1. Front Cover

Good afternoon, everyone. I’m Yuichiro Wakatsuki, Co-President of Nippon Paint Holdings.

Thank you for taking the time to join us today as we provide an update on our Medium-Term Strategy.

We’re also pleased to welcome members of the press in attendance today.

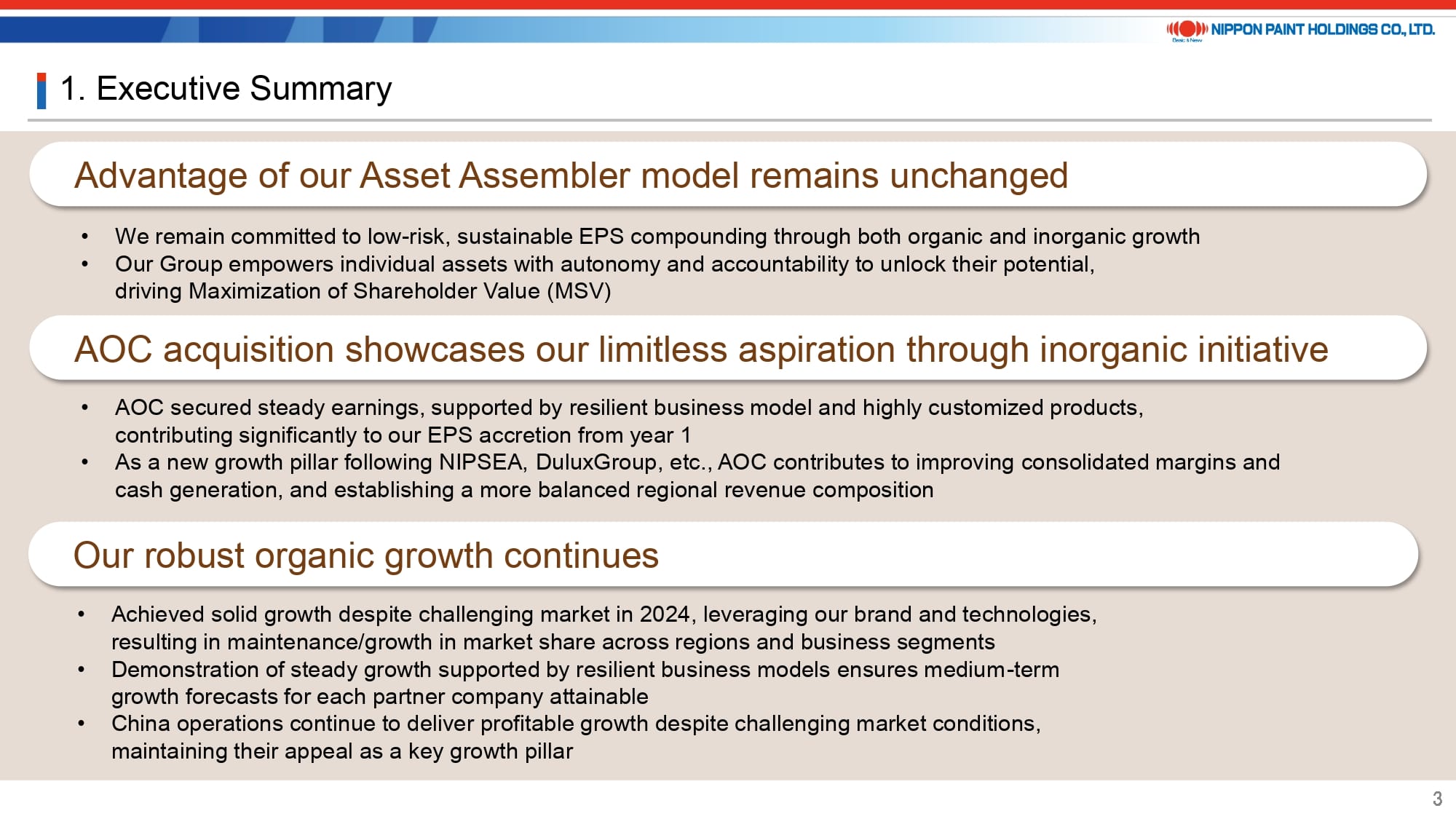

2. Executive Summary

Let me begin with today’s executive summary.

Our Medium-Term Strategy remains unchanged from the version we presented in April 2024. At the core of this strategy is our strong conviction that our greatest strength lies in the Asset Assembler model, which is firmly guided by our unwavering commitment to Maximization of Shareholder Value (MSV). While the Asset Assembler model may not appear dramatic, it is purposefully designed to compound low-risk, sustainable EPS by bringing together robust, high-quality businesses. We entrust these outstanding companies to their highly capable management teams, providing them with autonomy with accountability, a framework that enables each team to unlock the full potential of their respective assets.

At our briefing session in April 2024, I explained that our Asset Assembler model is driven by both organic and inorganic growth. I also emphasized that we aim to achieve unlimited EPS compounding through M&A, with no restrictions on region, business domain, or size of acquisition targets, as long as they are low-risk and offer good returns. Naturally, I am unable to disclose specific acquisition targets. However, we have received feedback from some investors that our M&A approach can be difficult to visualize. Following our announcement of the acquisition of AOC in October 2024 and successful closing of the transaction in March 2025. we’ve heard that this acquisition has significantly improved understanding of our strategy. Today, I would like to take this opportunity to provide further insight into our approach. As reflected in the upward revision to our financial guidance announced today, the acquisition of AOC is expected to deliver significant EPS accretion from the first year and is fully aligned with our strategy from multiple perspectives.

Let me also touch on the topic of synergy. I have consistently emphasized to investors that acquisitions driven solely by synergy expectations can carry the risk of overpaying for assets. It is therefore essential that acquisition targets are sufficiently profitable on a standalone basis. The acquisition of AOC is fully aligned with this principle, particularly in terms of valuation discipline. That said, this does not mean we will forgo synergy opportunities - on the contrary, we are committed to ambitiously pursuing them.

For example, our Group’s purchasing teams have already begun active collaboration with their counterparts at AOC. Just recently, I had a discussion with AOC’s CEO, and we reaffirmed our commitment to pursuing synergies relentlessly - wherever they may arise - whether within AOC or across the broader Nippon Paint Group. Moreover, the efficiency of AOC’s business systems has been a source of inspiration for many of our Partner Company management teams, who are now eagerly striving to learn from their expertise. One of our key strengths is that these initiatives are not led by headquarters, but are instead driven by each Partner Company, which independently identifies and adopts what is most relevant to their operations. If Partner Companies lack the necessary contact points, we at headquarters step in to facilitate connections and support collaboration. This approach not only reinforces our principle of autonomy with accountability, but also fosters motivation across our Partner Companies.

I covered much of our organic growth initiatives during the earnings conference call in February 2025. To reiterate, our businesses are fundamentally linked to economic growth in each country and region. In addition to macro growth drivers such as population increases and per capita GDP growth, our business model provides the potential for GDP-plus (GDP+α) growth through market share expansion. This is especially true in the decorative paint segment, where demand tends to be non-cyclical. Furthermore, as highlighted during our IR Day in December 2024, our Group’s strong brand portfolio is another key competitive advantage. Taking all of these factors into account, we remain confident in our ability to deliver sustainable growth, and accordingly, we have maintained our medium-term growth projections without change.

We’ve observed a recent dip in investor focus on our China business. However, it’s important to highlight that NIPSEA China has demonstrated robust resilience, consistently achieving profitable growth in a challenging market, and remains a key focus for growth.

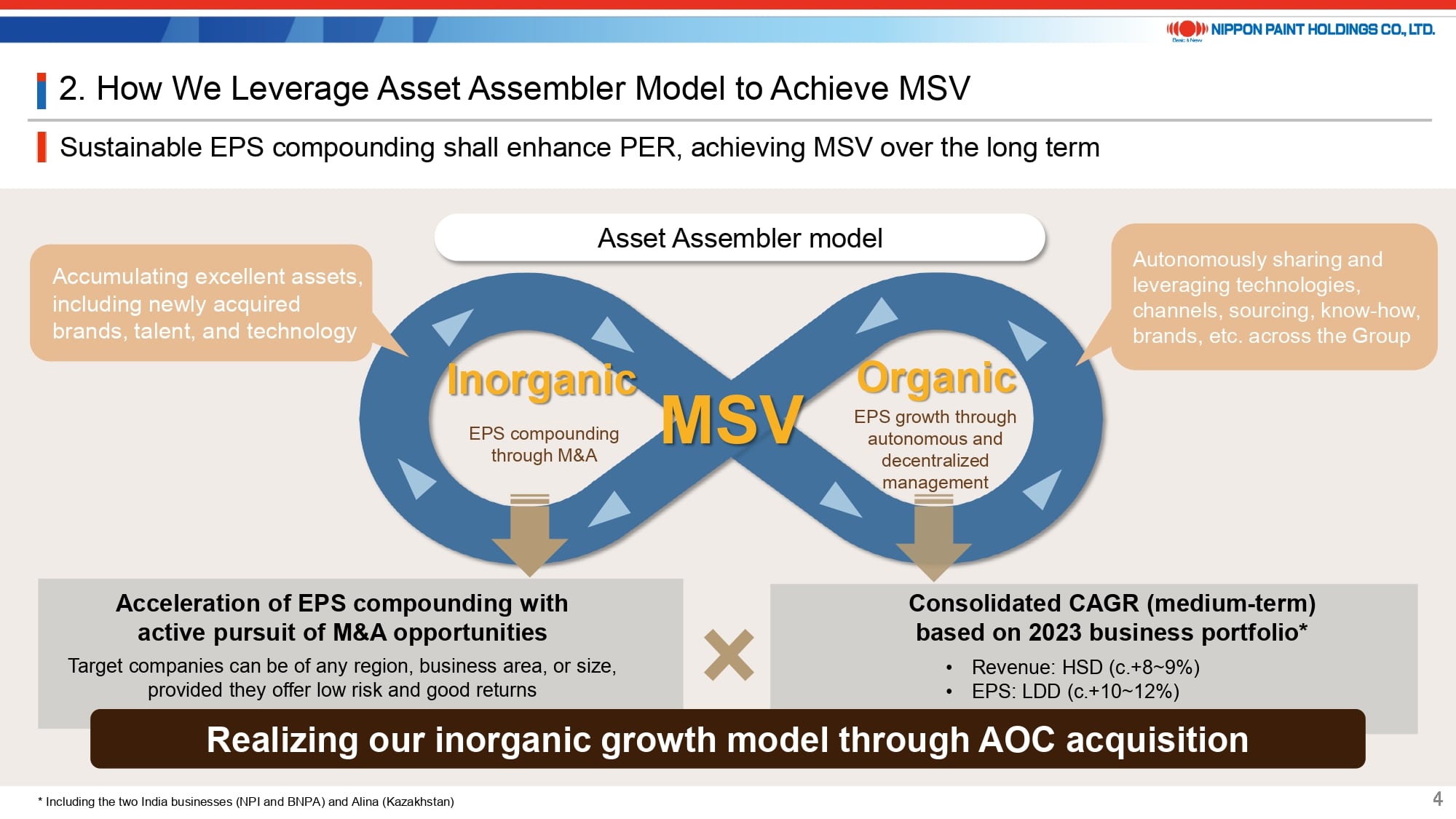

3. How We Leverage Asset Assembler Model to Achieve MSV

This section provides a detailed recap of our Asset Assembler model, expanding on the executive summary I just presented.

At its core, our model aims to achieve sustainable EPS compounding through a combination of organic and inorganic growth, which are fundamentally interconnected. In particular, assets acquired through M&A contribute to EPS growth after joining the Group by operating under our autonomous and decentralized management framework, while also fostering collaboration across the Group, including the pursuit of synergies. I believe the acquisition of AOC has helped investors visualize this model more concretely. That said, we fully recognize that delivering results and building a strong track record will be critical as we move forward.

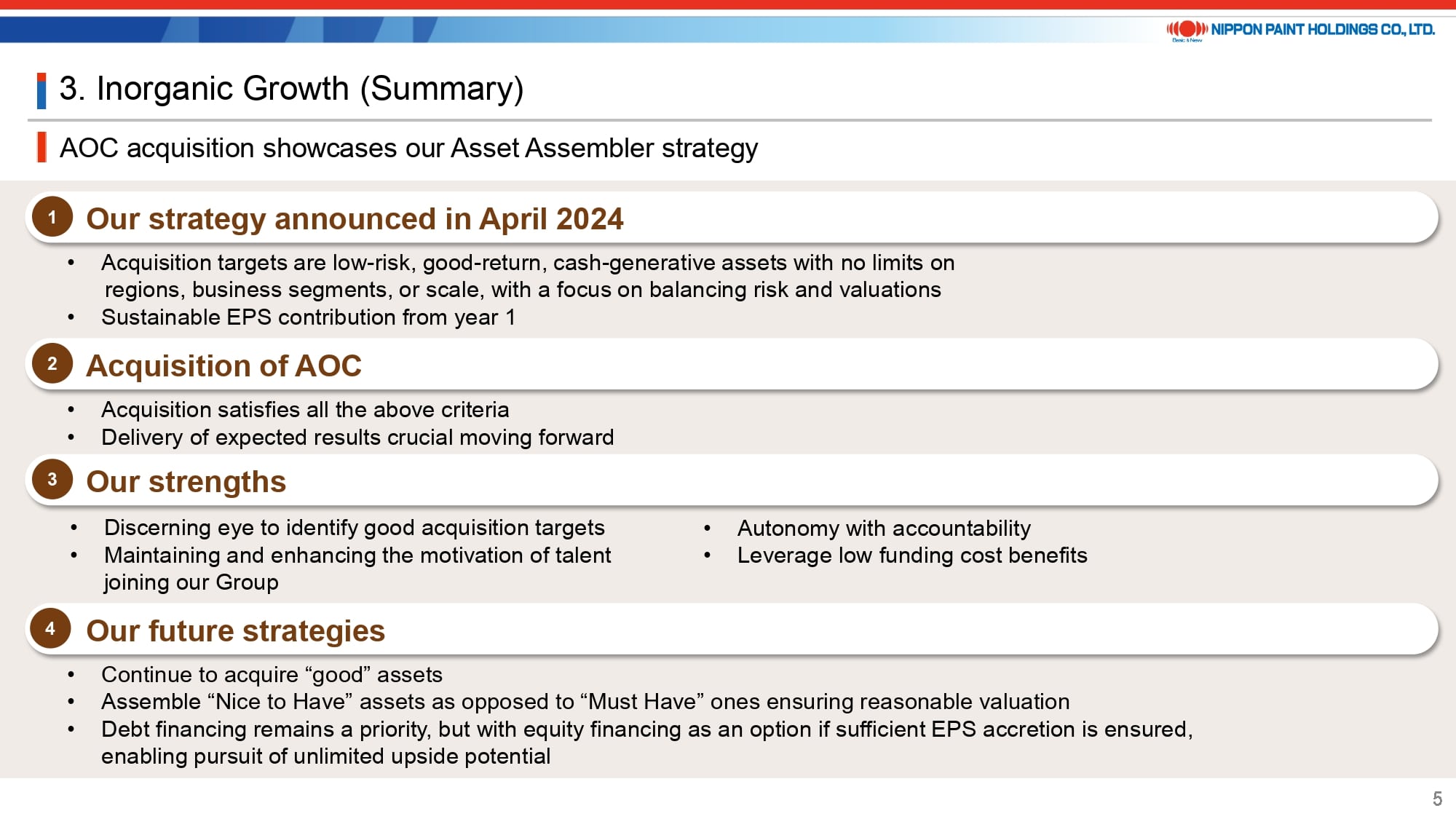

4. Inorganic Growth (Summary)

This slide provides a summary of our inorganic growth strategy, specifically our approach to M&A.

The acquisition of AOC is fully aligned with the Medium-Term Strategy announced in April 2024 and serves as a clear example of how we can effectively leverage our strengths in executing value-accretive M&A.

As I stated in October 2024 when we announced the acquisition, this transaction is not the end goal, but rather the beginning of our ongoing journey to assemble high-quality assets. We remain committed to pursuing the acquisition of low-risk, good-return businesses without long intervals between transactions. A key strength of our portfolio is that virtually all Partner Companies are capable of growing autonomously and generating cash independently. As a result, there are no parts of our Group that depend on acquisitions to sustain their operations, we have no “Must Have” deals. This strategic flexibility allows us to make disciplined, financially sound decisions: we proceed with acquisitions when the financials are attractive, and we are fully prepared to walk away when they are not. This approach helps us avoid the risk of overpaying.

In terms of funding capacity, which I will elaborate on shortly, we have continued to maintain strong cash generation even after completing the AOC acquisition. This ensures we have ample headroom for additional debt financing if needed. That said, we also view equity financing as a viable option when an acquisition is expected to deliver meaningful EPS expansion. In essence, our Asset Assembler platform offers virtually unlimited growth potential, and when combined with our access to low-cost capital, it represents one of our key strategic advantages.

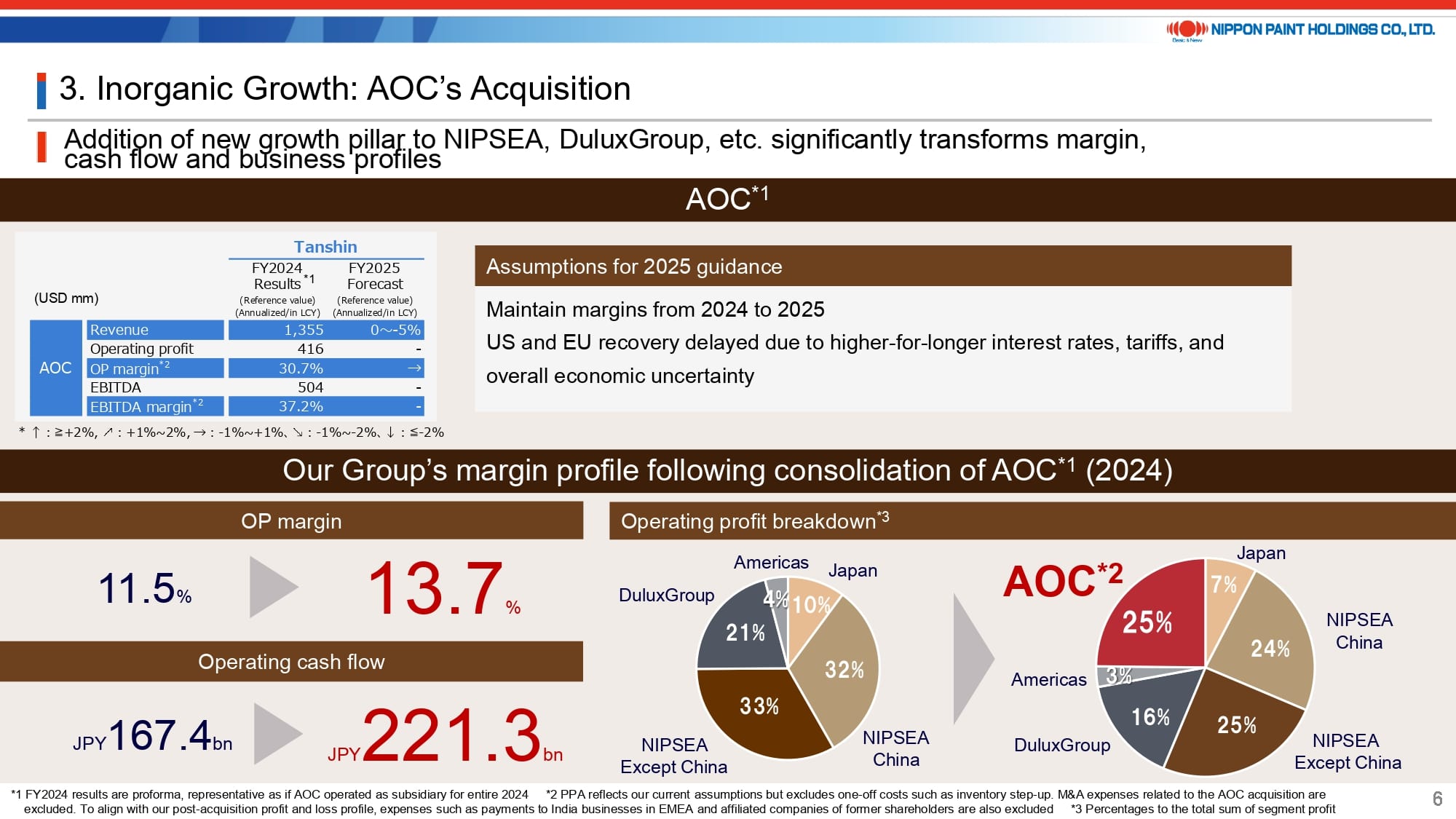

5. Inorganic Growth: AOC’s Acquisition

The addition of AOC as a new growth pillar in our portfolio has significantly enhanced our consolidated margin, cash flow, and profit profile. While AOC will contribute 10 months of performance to our FY2025 results, our forecast assumes that margins will be maintained, and sales volumes may decline slightly due to an uncertain market environment, including the impact of U.S. tariffs. Since the acquisition announcement, we have been closely monitoring AOC’s performance on a monthly basis, and the company has consistently maintained, and even expanded, its contribution margin, despite these external challenges. As such, our outlook remains unchanged as we believe AOC is well-positioned for medium- to long-term growth, supported by potential interest rate reductions and economic recovery in the U.S., as well as margin improvement in its European operations.

At the investor briefing announcing the acquisition, I highlighted AOC’s key strengths, including its high profitability and strong cash flow generation, supported by efficient business systems and low capital expenditure requirements. These low capex needs stem from the nature of their factory operations, which center around reactors that use a process similar to paint manufacturing. With proper maintenance, these facilities can operate effectively for many years. To help investors better visualize this, I’d like to share a video of AOC’s factory in Tennessee for your reference.

Our operations team, who visited the factory during the due diligence process, confirmed that it is a highly organized and efficient facility, with operations that are fundamentally similar to those of paint manufacturing plants.

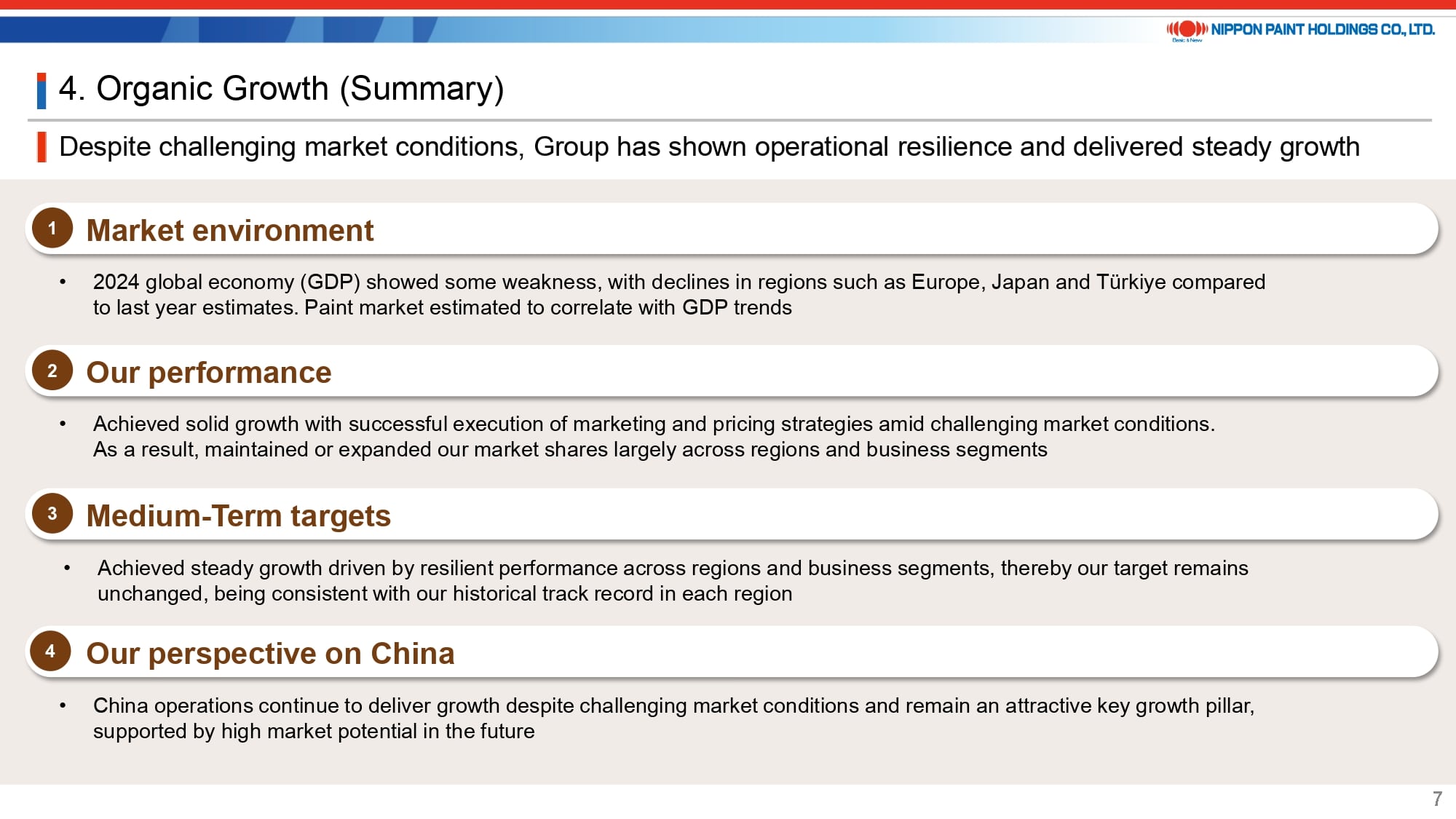

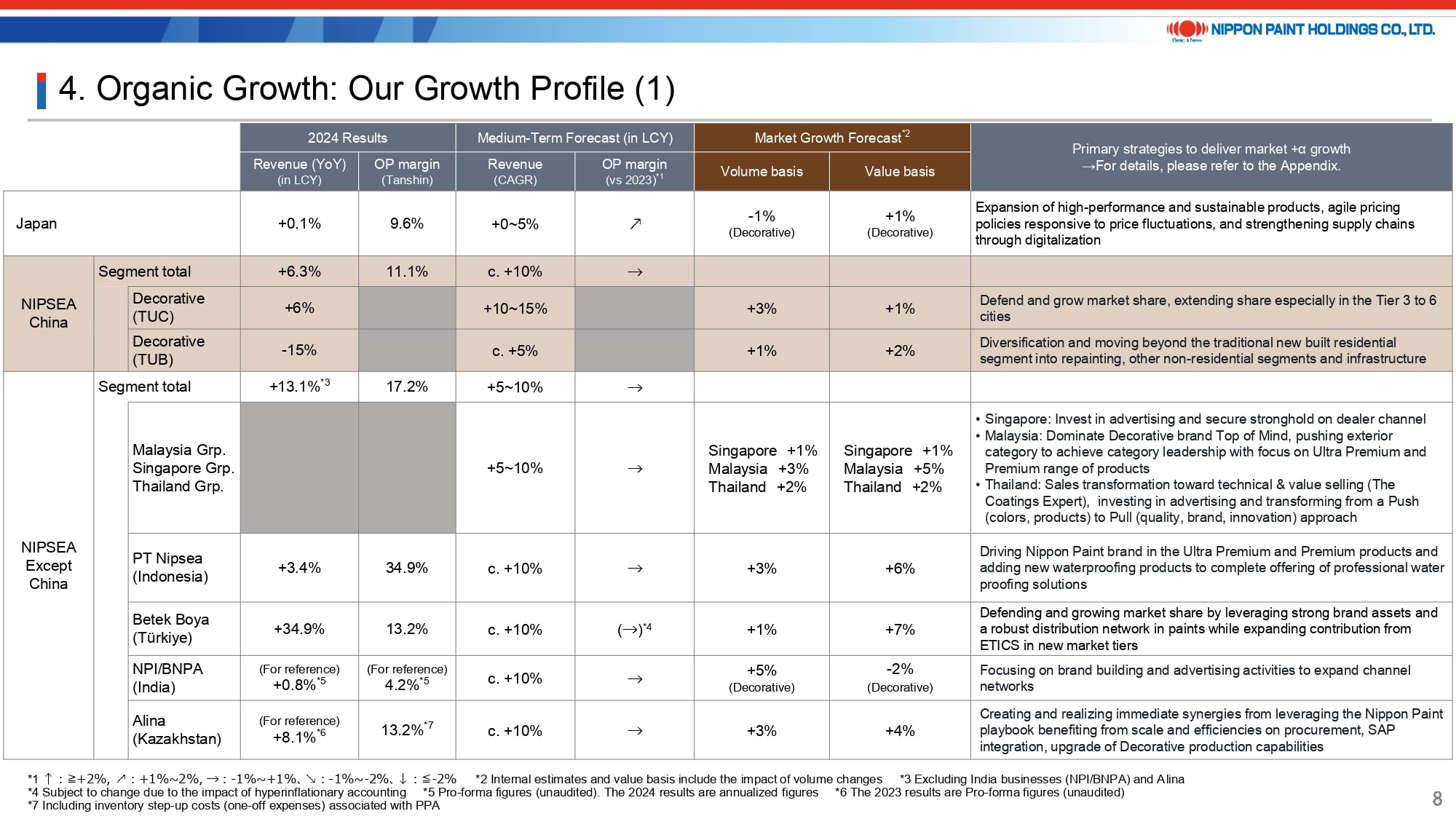

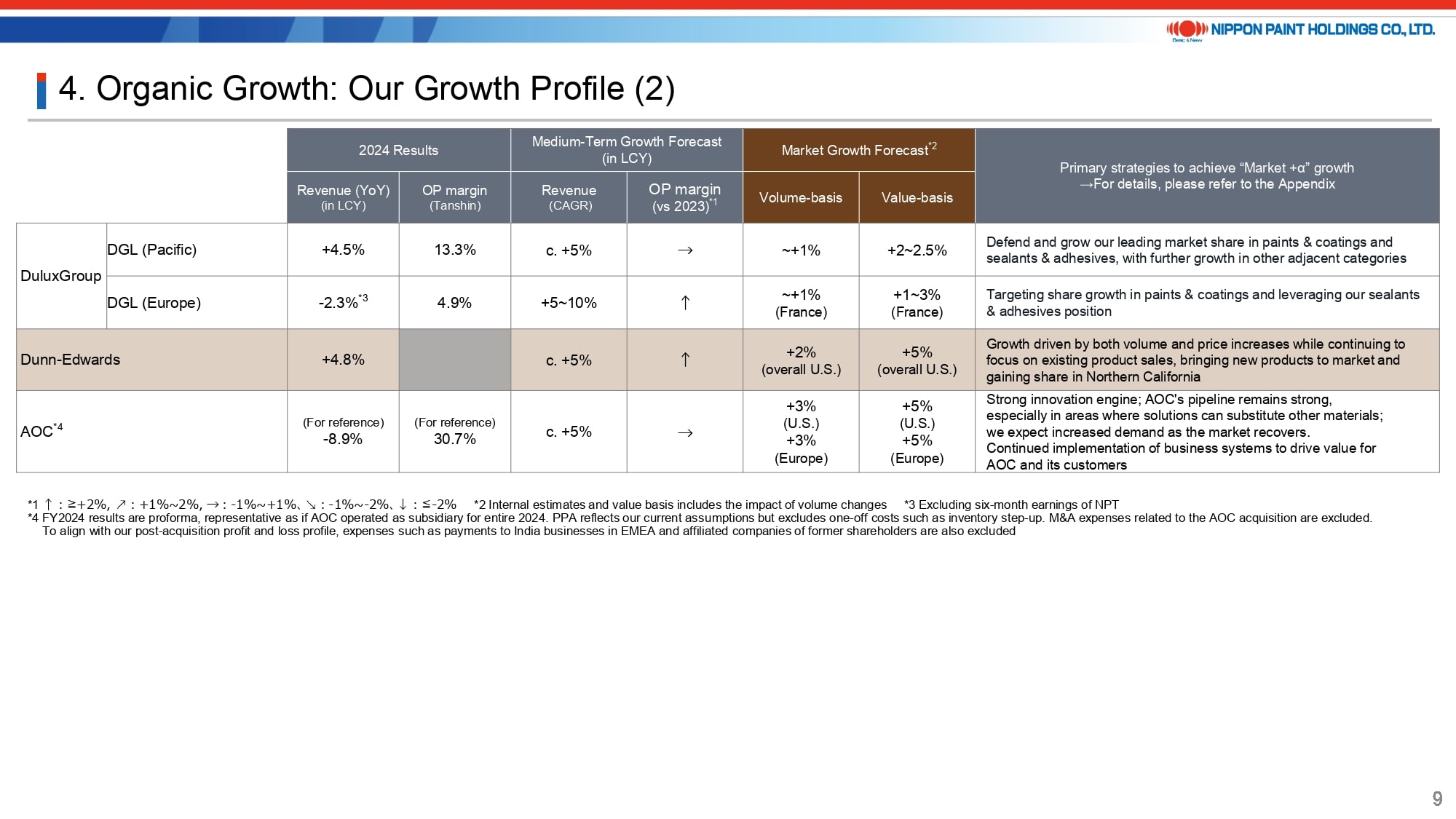

6. Organic Growth (Summary) / Organic Growth: Our Growth Profile

This page provides a summary of our organic growth, with detailed updates on growth by market and business starting from page 8.

As briefly mentioned at the outset, our Group has consistently delivered steady and stable growth overall, despite some fluctuations along the way. We remain confident in our ability to maintain this growth trajectory going forward. I will address the content on pages 8 and 9 during the question-and-answer session.

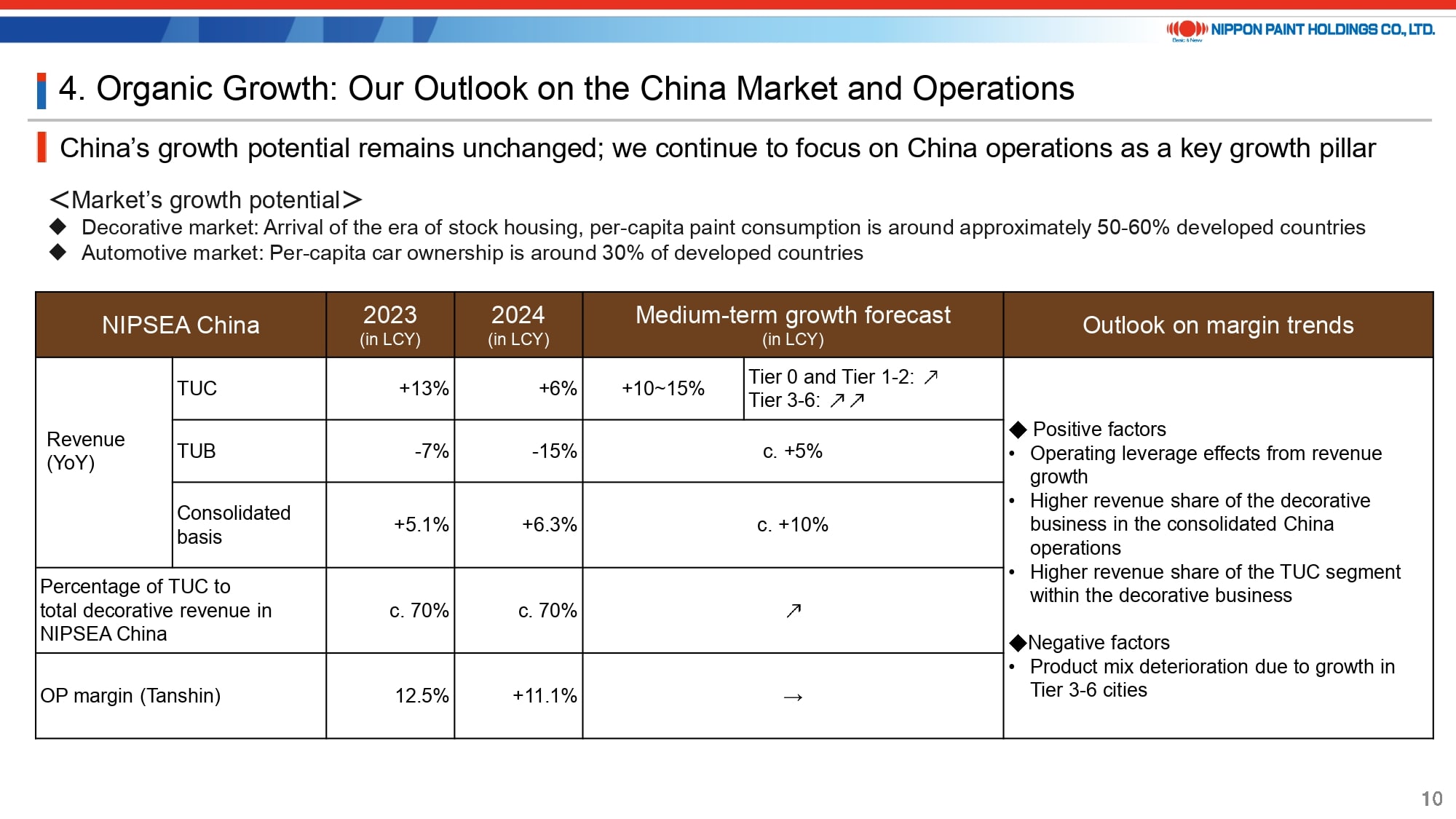

7. Organic Growth: Our Outlook on the China Market and Operations

Our description of the China market and our operations there remains consistent with previous communications.

We continue to believe that decorative paint demand in China has significant room for growth compared to developed markets. Moreover, as many global markets mature, China stands out as one of the few remaining regions with substantial long-term growth potential.

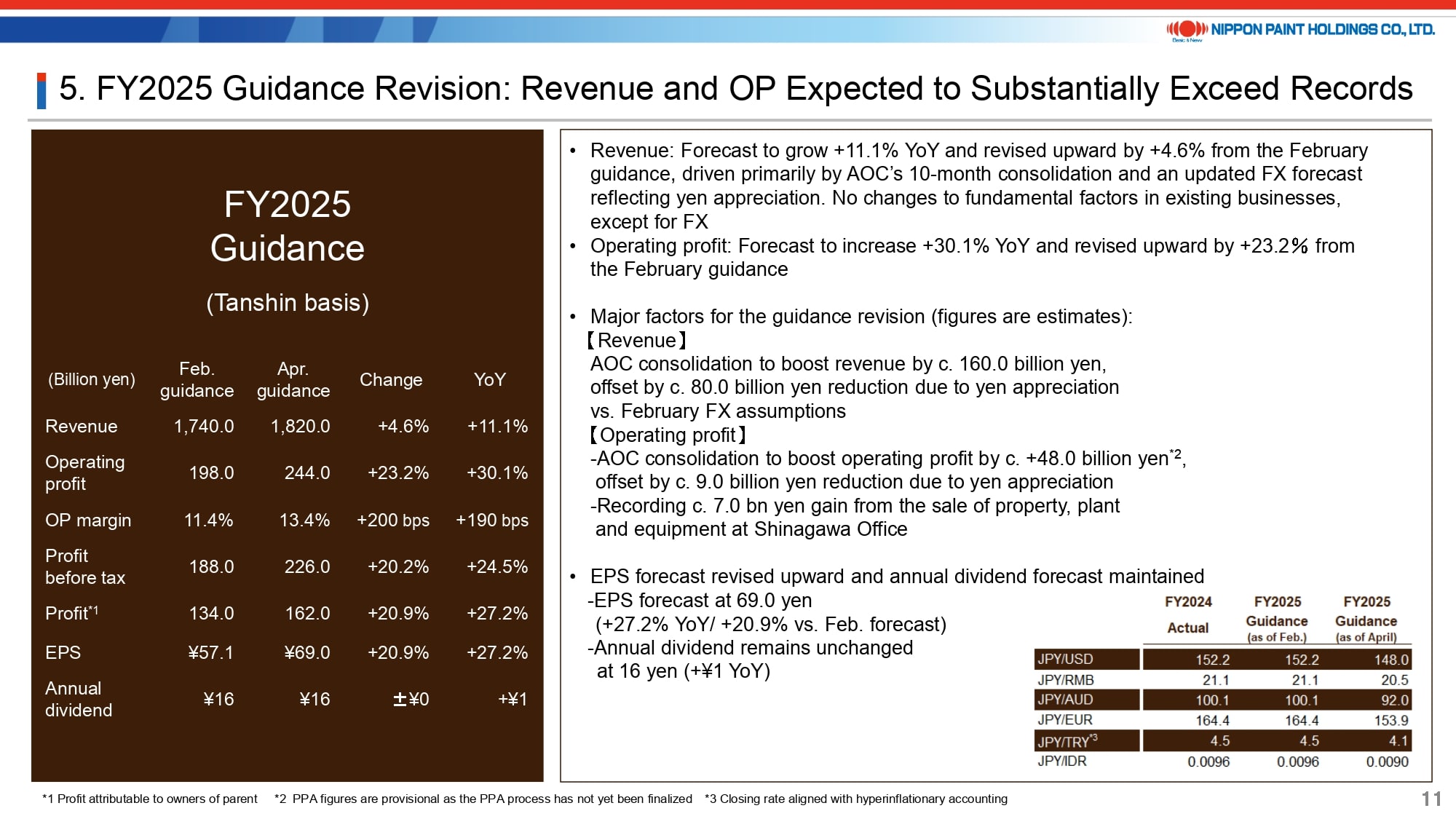

8. FY2025 Guidance Revision: Revenue and OP Expected to Substantially Exceed Records

With the Asset Assembler model taking clearer shape, we have made an upward revision to our FY2025 guidance.

The performance of our existing businesses, excluding AOC, remains largely unchanged on a local currency basis. However, since February 2025, the yen has appreciated slightly against major currencies. As shown in the table at the bottom right of this page, we have revised our foreign exchange assumptions, resulting in a downward adjustment to guidance due to currency effects. On the other hand, we have factored in a 10-month contribution from AOC following its consolidation, along with an expected operating profit gain from the sale of property, plant, and equipment at our Shinagawa Office. Taking all these elements into account, we have made a substantial upward revision to our FY2025 guidance.

Let me briefly outline the key factors behind the revision to our EPS guidance. Our original forecast projected an EPS of 57.1 yen. The recent appreciation of the yen is expected to have a negative impact of approximately 2.7 yen. On the positive side, the 10-month contribution from AOC’s consolidation is forecast to add around 12.5 yen, and the sale of property, plant, and equipment at our Shinagawa Office is expected to contribute an additional 1.9 yen. Taking all these factors into account, our revised EPS guidance is approximately 69 yen.

I would like to highlight two key points regarding the expected EPS contribution of 12.5 yen from AOC.

-

Provisional PPA assumptions:

This figure was calculated based on preliminary assumptions for purchase price allocation (PPA) made during the due diligence process, which include the amortization of intangible assets. However, the actual PPA process only began after the acquisition closed and is expected to be finalized in the second half of this year. As a result, AOC’s EPS contribution may be subject to revision. -

Inclusion of one-off acquisition costs:

The EPS contribution figure includes one-off acquisition-related costs for FY2025, such as advisory fees, insurance expenses, and inventory step-up costs related to PPA. It’s important to note that the inventory step-up costs are still estimates and will also be finalized in the latter half of the year. These one-off costs are expected to reduce after-tax profit by slightly over 3.0 billion yen, equivalent to an EPS impact of approximately 1.3 yen. Excluding these one-off items, AOC’s normalized contribution for 10 months is estimated at 13.8 yen, derived by adding 1.3 yen to the initial 12.5 yen figure. A simple annualization of this amount results in a projected EPS contribution of approximately 16.5 yen, which also takes into account interest expenses related to the acquisition.

Please note that these figures are preliminary estimates and may change depending on AOC’s actual performance this year, the final outcome of the PPA, interest rate trends, and other relevant factors. I’ve provided this supplementary explanation to underscore the significance of AOC’s contribution to our overall performance.

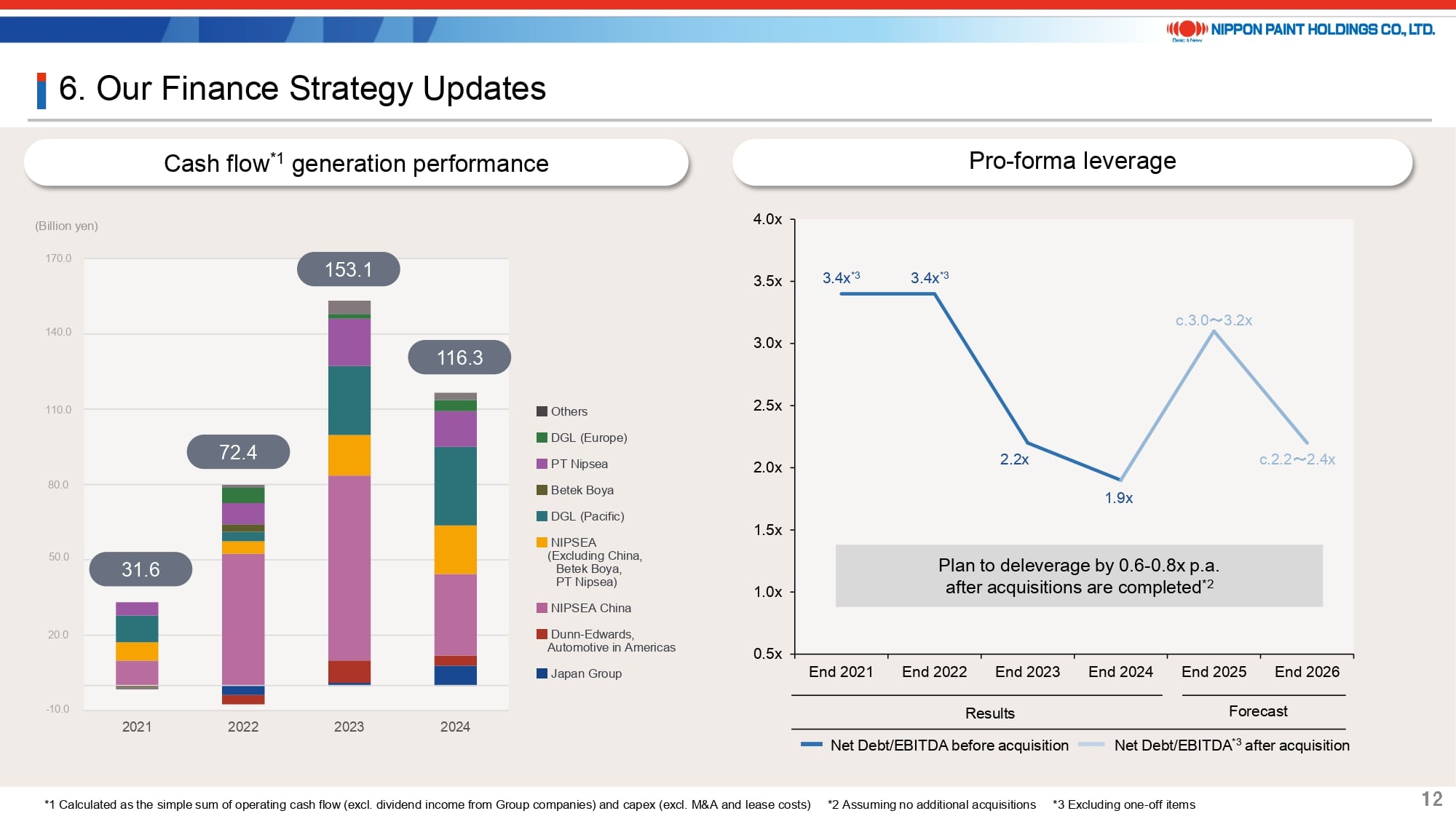

9. Our Finance Strategy Updates

This page provides an update on our cash flow generation performance.

As explained in April 2024, our cash flow in FY2023 was exceptionally strong, supported by focused efforts to improve receivables collection, particularly in NIPSEA China. While cash flow in FY2024 has seen a slight decline compared to the previous year, we have continued to demonstrate robust cash flow generation capabilities.

At the end of FY2024, our leverage ratio declined to below 2x. Looking ahead to the end of FY2025, and factoring in only the acquisition of AOC, the ratio is expected to increase to slightly above 3x, while still remaining well within a prudent and manageable range. Importantly, AOC’s strong cash generation capabilities are expected to contribute to a steady reduction in leverage, bringing the ratio back down to slightly above 2x by the end of FY2026. As mentioned earlier, this reinforces our confidence in having ample financial capacity to continue pursuing M&A opportunities going forward.

Our approach to share buybacks remains unchanged from April 2024. While we recognize that our current share price is not fully satisfactory, our priority is to allocate capital toward M&A opportunities that will drive future profit growth. From the standpoint of sustainable EPS compounding, share buybacks are not currently under consideration. That said, we will continue to monitor market conditions closely and remain open to exploring all potential options in the future.

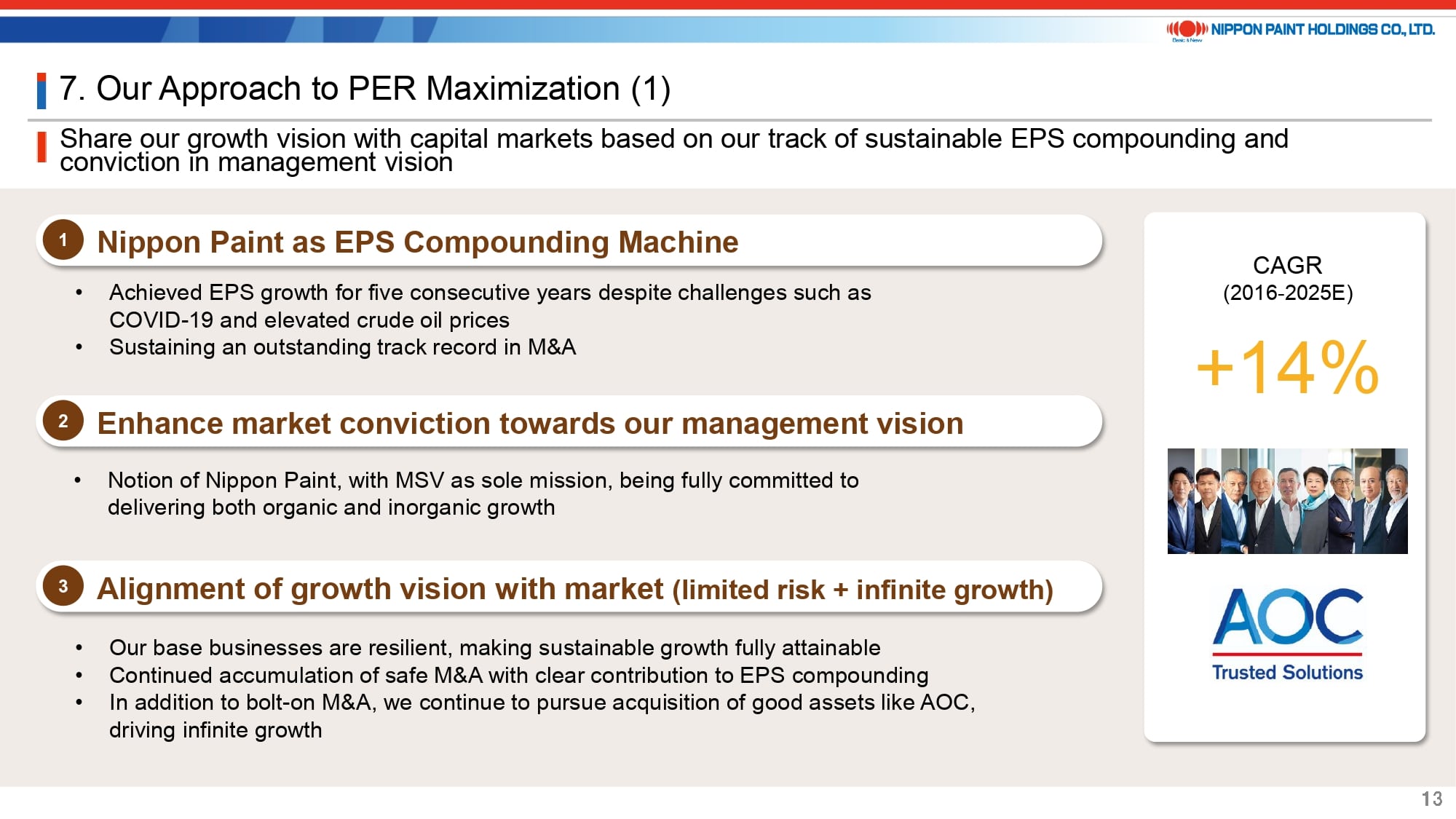

10. Our Approach to PER Maximization (1)

We have received feedback from some investors that, while our strategy is well understood, what ultimately matters is an increase in the share price. This is a perfectly valid and important perspective, and we take it seriously. We remain firmly committed to rewarding our shareholders, who have invested in our stock based on their alignment with and confidence in our strategy. Closing the valuation gap remains a key challenge we continue to address.

This page outlines our three core strategic approaches.

- Driven by our mission of Maximization of Shareholder Value (MSV), we are fully committed to sustainable EPS compounding, positioning ourselves as a true “EPS compounding machine.” Whether through organic or inorganic growth, we continue to demonstrate this commitment through our consistent track record.

- Our ego-less management philosophy is not about individual leaders, not about myself, nor about Wee Siew Kim, but about a management style that rejects anything misaligned with MSV. I believe this philosophy merits greater confidence from capital markets. While this may sound self-congratulatory, I take pride in the fact that we are one of the very few companies solely focused on the pursuit of MSV, with both the executive team and Board of Directors operating in complete alignment.

- We are fundamentally committed to balancing growth with safety. In addition to showcasing the resilience of our core businesses, which have successfully navigated challenges such as the pandemic and rapid inflation, we leverage our strengths to pursue low-risk M&A. This includes careful evaluation of target business stability, sound valuation practices, the ability to unlock autonomous growth, and prudent balance sheet management. By consistently executing M&A aligned with this philosophy, we aim to build a shared vision of sustainable growth with our investors.

At the strategy discussion session with all Board members, held following the General Meeting of Shareholders in March 2025, I shared a spreadsheet that serves as a comprehensive summary of our 10-year roadmap. While simple in format, this document consolidates our long-term strategic direction into a single, accessible view. Since 2021, when Wee Siew Kim and I assumed our roles as Co-Presidents and Goh Hup Jin became Chairman of the Board, this spreadsheet has been shared and updated from time to time.

This spreadsheet presents the results of simulations based on a range of variables, including our organic net profit, acquisition prices, valuation multiples, interest rate levels, growth rates of acquisition targets, and cash conversion rates. It also calculates the resulting consolidated Net Debt/EBITDA and Debt/Equity ratios. In addition, the model supports simulations involving equity financing, such as the issue price of new shares, the number of shares issued, and the price-to-earnings ratio (PER) of our stock. This spreadsheet provides a roadmap for evaluating how we can safely and sustainably execute M&A to maximize shareholder value. While I will refrain from sharing specific figures, the simpler we view this, the greater the potential upside for our company becomes. The Board of Directors has thoroughly discussed and unanimously agreed that, provided we pursue the right M&A deals with prudence and discipline at reasonable valuation multiples, this roadmap is entirely achievable.

To avoid any misunderstanding, I want to emphasize that M&A is not an end in itself, but a means to achieve our strategic objectives. Each potential acquisition presents its own unique set of risks and opportunities, and we remain committed to thoroughly evaluating each opportunity on its own merits, rather than pursuing M&A for its own sake.

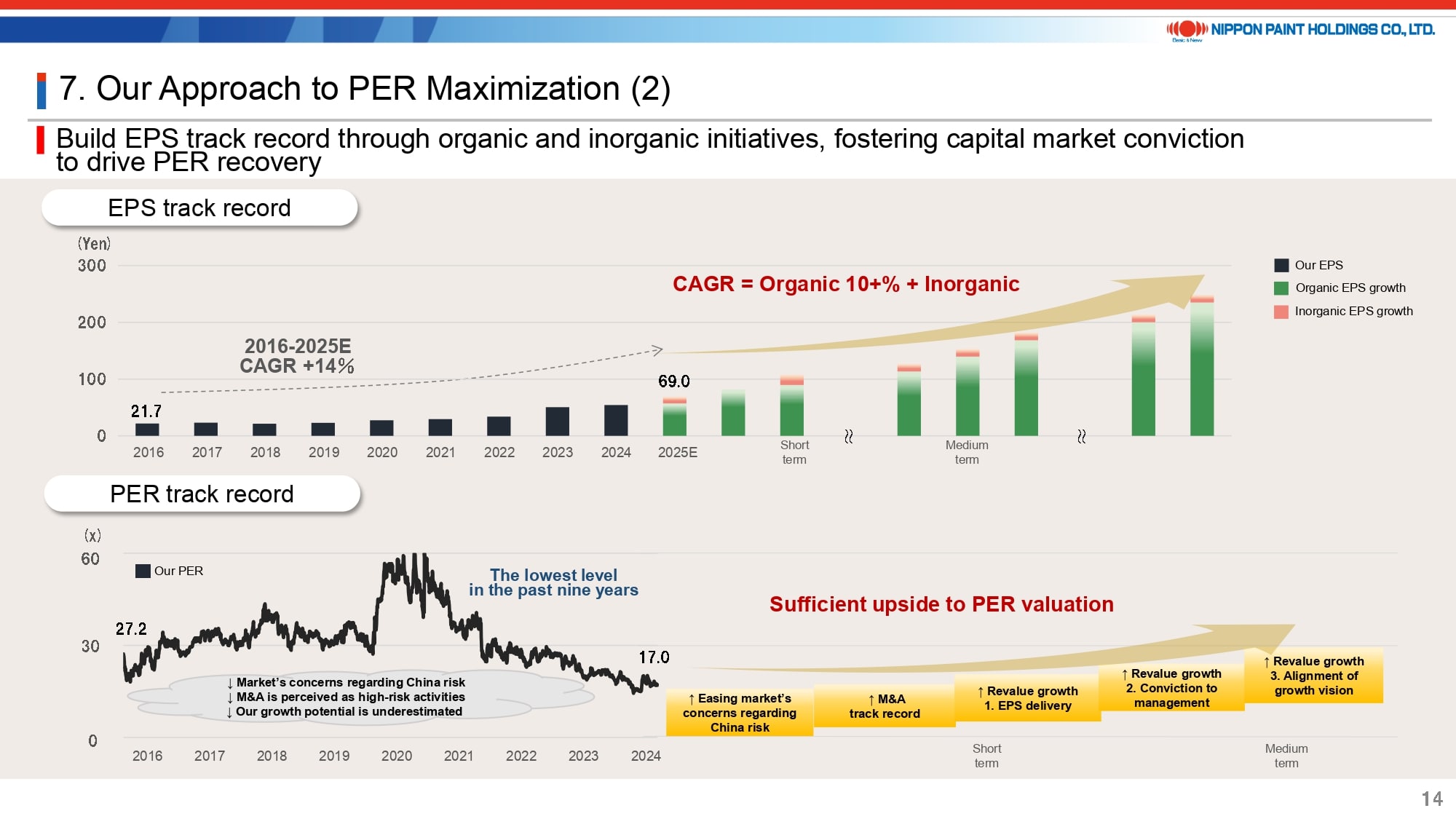

11. Our Approach to PER Maximization (2)

The charts on page 14 visually illustrate our overall approach.

While the individual bars and lines are not intended to convey precise values, the upper chart represents the concept of continuous EPS compounding driven by both organic initiatives and M&A. The lower chart highlights the key factors that contribute to PER improvement. Our objective is not to push PER to unprecedented levels, but rather to restore it to levels seen in the recent past in a timely and sustainable manner.

12. In Summary

Page 15 provides a summary of today’s presentation.

We remain steadfast in our commitment to Maximization of Shareholder Value (MSV) as our sole mission, leveraging the strengths of our Asset Assembler platform to drive EPS growth, not only in the short term, but also sustainably over the long term. The concept of MSV is grounded in the belief that listed companies exist to maximize residual shareholder value, the value that remains after fulfilling clearly defined obligations to stakeholders. In essence, our management’s mission is to pursue unlimited, yet disciplined and sustainable, growth.

To drive organic growth, we focus on fully unlocking the potential of our existing assets. In M&A, we maintain a disciplined approach, carefully weighing risks against valuations to ensure sound decision-making. Both strategies support sustainable EPS compounding, allowing us to build a strong performance track record while shaping realistic and appropriate expectations for future growth.

Through these efforts, we remain firmly committed to maximizing our PER over time.

We will continue to engage proactively with the capital markets while consistently delivering strong performance. We sincerely appreciate your ongoing trust and support as we move forward.

Thank you for your time and attention.