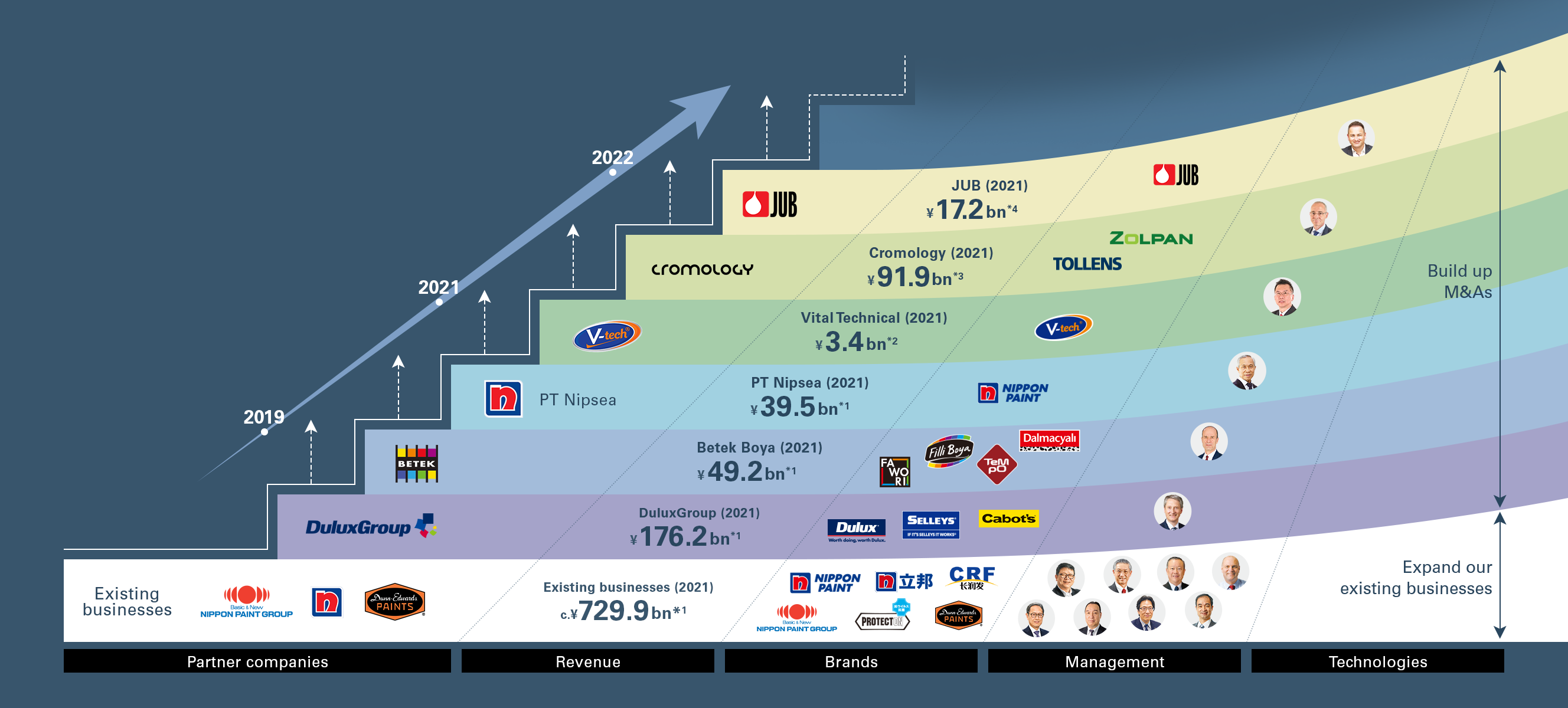

Using Asset Assembler model, we will accelrate growth through the existing businesses and M&A

In order to achieve our mission of Maximization of Shareholder Value (MSV), we have adopted a business model to achieve strong growth with limited risk by raising emphasis on the autonomy and accountability at every partner company* and building up M&A deals in the attractive market of paint and adjacencies. We decided to call it Asset Assembler model.

* Consolidated subsidiaries of Nippon Paint Holdings

Our medium- and long-term growth model as an Asset Assembler

Accelerating growth with limited risk by assembling excellent talent and brands through M&A, building on organic growth

*1 On a segment basis (after elimination of intersegment transactions and after PPA)

*2 Vital Technical's revenue represents its nine months of revenue; Exchange rate: MYR 1=JPY 26.61

*3 Exchange rate: EUR 1=JPY 132.79; Pro forma figures

*4 Exchange rate: EUR 1=JPY 135.19

The key element of this model is that excellent management teams pursue autonomous growth in the Nippon Paint Group and exploit the technological strengths, distribution networks, purchasing capabilities, and financing capabilities of the Nippon Paint Group platform, rather than relying on initiatives of the headquarters. This will allow us to accumulate expertise in various areas and generate synergies as well as to attract new partners to the Nippon Paint Group.

By focusing on the paint and adjacencies markets, which are growth markets with the ability to generate sustainable earnings and cash, the Asset Assembler model allows us to accelerate growth with limited PMI (Post Merger Integration) risk involving M&A. Through the expansion of our existing businesses and aggressive M&A, we will build up assets with strong brands and excellent management teams, effectuating accelerated growth with limited risk.

-

-

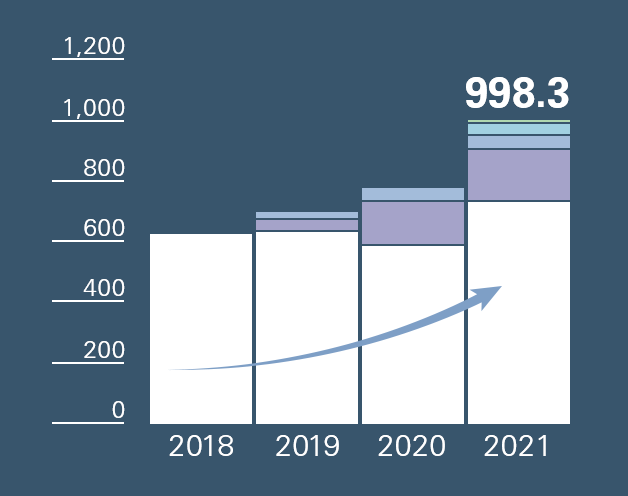

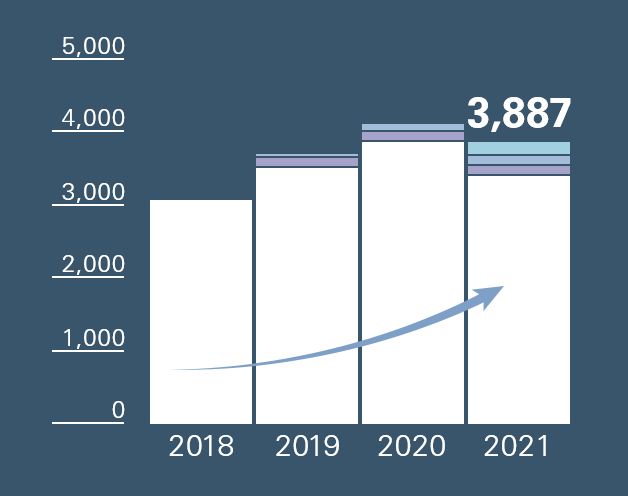

Revenue (Billion yen)

-

-

-

-

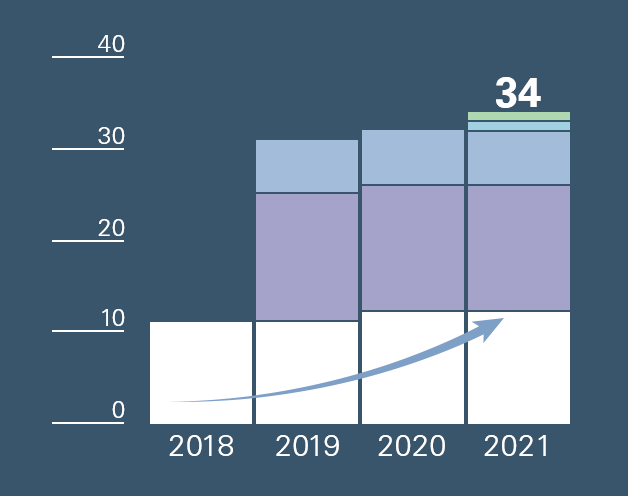

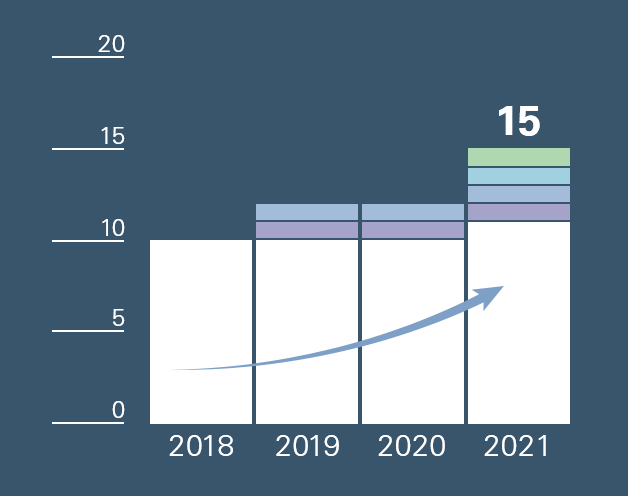

Number of key brands

-

-

-

-

Number of CEOs of key partner companies

-

-

-

-

Number of engineering talent

-

-

Key Assets (Partner Companies*)

* Consolidated subsidiaries of Nippon Paint Holdings

Dunn-Edwards

DuluxGroup

Betek Boya

Indonesia business

NIPSEA business

(Consolidated in 2014 and became a wholly-owned subsidiary in 2021)

Vital Technical

Cromology

JUB

Japan Group