1. Introduction

Good afternoon. You have just heard from Patrick Houlihan and Gladys Goh on Branding of 2 Partner Company Groups (PCGs)– DuluxGroup and NIPSEA Group.

Allow me to use the next 20 plus mins on NIPSEA Group – one of 4 PCGs in the Nippon Paint Group.

2. NIPSEA Group – One of 4 key Partner Company Groups

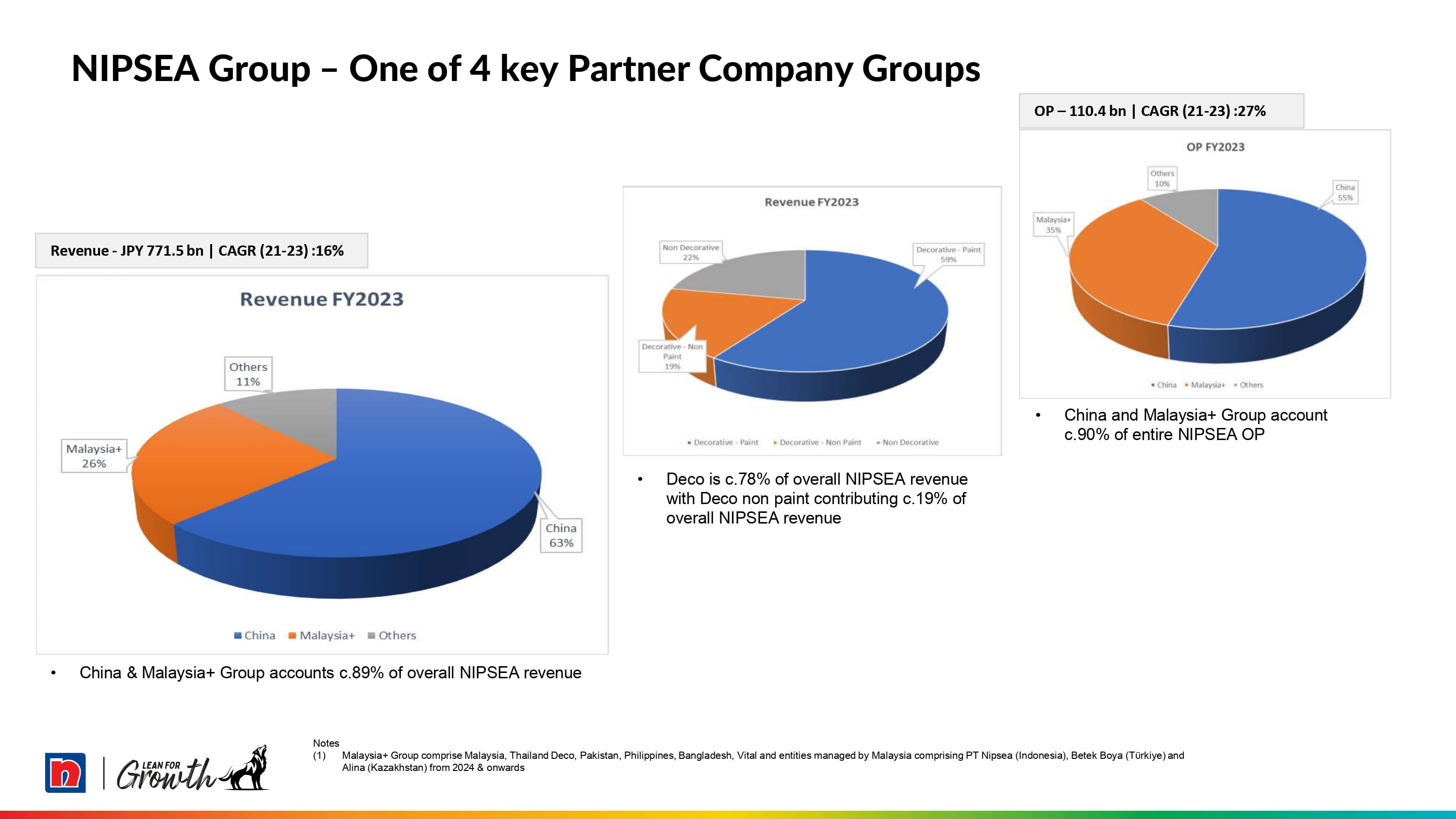

To set the context, Who is NIPSEA? The companies in NIPSEA Group operate in 28 countries and regions with 29,000 colleagues. The 28 countries are organized within NIPSEA Group in operating business groups. The 2 biggest operating business groups are China (63%) and Malaysia+ Group (26%) – comprising 89% of NIPSEA Group’s 2023 revenue of 771 billion yen.

By Product segments: Decorative is 78% (59% decorative paints and 19% decorative non-paint). The non-paint part is key, as they allow us to provide a more complete offerings to our customers.

At the operating profit level, China is 55% and Malaysia+ Group 35%; both totaling 90% of NIPSEA Group’s operating profit.

With China and Malaysia+ Group at approx. 90% of revenue and operating profit; and Decorative at 78% of revenue, in this presentation, I will focus on China, Malaysia+ Group and Decorative Segment.

3. 2021 to 2023 –Resilience amid uncertain times

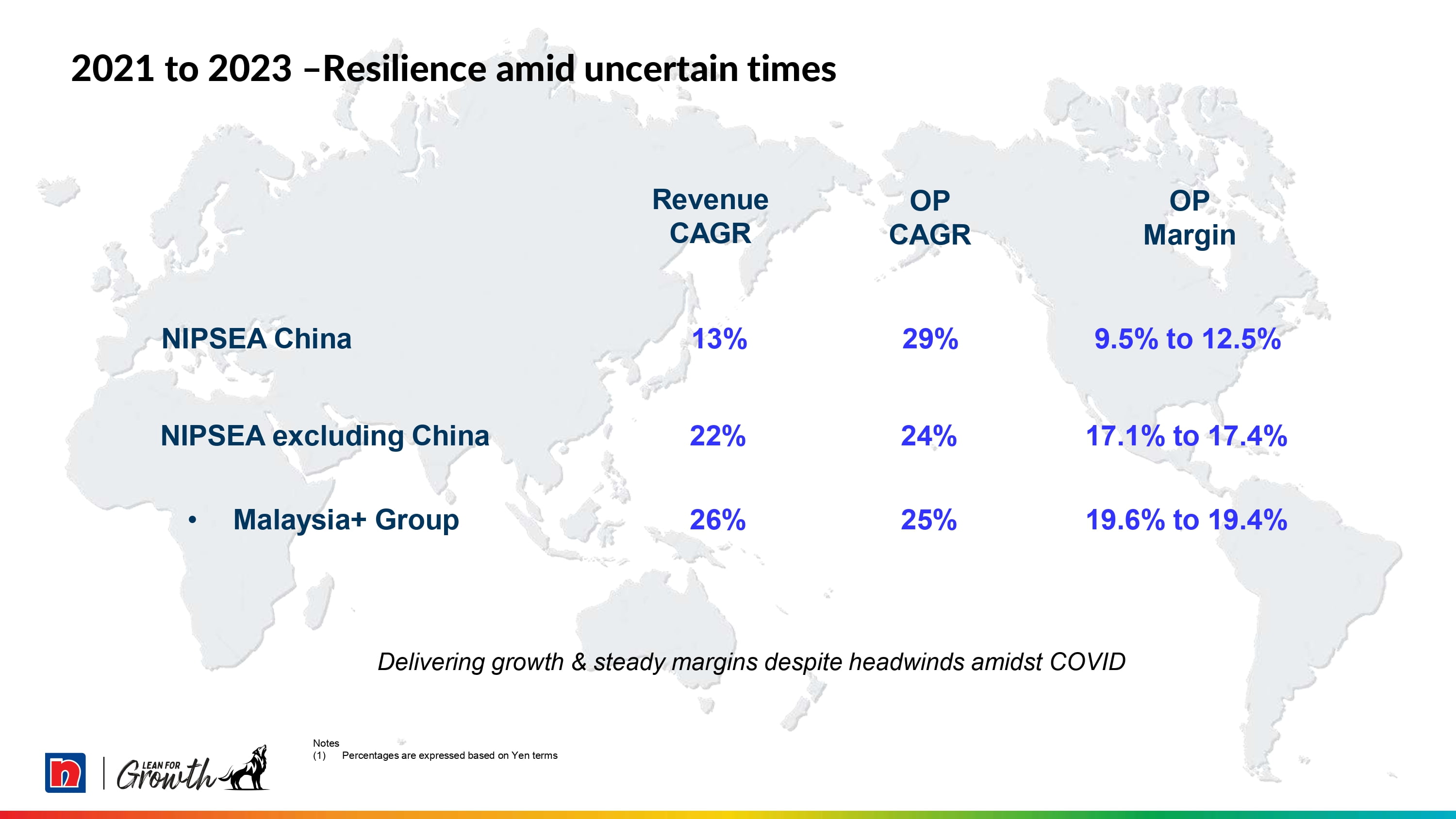

In the last 3 years, COVID and also China’s Zero-COVID policy; supply chain disruptions; inflation and hyperinflation; wars all reared their ugly heads.

In spite of these challenges and uncertainties, NIPSEA China and Malaysia+ Group remained fairly resilient: both growing revenue, operating profit and increasing margins.

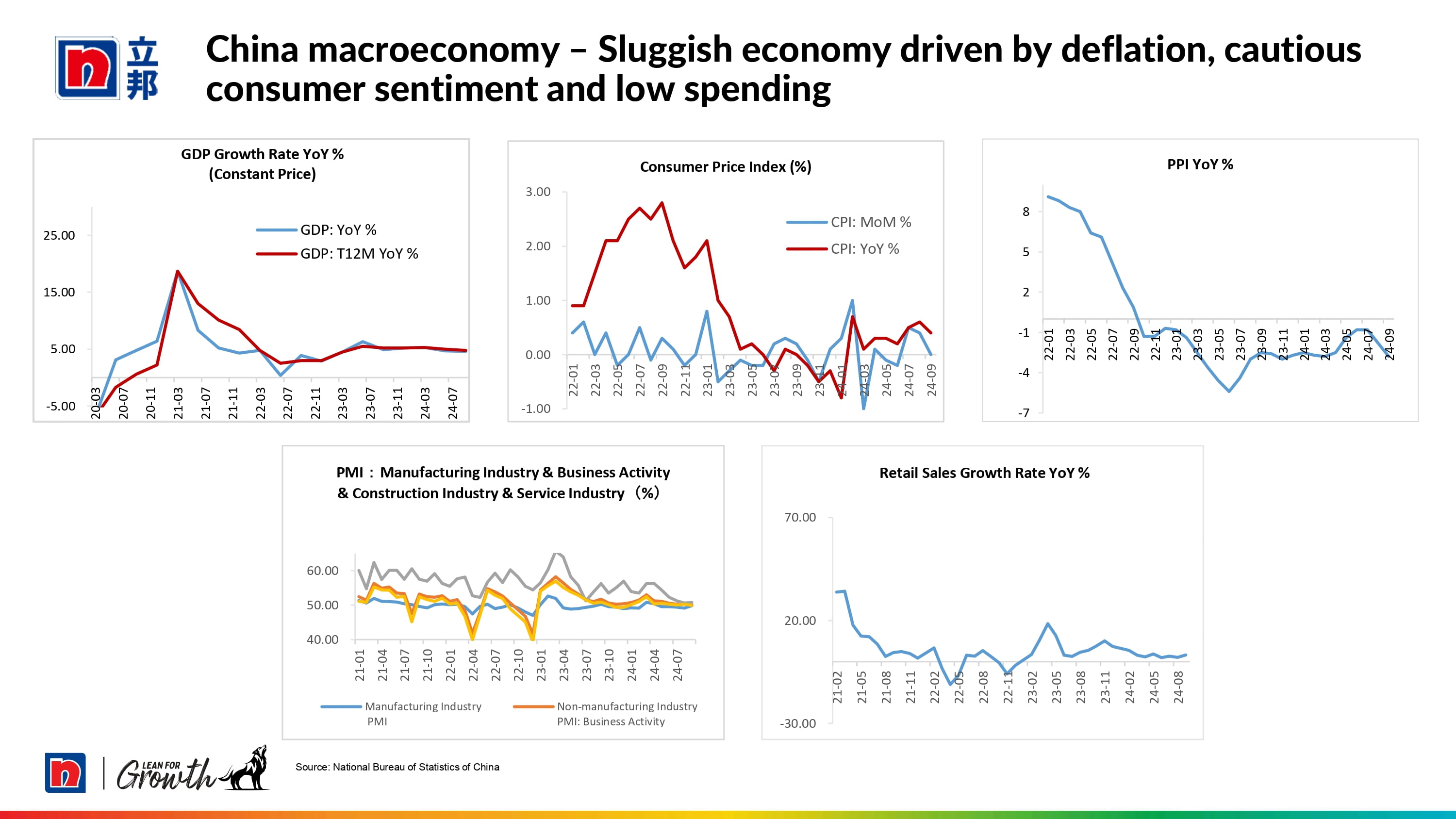

4. NIPSEA China / China macroeconomy – Sluggish economy driven by deflation, cautious consumer sentiment and low spending

China is a sluggish economy afflicted by disinflation, poor consumer sentiments, low spending and buffeted by trade/technological decoupling.

These 5 charts paint an economy that has muddled along, seemingly still unable to tip back into vibrancy.

5. Residential market & building materials segment is soft

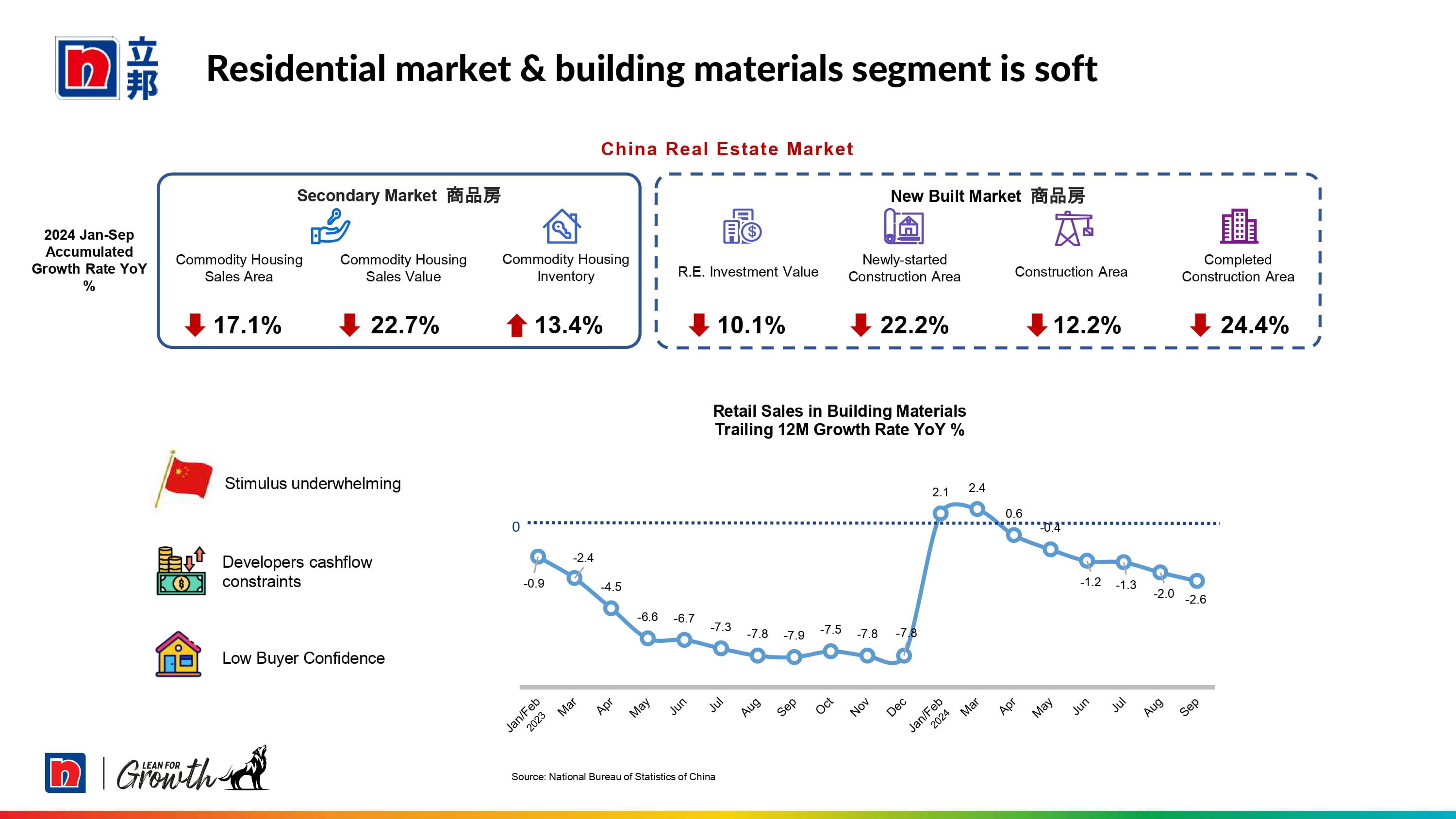

Besides consumer sentiment, residential/new building sales is a key driver of market growth.

Commodity housing sales (used as a proxy for residential housing) in both the secondary and new build markets continue to decline in 2024.

Since the Three Red Lines led a year later to the collapse of a major real estate developer, the property sector in China has been in a tailspin.

Underwhelming stimuli; developer cash flow tightness; low property buyer confidence contributed to falling building material sales.

6. Paint market facing challenges. Where are the opportunities?

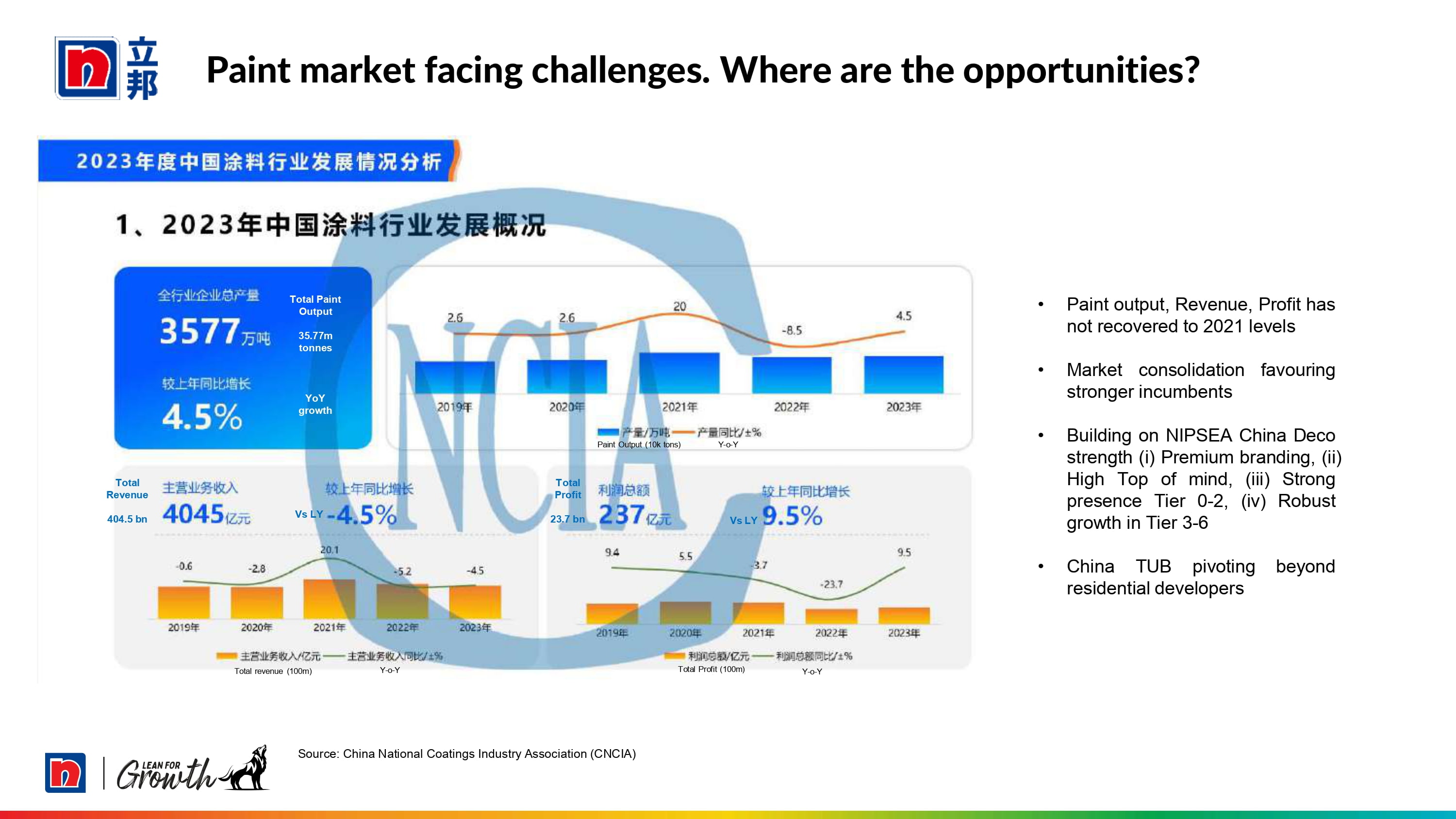

Paint industry revenue and profits in China have been volatile; and have hardly moved from 2019 levels.

All of you look at China with different data sets. But the broad consensus is quite clear - both the Chinese economy and paint market are quite bad. My colleagues on the ground are taking this dismal situation in our stride. But we see opportunities.

You will wonder if we are out of our minds. Let me deal with the “WHY” we see a glass half full, as opposed to half empty? Where we see opportunities. And HOW? Which is what we have to do to persevere and thrive.

We see market consolidation favoring incumbents. Difficult operating conditions are making it difficult for many smaller paint and coating companies to continue business as usual. Although there are some 42,700 paint and related companies on the China Paint Association register, close to half of them in some state of dormancy.

And we hope to capitalize by:

- Building on NIPSEA China strength (i) premium branding, and (ii) driving high Top of Mind and (iii) with our strong presence across Tier 0 and 1-2 cities (iv) springboard into the erstwhile “local” markets in Tier 3-6 cities;

while

- China TUB pivots beyond residential developers (which had previously been the singular focus) into other targeted segments like factories, schools, hospitals and public buildings.

From now on, there will be less financial numbers. More on views, thoughts, approaches and actions.

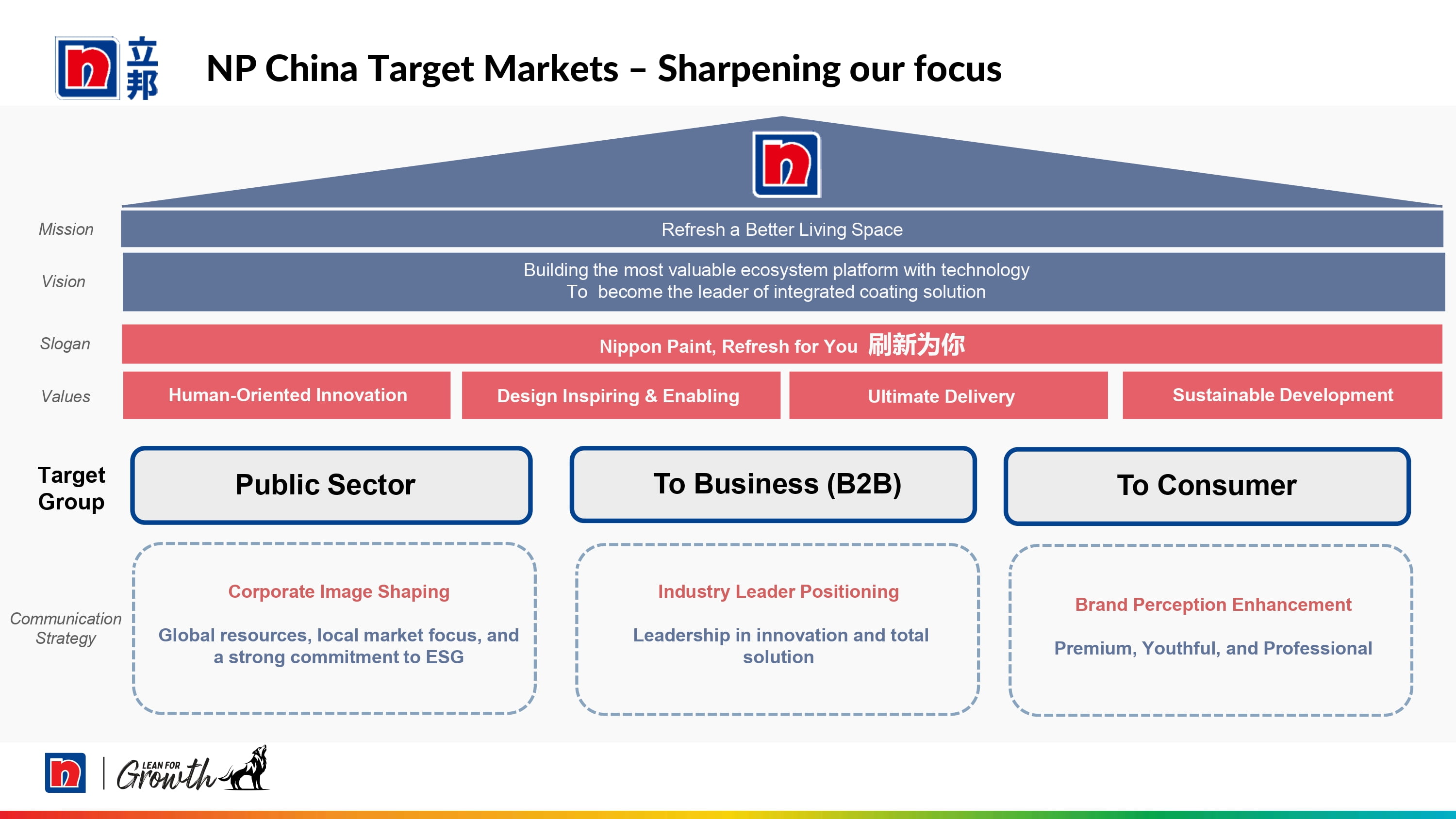

7. NP China Target Markets – Sharpening our focus

Using the next 9 charts and 2 short videos, I hope to share with you what keeps my colleagues in Nippon Paint China busy, motivated and positive.

For a start, the changing landscape and developing opportunities sharpened the arena we wanted to play:

Let me dive into each of them.

8. Public Sector - Public infrastructure opportunities for future growth, supplemented by strong commitment to ESG

To the Public Sector, we are organized to reach out with a narrative pulling together our extensive portfolio backed by decades long commitment to ESG and sustainability agenda in China itself.

This culminated in our recent participation at the CIIE (China International Import Expo) in Shanghai last month. I was there. As we hosted delegations of provincial and city officials, I saw for myself the wow effect when they realized that Nippon Paint China was more than an interior/exterior wall paint company. We took this opportunity to do the global launch of products that showcased the extensive portfolio we could stitch together to meet China’s needs with our global capabilities. These are:

- Photocatalytic paint. Painted on the exterior wall of a 6-story apartment block in Shanghai will remove exhaust pollutants equivalent to the annual emissions of 10 cars. For cities in China, it is an exciting option in their urban renewal and air purification drive. An additional appeal is the technology behind this product was developed through an innovation platform co-founded by Nippon Paint, East China University of Science and Technology, and East China Normal University;

- Green auto coating products that reduces energy inputs thereby reducing footprint. You may be aware that the painting workshop is the most energy-consuming part of automobile production, accounting for approximately 70% of the total energy consumption in automotive manufacturing, reducing 1.5m tons of carbon emission based on 2023 total car production volume in China;

- Street makings that are visible in poor ambient conditions that are better noticeable by the human eye and Lidar detectors a 100 meters sooner than current applications. Additionally, this product is environmentally friendly and wear resistant. Compared to traditional water-based road marking paints, the service life of product can be increased by 3 to 4 times under the same amount of usage. Additionally, the product has the characteristic of fast drying, capable of drying in just 15 minutes, reducing the road occupation time during construction.

This year we are already working on 100 plus projects. Having gotten the attention of these provincial and city leaders and administrators, we have to work hard to convert the discussions into real revenue flow.

9. To Business – Pivoting, driving strategy shift, positioning for sustainable growth

Through participating in dedicated industrial exhibitions and fora, our pivot beyond residential properties are getting the awareness of the intended customers. Beyond the traditional large national developers, we now engage with a wider customer base of regional players and local contractors; offering targeted solutions from old house renovation; old districts refurbishment; hospitals, schools uplifts. Dedicated teams are reaching out to business partners in industrial parks and factories, precision manufacturing and food processing – meeting specific needs with our tailored solutions; opening up a new large addressable market.

Take for example, at the CIIE, we showcased four urban renewal micro-scenarios that we had pitched to city authorities and property owners over the past 2 years: historical building restoration, public building renovation, industrial building transformation, and old neighborhood refurbishment, including classic coating solutions for urban revitalization settings, such as the “Restoration as Original” coating solution and the “Fast Facade Refresh” solution without tile removal.

Here, we come across as a solution provider who understands the pain points of our customers, and not just a paint purveyor. These solutions excel in shortening renovation timelines, reducing resource waste, enhancing green energy-saving measures, and improving overall living comfort. For instance, our rapid hallway renovation solution reduces the project time to just 6 hours, saving over six days compared to traditional methods.

And we do not forget the application teams – which is an indispensable piece of our service delivery. In Nippon Paint’s network of schools, we train painters for the specialized applications – and we are recognized as the first Government certified foreign private enterprise to award such certificates.

10. To Consumer – Colour strategy & Textured products “Magic Paint” key, strengthening our position as market leader

Two years ago at this IR briefing, I rolled out the color and texture strategy to gain dominance in the consumer market. As the market leader, by doing so we hope to stimulate demand and buying interest by engaging the consumer, increasing their access to colors through our growing footprint of CCM (computer color matching) machines and also to ensure we achieve customer satisfaction by training an army of applicators. With textures, this is even more critical – as texture coating is more skill demanding than basic brush and roller applications.

11. To Consumer – Colour strategy: Annual Colour Trend Launch Campaign - Retaining long term & attracting potential consumers

Here, the video does the talking.

12. Textured “Magic Paint”, engaging the young and high-end consumers / Brand leadership – Clear Top of Mind leader

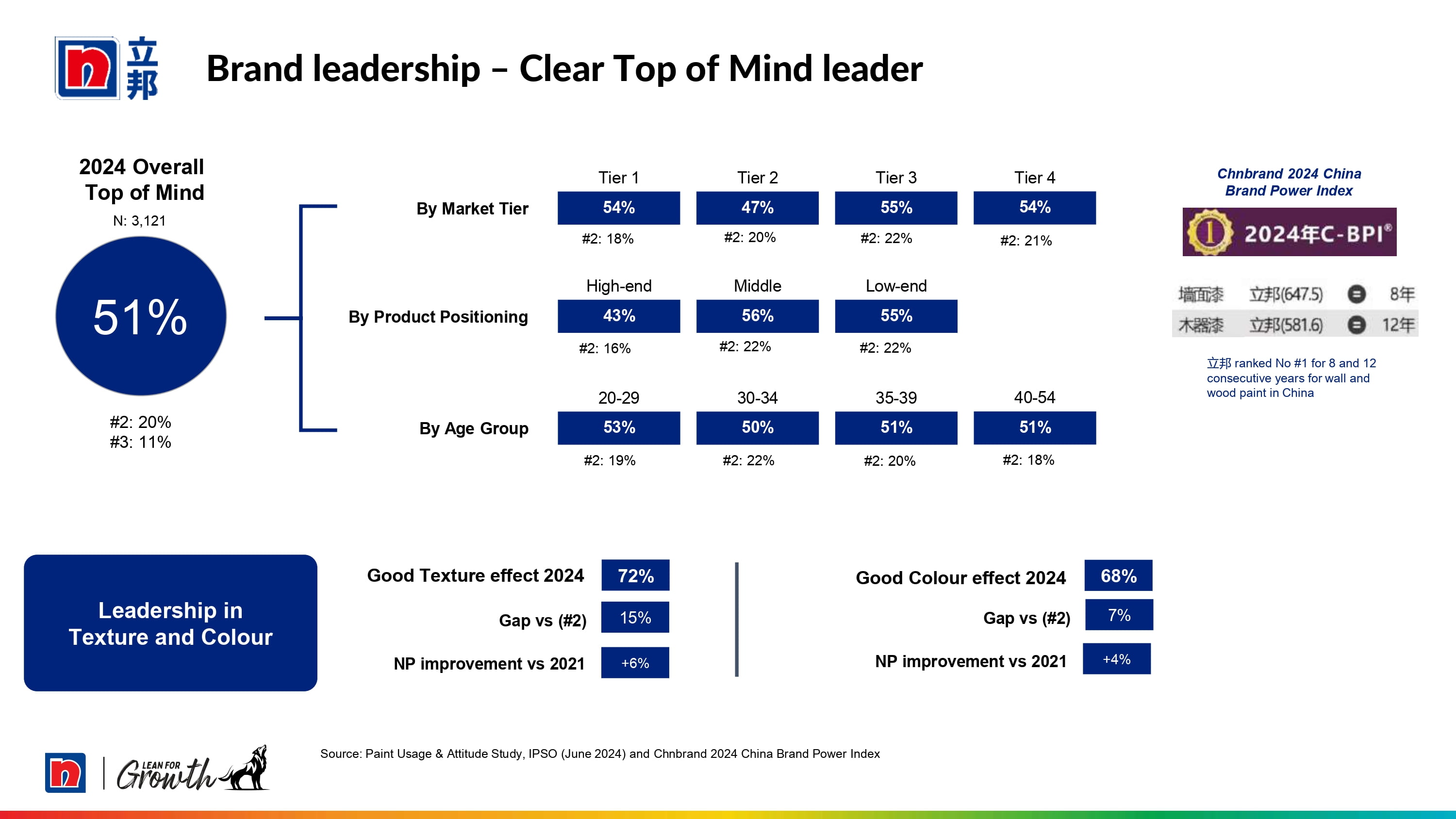

For the past 2 years – Top of Mind (TOM) is 51% across age groups, city tiers and price segments. And we specifically test our progress in texture; 68% and 72% TOM respectively. Being the clear TOM leader, when the consumer sentiment returns; and renovations pick up, we believe we are well positioned to ride the wave.

13. NIPSEA China Distribution

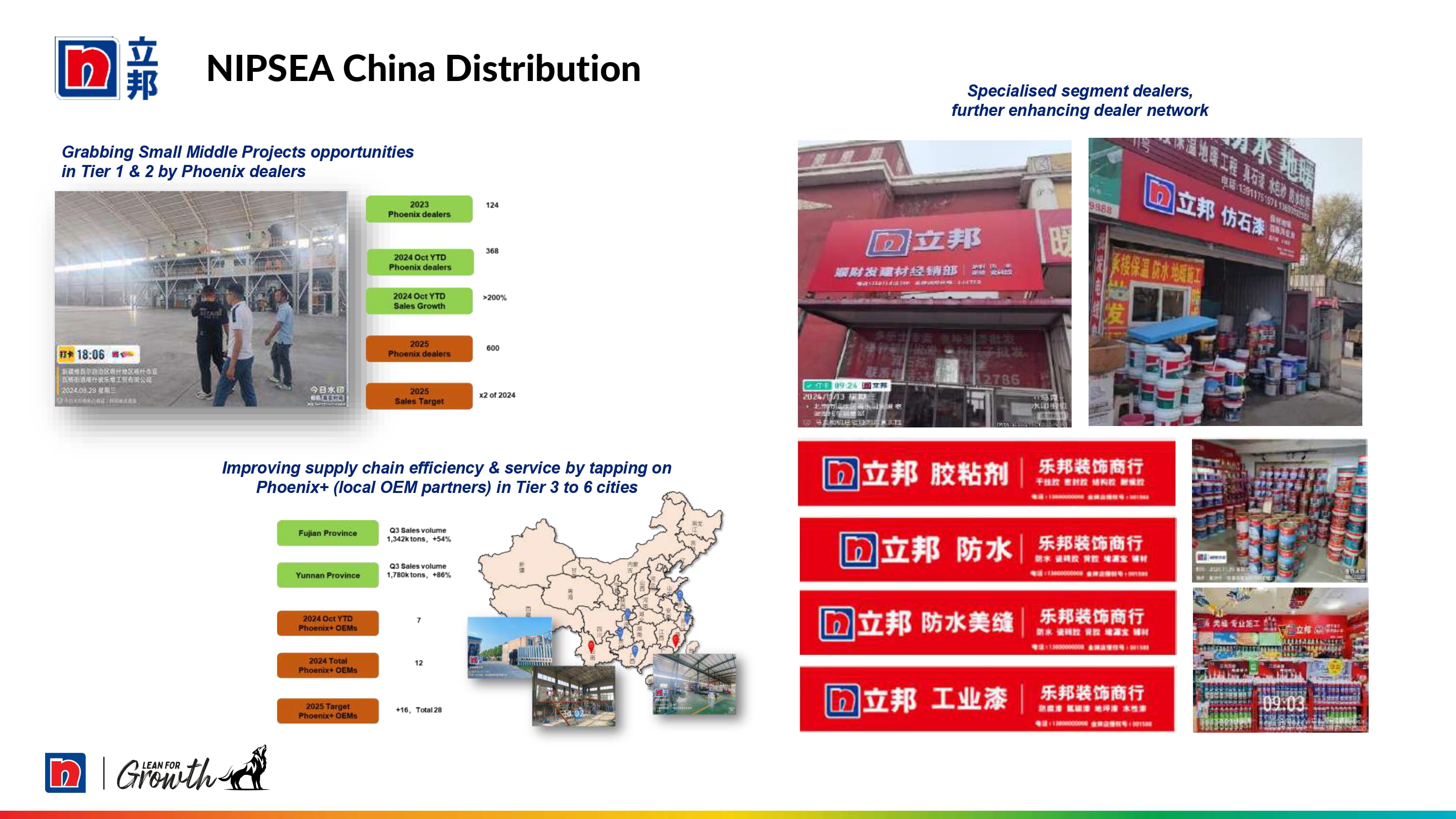

We continue to innovate to ensure that we are backed by strong distribution. A new group of Phoenix partners in the top tier cities enhance our access to small and mid-sized property projects; and new Phoenix partners in the Tier 3-6 cities also amp up our supply efficiency. Here, the market consolidation fuels the induction of new partners, who otherwise were competitors.

With several years of developing adjacencies like tiling adhesive, water proofing products, we are rolling out specialized segment dealers, resulting in more aggressive customer end actions and of course, we hope, wider coverage.

14. Boosting product appeal across Tier 3 to Tier 6 cities with targeted product offerings and exterior textured paint

I mentioned that new Phoenix partners in the Tier 3-6 cities also amp up our supply efficiency. We also arm them with product offerings that are functionally and price wise appropriate for these markets.

15. NIPSEA Malaysia Group+ / Nippon Paint Malaysia Group+

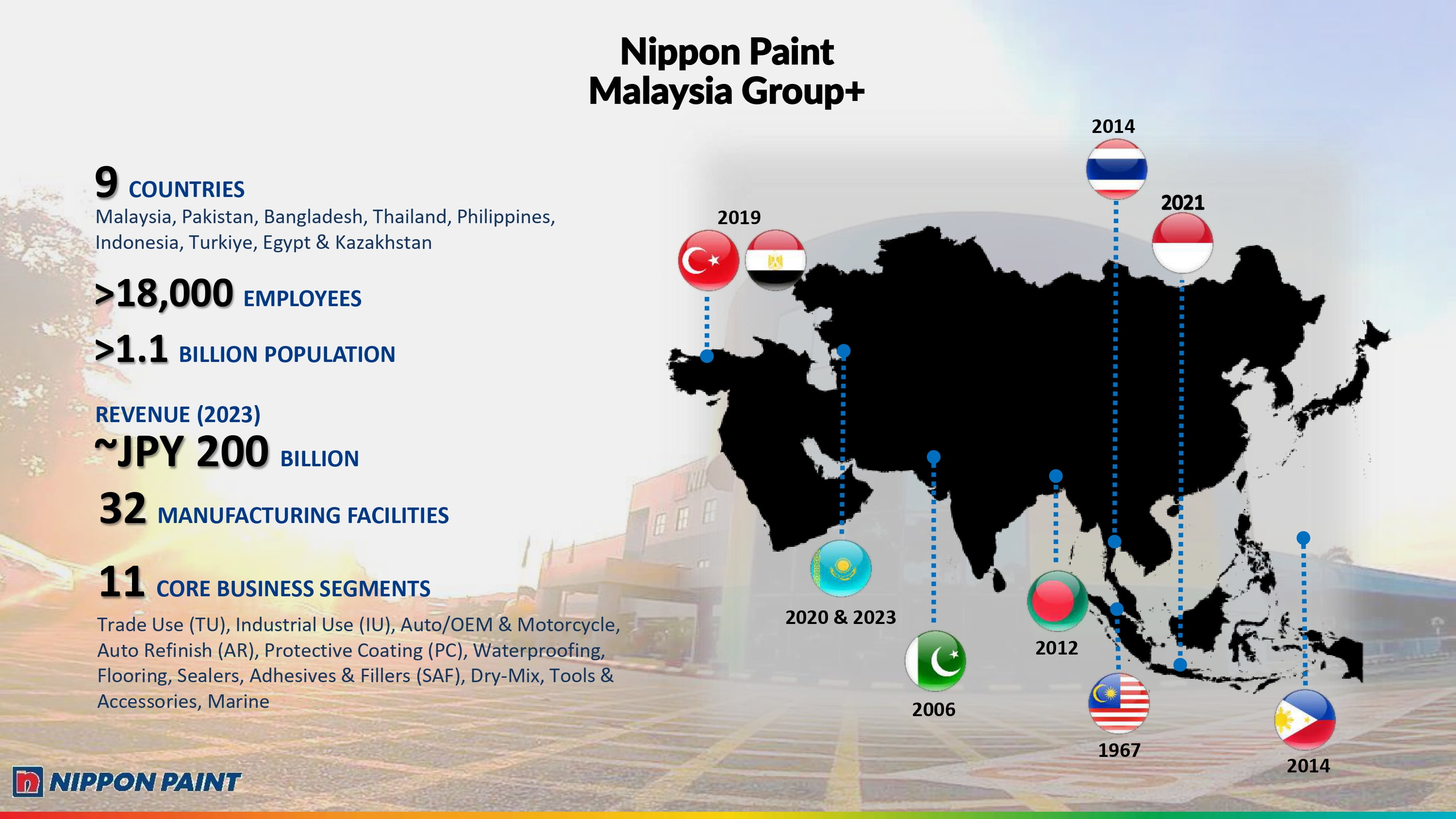

In the NIPSEA Group, the Malaysia+ Group is a substantial 200-billionyen piece operating in 9 countries and growing. Over the years, we stitch this Group together: Malaysia in 1967, followed by Pakistan, Bangladesh, Thailand, Philippines, Indonesia, Turkey, Egypt and Kazakhstan. Unlike our China Group, Malaysia+ Group is a lot more diverse in nationalities, cultures and business practices. However, it embodies the same essence of the NIPSEA Group in that it subscribes to independent, autonomous local units that is bound together by a common mission of MSV.

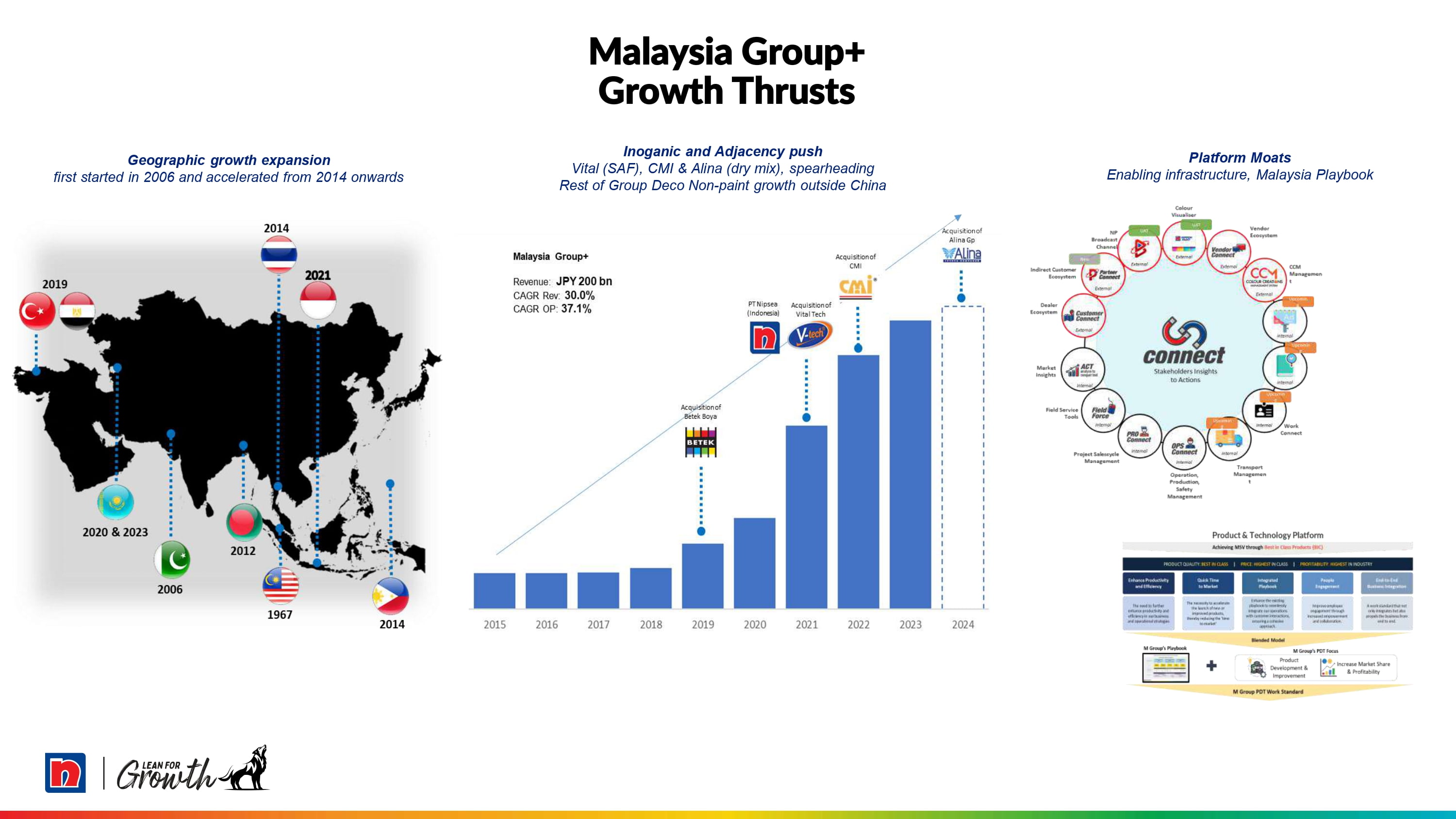

16. Malaysia Group+ Growth Thrusts

From the bar charts, Malaysia+ Group has grown by geographic expansions and also segment growth.

As is true for many entities in the NIPSEA Group, Malaysia+ Group participates in the paint and coatings across multiple segments: Decorative, Industrial including Automotive & Motorcycle, Auto Refinish (AR), Protective Coating (PC), Waterproofing, Flooring, Sealers, Adhesives & Fillers (SAF), Dry-Mix, Tools & Accessories and Marine. When it enters any new geographies, it penetrates with a leading segment and over time brings the entire spectrum of offerings.

Beyond the paints and coatings, with DuluxGroup’s Selleys Business Unit (and brand) and China’s lead – Malaysia+ Group is building the SAF and dry mix/putty adjacencies which complete its Total Coating & Construction Solutions (TCCS) business approach basing on Vital, CMI and another small bolt on before the end of this year. These additional Paint plus adjacencies added to the growth trajectory. Once Malaysia gets the approach right, the other units in the Malaysia+ Group adapts and also roll out.

Each entity takes and adapts, taking into consideration their peculiar market conditions. Whilst each entity is too small by itself to be able to forge into new segments – but collectively we thrive as we could take the core and adapt. This is the power of local managements coupled with Group investments – affordability, speed to market and of course, tempered with a large dose of flexibility.

The track record of growth and profitability underpins the confidence that we can replicate this play book. This disciplined approach to growth are supported by several platforms that had been built and enhanced over the years.

The units of the Malaysia+ Group are bound together by these platforms which collectively are the moats which defend our competitive positions.

Let me take the rest of the available time to briefly describe these platform moats:

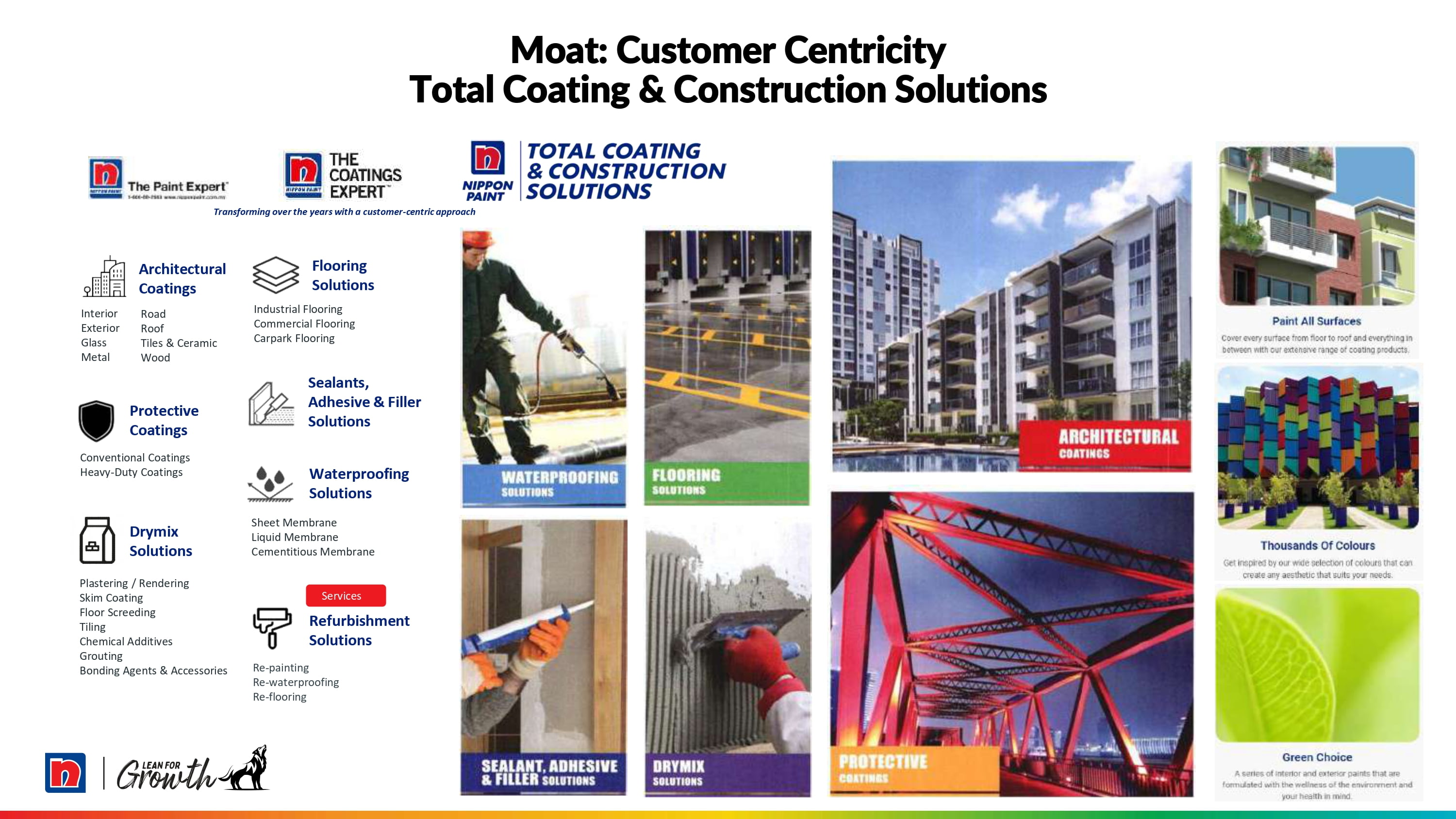

- Customer Centricity: Total Coating & Construction Solutions (TCCS)

- Technology & Products;

- Digital;

- Business

17. Moat: Customer Centricity Total Coating & Construction Solutions

Total Coating & Construction Solutions (TCCS) is one such platform moat. Piloted and painstaking developed in Malaysia over the years, TCCS aims to take away the hassle when it comes to decorative and surface protection from both consumers and business. In effect, Nippon Paint Malaysia are still known in many markets as the Paint Expert.

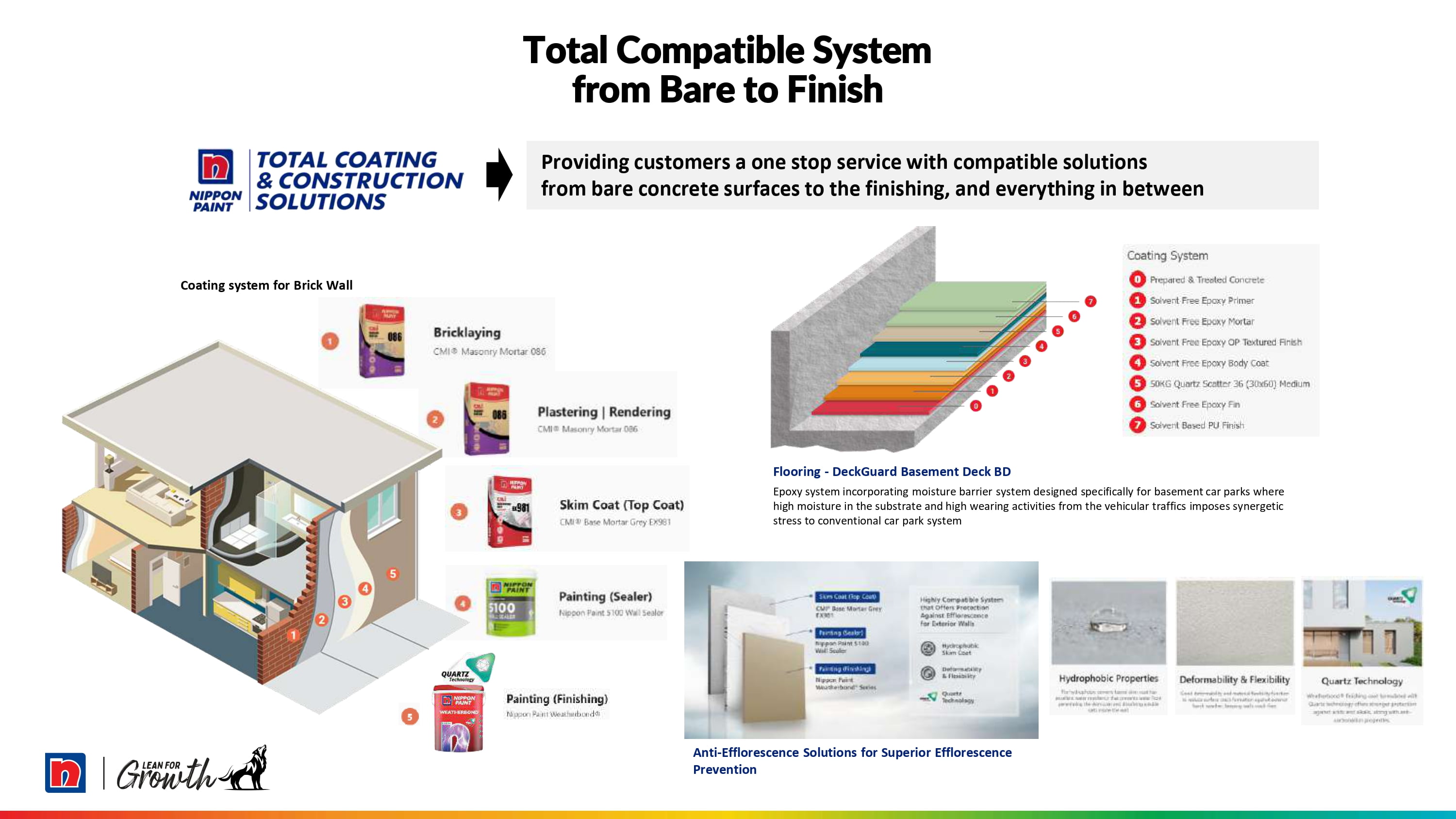

18. Total Compatible System from Bare to Finish

Providing our customers with a one stop service with compatible solutions from bare surfaces to the finishing for all insights and technical competence for compatible solutions from bare to finishing – architectural, protective, floor, wood, sealants, fillers & adhesives, dry mix, etc.

Whether renovations or new construction, we constantly engage the tradesmen, trade associations and designers to ensure having the pulse of the market; drive innovations and constantly catalyze early adoption.

Our Malaysia colleagues continually keep pulse with our Chinese colleagues who are also rapidly innovating in this space.

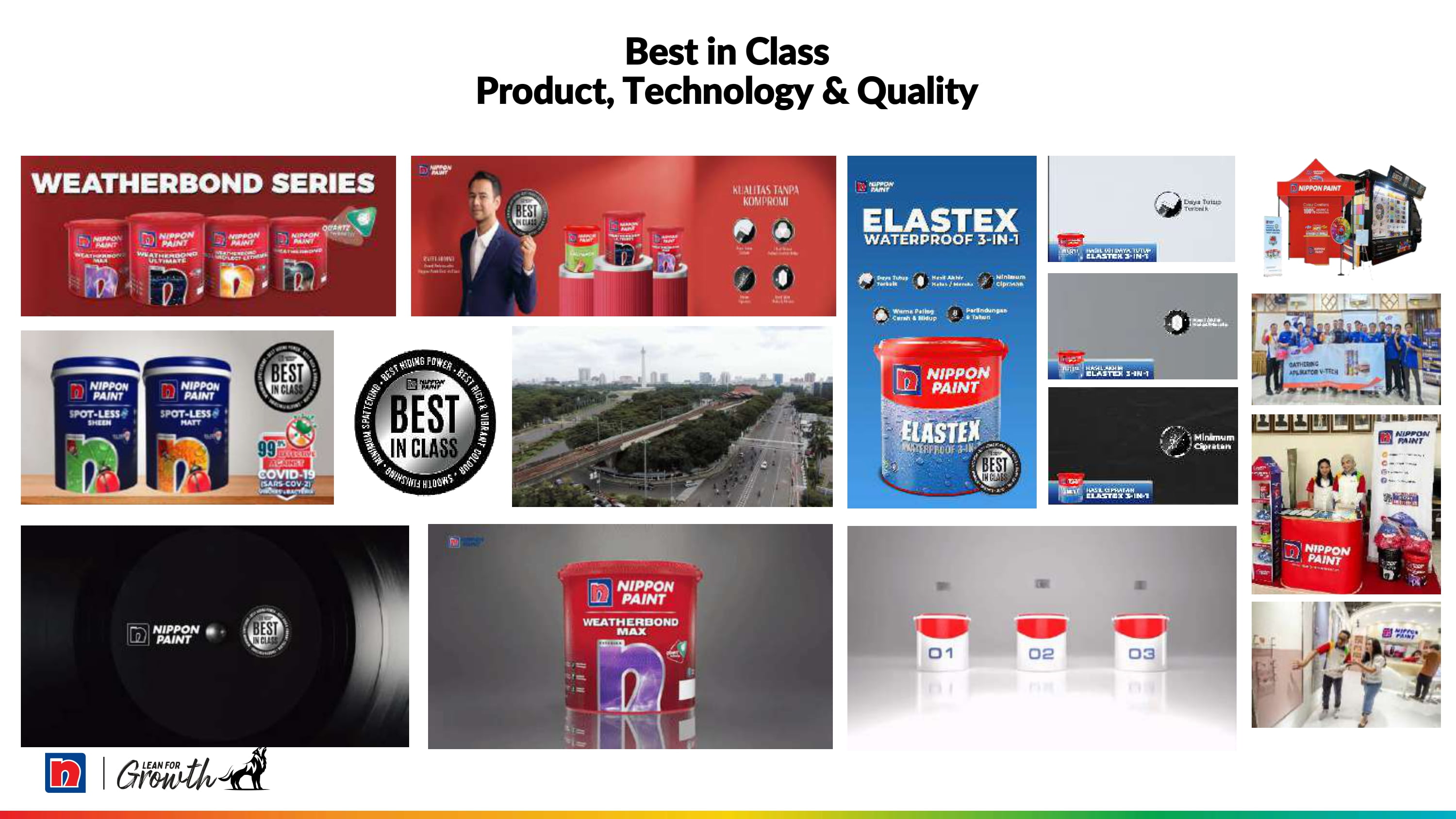

19. Best in Class Product, Technology & Quality

The Systems approach drive us to deliver products that are Best In Class – meeting the preferences of the market, which are continuously test marketed to ensure we keep up with competition.

20. Moat: Integrated Digital Platform

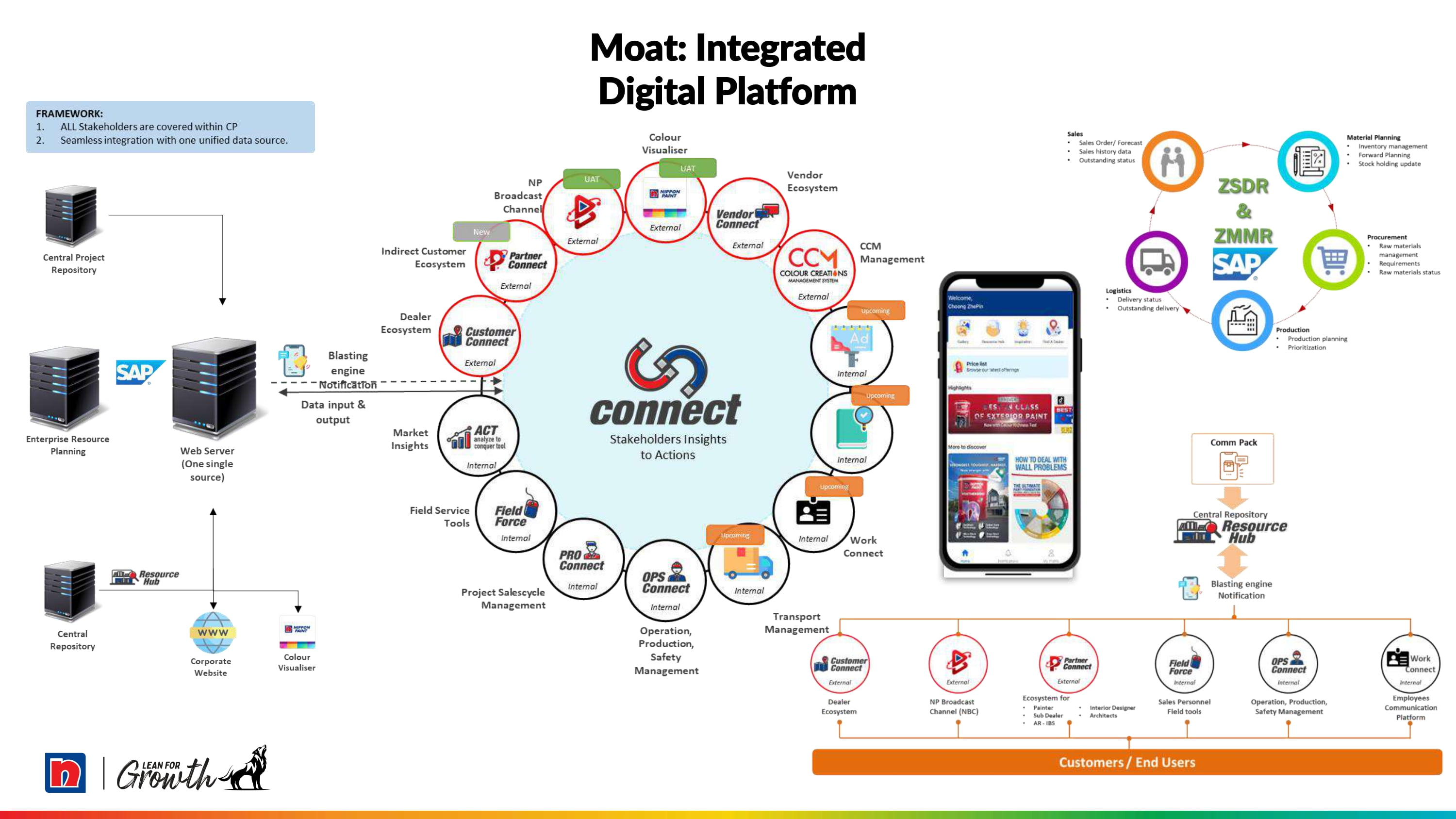

Another platform moat is the Integrated Digital Platform, which is conceived from the beginning with an architecture that allows additional functional capabilities to be bolted on as they are developed. Many of the market facing modules on customer, sales, market data are all deployed. Real time data are backend integrated into our operating system; be they procurement, production, logistics. As you see from “Connect” integrated digital platform – there are still modules that are being developed and progressively deployed across the Group. Connect is also available to customers as they benefit from TikTok and YouTube videos generated by the stakeholders in our eco system as well as from satisfied customers.

Besides being fully mobile enabled, it is beginning to take advantage of AI advances – for example, one key high productivity color matching AI tool will be launched early next year.

21. Moat: Processes & Systems

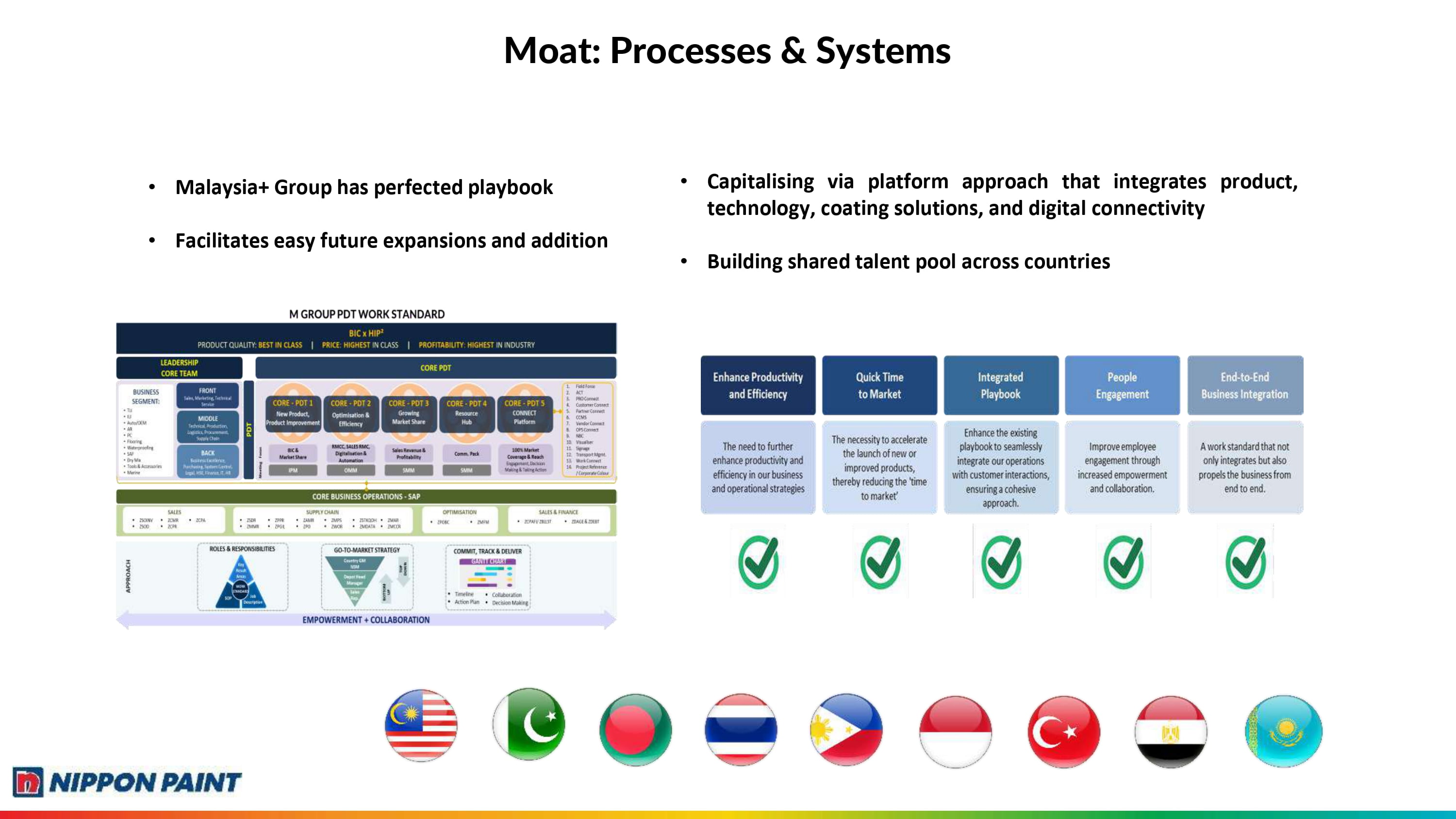

Malaysia+ Group has perfected a playbook

- Allows for growth with future bolt-on modules with relative ease

- And business units via the platform approach that integrates product, technology, coating solutions, and digital connectivity and local competitors as they combine local autonomy with the competences and offerings that the scale of a larger group can bring to bear.

Which proliferation and continual enhancement we want to assure by emphasizing talent development - nurturing a talent pool of executives from various countries that speaks a common language of business approach.

22. Summary

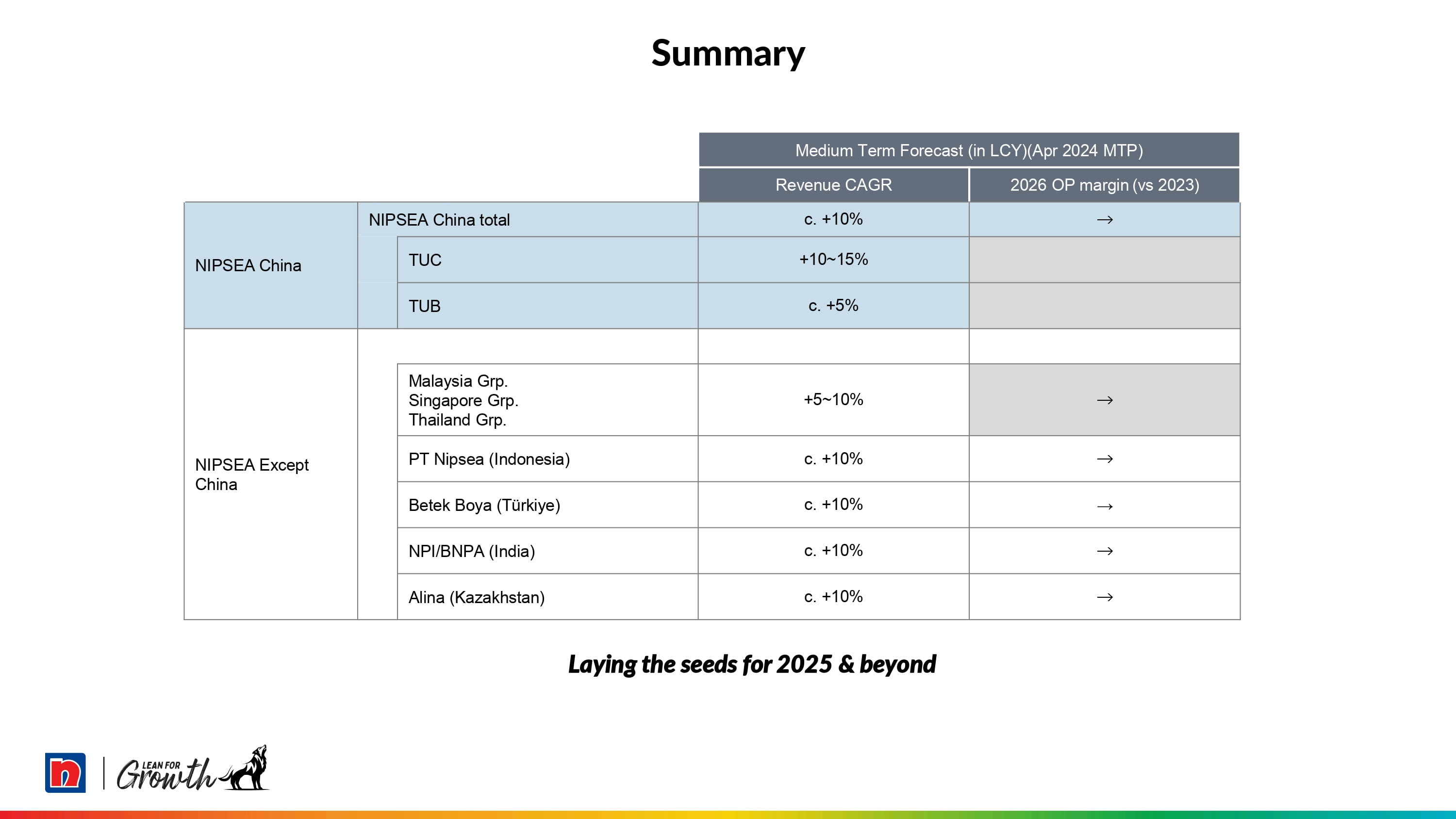

The journey is exciting and unfolding. We are making money along the way. And we believe that the Malaysia+ Group platform playbook has legs. Latest addition is Alina and by year-end another addition to its dry mix/putty portfolio.

Through the descriptions of China and Malaysia+ Groups, I hope you get a flavor of how we at the NIPSEA Group operationalize our mantra of allowing local autonomy while benefitting from the strength of being part of a larger Group. We take the world as a given and the past 20 mins, you get a glimpse of how we can adapt and thrive.

2024 has been tough going. We continue to lay the seeds for 2025 and beyond.

Thank you.