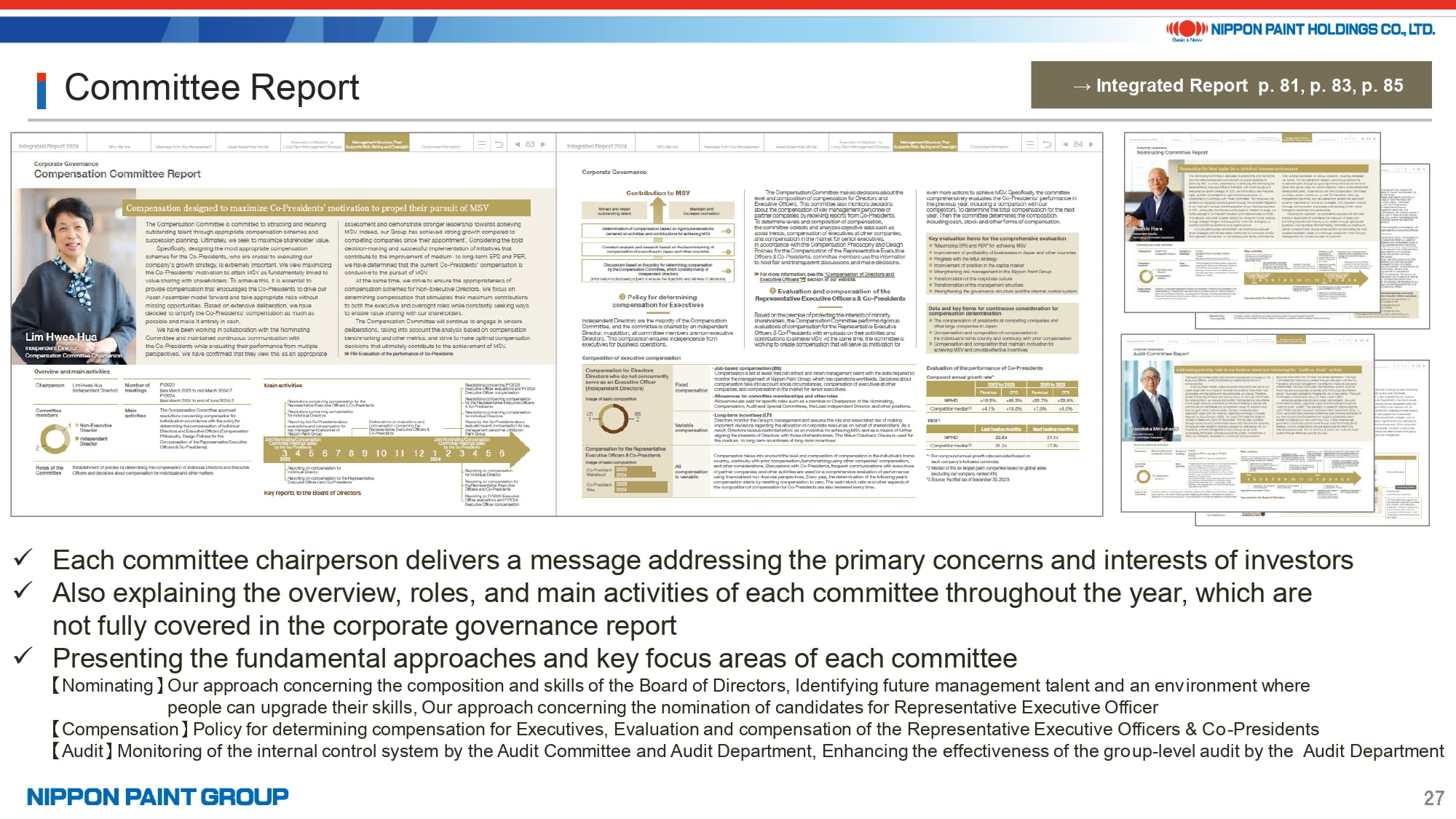

As a Company with Three Committees, the Report includes dedicated sections for the report of each committee.

The Chairperson of each committee has provided comments addressing key topics raised in investor meetings. Additionally, the Report offers details not fully covered in the corporate governance report, such as an overview of each committee’s roles, positions, and main activities over the past year.

Through charts and tables, we also explain each committee’s perspectives and key considerations on issues such as identifying and developing the next generation of leadership, the nomination process for representative executive officer candidates, and the evaluation and compensation of the Co-Presidents.

27. Governance Discussions

Next is the “Governance Discussions” section.

For the past three years, we have featured discussions between Board Chair Nakamura and the Chairperson of one of our key committees—Nomination, Compensation, or Audit. This year, in response to investor feedback, we organized a dialogue between Chairman Goh Hup Jin, who also represents our majority shareholder Wuthelam Group, and Board Chair Nakamura.

In this discussion, Chairman Goh reflects on his involvement with our company since 1979 and revisits the significant governance reforms that have shaped our organization over the years. He also offers candid insights into his role within the current governance framework and his vision for advancing MSV in the future. We encourage everyone to take the time to read this thoughtful and insightful exchange.

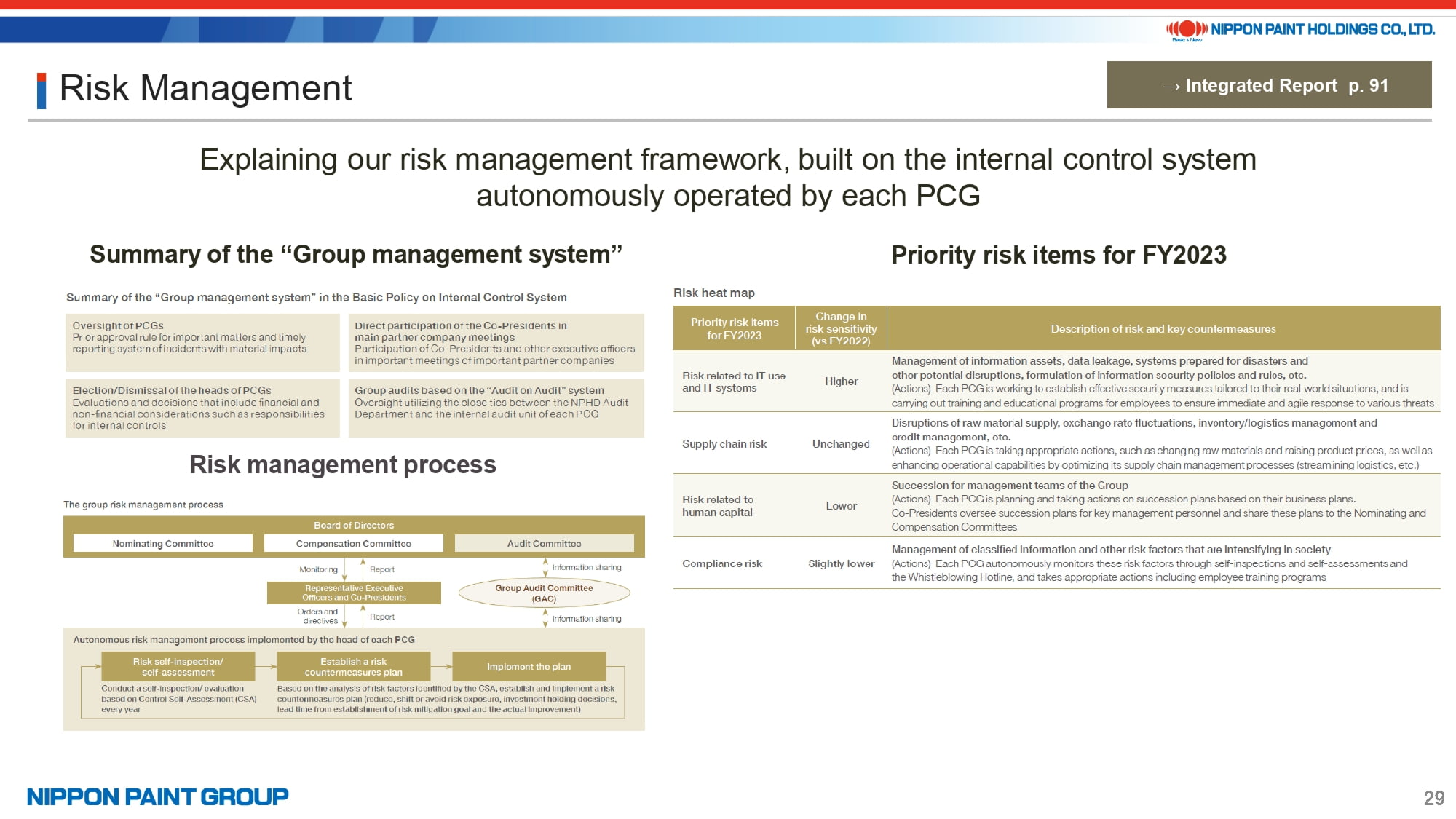

28. Risk Management

Next, I will discuss risk management within the context of our Asset Assembler model.

Our company implements risk management through an internal control system that is autonomously operated by each Partner Company Group. In this section, we not only explain the key components and overall risk management process but also offer insights into the priority risk items identified in our annual risk heat map. This includes an analysis of shifts in risk sensitivity and the key countermeasures we have put in place to address these evolving risks.

This concludes my presentation. I would now like to open the floor for the Q&A session.

As we prepare for the 2025 edition, we are eager to integrate candid insights, especially from investors and buy-side analysts, into our planning and production process. Your valuable feedback and suggestions are greatly appreciated.

Thank you for your attention.